LensCrafters 2005 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 145 <

Total royalties and related advertising expenses for the years ended December 31, 2003, 2004 and

2005 aggregated Euro 64.3 million, Euro 83.0 million and Euro 82.0 million, respectively.

Total payments for royalties and related advertising expenses for the years ended December 31, 2003,

2004 and 2005 aggregated Euro 124.2 million, Euro 68.5 million and Euro 119.8 million, respectively.

Leases and licenses

The Company leases through its worldwide subsidiaries various retail store, plant, warehouse and

office facilities, as well as certain of its data processing and automotive equipment under operating

lease arrangements expiring between 2006 and 2025, with options to renew at varying terms. The

lease and license arrangements for the Company’s U.S. retail locations often include escalation

clauses and provisions requiring the payment of incremental rentals, in addition to any established

minimums contingent upon the achievement of specified levels of sales volume. In addition, with the

acquisition of Cole, the Company operates departments in various host stores paying occupancy

costs solely as a percentage of sales. Certain agreements which provide for operations of

departments in a major retail chain in the United States contain short-term cancellation clauses.

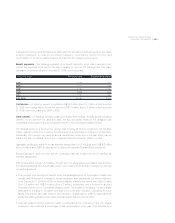

Total rental expense under operating leases for each year ended December 31 is as follows:

In thousands of Euro 2003 2004 2005

Minimum rent 204,406 208,134 224,913

Contingent rent 4,883 15,051 57,776

Sublease income (44,739) (49,247) (27,645)

164,550 173,938 255,044

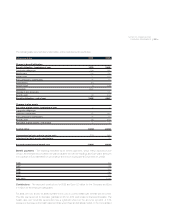

Future minimum annual rental commitments for operating leases are as follows:

Years ending December 31 - In thousands of Euro

2006 209,934

2007 173,425

2008 137,466

2009 106,979

2010 76,740

Thereafter 186,170

Total 890,714

Guarantees

The United States Shoe Corporation, a wholly owned subsidiary of the Company, remains contingently

liable on seven store leases in the United Kingdom. These leases were previously transferred to third

parties. The third parties have assumed all future obligations of the leases from the date each

agreement was signed. However, under the common law of the United Kingdom, the lessor still has

the right to seek payment of certain amounts from the Company if unpaid by the new obligor. If the

Company is required to pay under these guarantees, it has the right to recover amounts from the new

obligor. These leases will expire during various years until December 31, 2015. At December 31, 2005,

the maximum amount for which the Company’s subsidiary is contingently liable is Euro 10.6 million.