LensCrafters 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S

DISCUSSION AND ANALYSIS | 69 <

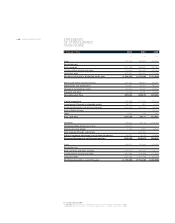

purposes, including the refinancing of existing Luxottica Group S.p.A. debt as it matures. Tranche B is

a term loan of US$ 325 million which was drawn upon on October 1, 2004 by U.S. Holdings to finance

the purchase price of the acquisition of Cole National. Amounts borrowed under Tranche B will mature

in June 2009. Tranche C is a Revolving Credit Facility of Euro 335 million-equivalent multi-currency

(Euro/US$). Amounts borrowed under Tranche C may be repaid and reborrowed with all outstanding

balances maturing in June 2009. At December 31, 2005, US$ 290.0 million (Euro 244.8 million) had

been drawn from Tranche C by U.S. Holdings and Euro 50 million by Luxottica Group S.p.A. The

Company can select interest periods of one, two, three or six months with interest accruing on Euro-

denominated loans based on the corresponding Euribor rate and US$ denominated loans based on

the corresponding LIBOR rate, both plus a margin between 0.40% and 0.60% based on the “Net

Debt/EBITDA” ratio, as defined in the agreement. The interest rate on December 31, 2005 was 2.94%

for Tranche A, 4.56% for Tranche B, 4.83% on Tranche C amounts borrowed in US$ and 2.87% on

Tranche C amounts borrowed in Euro. This credit facility contains certain financial and operating

covenants. The Company was in compliance with those covenants as of December 31, 2005. The

Mandated Lead Arrangers and Bookrunners are ABN AMRO, Banca Intesa S.p.A., Bank of America,

Citigroup Global Markets Limited, HSBC Bank plc, Mediobanca - Banca di Credito Finanziario S.p.A.,

The Royal Bank of Scotland plc and UniCredit Banca Mobiliare S.p.A. UniCredito Italiano S.p.A. - New

York Branch and UniCredit Banca d’Impresa S.p.A. act as Facility Agents. Under this credit facility, Euro

974.3 million was outstanding as of December 31, 2005. This agreement was amended in March 2006

(see “Subsequent events”).

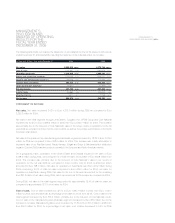

In June 2005, the Company entered into nine interest rate swap transactions with an aggregate initial

notional amount of Euro 405 million with various banks which will decrease by Euro 45 million every

three months starting on June 3, 2007 (“Club Deal Swaps”). These swaps will expire on June 3, 2009.

The Club Deal Swaps were entered into as a cash flow hedge on Tranche A of the credit facility

discussed above. The Club Deal Swaps exchange the floating rate of Euribor for an average fixed rate

of 2.40% per annum.

In August 2004, OPSM re-negotiated the multicurrency (A$/HK$) loan facility with Westpac Banking

Corporation. The credit facility had a maximum available line of A$ 100 million, which was reduced to A$

50 million in September 2005. For borrowings denominated in Australian Dollars, the interest accrues on

the basis of BBR (Bank Bill Rate), and for borrowings denominated in Hong Kong Dollars the rate is

based on HIBOR (HK Inter Bank Rate) plus an overall 0.40% margin. At December 31, 2005, the interest

rate was 6.03% on the borrowings denominated in Australian Dollars and 4.46% on the borrowings

denominated in Hong Kong Dollars. The facility was utilized for an amount of HK$ 125.0 million (A$ 21.9

million). The final maturity of all outstanding principal amounts and interest is August 31, 2006. OPSM

has the option to choose weekly or monthly interest periods. The credit facility contains certain financial

and operating covenants. As of December 31, 2005, the Company was in compliance with all of its

applicable covenants including calculations of financial covenants when applicable.