LensCrafters 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 113 <

Stock-based compensation - The Company has elected to follow the accounting provisions of

Accounting Principles Board (“APB”), Opinion No. 25, Accounting for stock issued to employees (“APB 25”),

for stock-based compensation and to provide the disclosures required under SFAS No. 123, Accounting for

stock-based compensation, as amended by SFAS No. 148, Accounting for stock-based compensation -

transition and disclosure (collectively, “SFAS 123”) (see Note 10). No stock-based employee compensation

cost is reflected in net income for options not included in the incentive plans (see Note 10), as all options

granted under the plans have an exercise price equal to the market value of the underlying stock on the date

of the grant. For options issued under the incentive plans, stock compensation expense has been recorded

based on the conditions of the plan. The Company changed its method of valuing options issued after

January 1, 2004 from the Black-Scholes model to a binomial model as the Company believes a binomial

valuation technique will result in a better estimate of the fair value of the options. The following table illustrates

the effect on net income and earnings per share had the compensation costs of the plans been determined

under a fair-value based method as stated in SFAS 123:

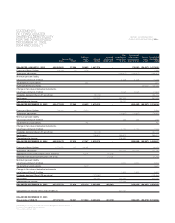

Year ended December 31 - In thousands of Euro, except share data 2003 2004 2005

Net income as reported 267,343 286,874 342,294

add: Stock-based compensation cost included

in the reported net income, net of taxes - - 21,706

deduct: Stock-based compensation expense

determined under fair-value based method

for all awards, net of taxes (11,127) (9,964) (23,203)

Pro forma 256,216 276,910 340,797

Basic earnings per share:

As reported 0.60 0.64 0.76

Pro forma 0.57 0.62 0.76

Diluted earnings per share:

As reported 0.59 0.64 0.76

Pro forma 0.57 0.61 0.75

The fair value of options granted was estimated on the date of grant using the Black-Scholes option

pricing model for options issued prior to January 1, 2004 and using a binomial model for options issued

after such date with the following weighted average assumptions:

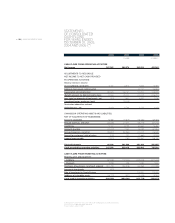

2003 2004 2005

Dividend yield 1.06% 1.71% 1.54%

Risk-free interest rate 3.65% 2.92% 3.17%

Expected option life (years) 5 5.44 5.84

Expected volatility 36.00% 36.56% 25.92%

Weighted average fair value (Euro) 5.45 5.10 4.27

The Company recognized forfeitures as they occur for the 2003 grants, and changing to the binomial

approach in 2004 has assumed a forfeiture rate of 6% for 2004 and 2005 grants.