LensCrafters 2005 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 139 <

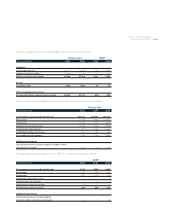

The table summarizes information about Stock Options for each year:

Number of options Weighted average exercise price

outstanding (denominated in Euro)(1)

Outstanding as of January 1, 2003 8,110,033 11.51

Granted 2,397,300 10.51

Forfeitures (176,600) 11.77

Exercised (213,433) 6.97

Outstanding as of December 31, 2003 10,117,300 10.29

Granted 2,035,500 13.79

Forfeitures (70,300) 9.73

Exercised (728,440) 8.07

Outstanding as of December 31, 2004 11,354,060 10.74

Granted 1,512,000 16.89

Forfeitures (51,500) 13.10

Exercised (2,770,250) 10.38

Outstanding as of December 31, 2005 10,044,310 12.68

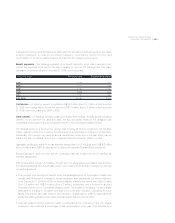

Stock Option grants outstanding at December 31, 2005 are summarized as follows:

Grant Exercise price Number Number Remaining

denominated in Euro (2) outstanding exercisable life (years)

1 7.38 397,600 397,600 1.1

2 4.38 788,660 788,660 2.1

3 9.52 804,250 804,250 3.1

4 12.84 1,214,750 1,214,750 4.1

5 15.03 1,622,650 1,622,650 5.1

6 10.51 1,772,200 1,015,700 6.1

7 13.79 1,941,200 584,200 7.1

8 16.89 1,503,000 - 8.1

(1) For convenience all amounts are translated at the noon buying rate in effect at the end of each year.

(2) Certain options were granted in U.S. Dollars and have been converted using a December 31, 2005 conversion rate of Euro 1.00 to US$ 1.1842.

The Company adopted SFAS 123-R as of January 1, 2006, and at such point began expensing Stock

Options over their vesting life based on their fair value as of the date of grant. Pro forma net income

and earnings per share calculated as if the compensation costs of the plans had been determined

under a fair-value based method are reported in Note 1.

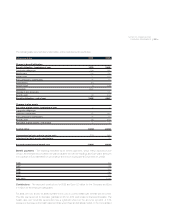

Stock incentive plans

In October 2004, under a Company Incentive Plan, the Company granted options to acquire an

aggregate of 1,000,000 shares of the Company to certain of North American Luxottica retail division’s

employees which may vest and become exercisable on January 31, 2007 only if certain financial

performance measures are met over the period ending December 2006. At December 31, 2005, there

were options to acquire 1,000,000 shares (the closing ADR price at December 31, 2005 on the New

York Stock Exchange was US$ 25.31 per share) at an exercise price of US$ 18.59 per share.

Compensation expense is recorded in accordance with variable accounting under APB 25 for the

options issued under the incentive plan based on the market value of the underlying ordinary shares

when the number of shares to be issued is known (“intrinsic value method”). During fiscal 2005, it