LensCrafters 2005 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.> 138 | ANNUAL REPORT 2005

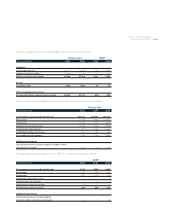

Financial Statements. The weighted-average discount rate used in determining the accumulated post-

retirement benefit obligation was 5.75% at September 30, 2004 and 6.00% at September 30, 2005.

The weighted-average discount rate used in determining the net periodic benefit cost for 2004 and

2005 was 5.75% and 6.0%, respectively.

Certain of the Company’s non-Italian and non-U.S. subsidiaries provide limited non-pension benefits to

retirees in addition to government sponsored programs. The cost of these programs is not significant

to the Company.

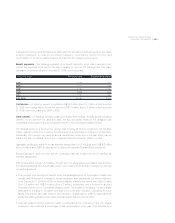

On December 8, 2003, the Medicare Prescription Drug Improvement and Modernization Act of 2003

(the “Act”) was signed into law. In accordance with FASB Staff Position 106-2, the Company’s

measures of accumulated postretirement benefit obligation and net periodic benefit cost in the

Consolidated Financial Statements reflect the effects of the Act. The adoption of FASB Staff Position

106-2 did not have a material effect on the Company’s Consolidated Financial Statements.

10. STOCK OPTION AND INCENTIVE PLANS

Stock Option plan

Beginning in April 1998, certain officers and other key employees of the Company and its subsidiaries

were granted Stock Options of Luxottica Group S.p.A. under the Company’s Stock Option plan. The

Stock Options were granted at a price equal to the market value of the shares at the date of grant.

These options become exercisable in either three equal annual installments beginning on January 31

one year after the date of grant or for the 2005 grant two annual equal instalments beginning on

January 31 two years after the date of grant and expire on or before January 31, 2014.

As the Company applies APB 25, no compensation expense was recognized because the exercise

price of the options was equal to the fair market value on the date of grant. However, as some of those

individuals were U.S. citizens/taxpayers and as the exercise of such options created taxable income,

the Company was afforded a tax benefit in its Federal tax return equal to the income declared by the

individuals. U.S. GAAP does not permit the aforementioned tax benefit to be recorded in the Statement

of Income. Therefore, such amount is recorded as a reduction of taxes payable and an increase to

additional paid-in capital. For the years ended December 31, 2004 and 2005, the benefit recorded

approximated Euro 0.8 million and Euro 4.7 million, respectively.