LensCrafters 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 126 | ANNUAL REPORT 2005

The deferred tax assets and liabilities as of December 31, 2004 and 2005, respectively, were

comprised of:

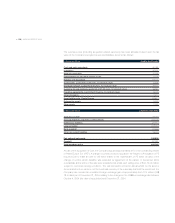

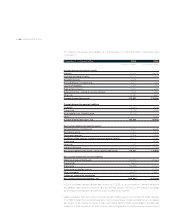

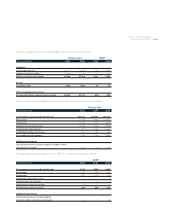

At December 31 - In thousands of Euro 2004 2005

Deferred tax asset/(liability) Deferred tax asset/(liability)

Current deferred income tax assets

Inventory 47,424 68,176

Insurance and other reserves 27,212 22,765

Recorded reserves 10,248 -

Net operating loss carryforwards 47,101 1,674

Loss on investments 3,930 2,513

Right of return reserve 10,572 8,039

Deferred revenue - extended warranty contracts 10,508 5,336

Other, net 14,232 3,691

Current deferred tax assets 171,227 112,194

Current deferred income tax liabilities

Dividends (6,092) (8,766)

Trade name (5,179) (5,597)

Asset held for sale - Pearle Europe (55,448) -

Other - (4,231)

Current deferred tax asset - net 104,508 93,600

Non current deferred income tax assets

Net operating loss carryforwards 70,071 52,659

Recorded reserves 14,305 11,248

Occupancy reserves 15,558 14,305

Employee-related reserves (including minimum pension liability) 28,503 22,585

Trade name - 78,746

Other, net 10,767 14,185

Valuation allowance (22,837) (15,038)

Non current deferred tax assets - net of valuation allowances 116,367 178,690

Non current deferred income tax liabilities

Difference in basis of fixed assets (126,324) (129,682)

Depreciation (2,843) -

Trade name (108,833) (116,551)

Trade name revaluation step-up - (40,950)

Other intangibles (19,917) (18,627)

Trademark accelerated amortization (74,341) -

Non current deferred tax liability - net (215,891) (127,120)

In 2004, the Italian statutory tax rate was reduced to 37.25%. As a consequence, deferred tax assets

and liabilities have been recomputed in line with the new tax rate. The result of the change in the Italian

tax rate was immaterial and has been included in deferred tax expense.

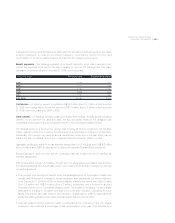

Italian companies’ taxes are subject to review pursuant to Italian law. As of December 31, 2005, tax years

from 1999 through the most recent year were open for such review. Certain Luxottica Group subsidiaries

are subject to tax reviews for previous years and during 2005 a wholly owned Italian subsidiary was

subjected to a tax inspection. As a result of this, some insignificant recorded losses were reversed and