LensCrafters 2005 Annual Report Download - page 148

Download and view the complete annual report

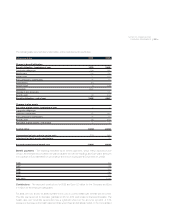

Please find page 148 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 147 <

competition agreement (the “Agreement”) violated the “Best Price Rule” promulgated by the U.S.

Securities and Exchange Commission by resulting in a payment for Mr. Hauslein’s SGHI shares and his

support of the tender offer that was higher than the price paid to SGHI’s stockholders in the tender

offer. The plaintiffs also alleged that the Company and Mr. Leonardo Del Vecchio, the Company’s

Chairman, violated Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated

thereunder. The plaintiffs sought, among other remedies, the payment of such higher consideration to

all tendering shareholders, other than Luxottica Group S.p.A. and its affiliates.

The Company and the other defendants filed a motion to dismiss the complaint in its entirety which, on

November 26, 2003, the Court granted in part and denied in part. The Court granted the Company’s

motion to dismiss plaintiffs’ claim under Section 10(b) and Rule 10b-5, but denied the Company’s

motion to dismiss plaintiffs’ Best Price Rule claim as well as the claim that the Company aided and

abetted Mr. Hauslein’s breach of his fiduciary duties. In so ruling, the Court noted that it was obligated,

for the purpose of rendering its decision on the motion to dismiss, to treat all of the plaintiffs’

allegations in the complaint as true. On June 8, 2004, the consolidated complaint was further

amended to add Mr. Leonardo Del Vecchio, the Company’s Chairman, as a defendant to the aiding

and abetting claim. Plaintiffs also added a new claim against Mr. Del Vecchio under Section 20(a) of

the Securities Exchange Act.

On August 31, 2005, the Company agreed with the plaintiffs to a full and final settlement and release (the

“Settlement”) of all claims against the Company, its acquisition subsidiary and Mr. Del Vecchio. The

Settlement, for a payment of Euro 11.6 million (or US$ 14.5 million) included in current year operations, was

approved by the Court and final judgment has been entered dismissing the case with prejudice.

In March 2002, an individual commenced an action in the California Superior Court for the County of

San Francisco against Luxottica Group S.p.A. and certain of our subsidiaries, including LensCrafters,

Inc., and EYEXAM of California, Inc. The plaintiff, along with a second plaintiff named in an amended

complaint, seeks to certify this case as a class action. The claims have been partially dismissed. The

remaining claims, against LensCrafters, EYEXAM and EyeMed Vision Care, LLC, allege various

statutory violations relating to the operation of LensCrafters’ stores in California, including violations of

California laws governing relationships among opticians, optical retailers, manufacturers of frames and

lenses and optometrists, false advertising and other unlawful or unfair business practices. The action

seeks unspecified damages, disgorgement and restitution of allegedly unjustly obtained sums,

punitive damages and injunctive relief, including an injunction that would prohibit defendants from

providing eye examinations or other optometric services at LensCrafters stores in California. In May

2004, the trial court stayed all proceedings in the case pending the California Supreme Court’s

decision in a case against Cole and its subsidiaries expected to address certain legal questions

related to the issues presented in this case. The Supreme Court has not yet scheduled oral argument

on that appeal. Although we believe that our operational practices and advertising in California comply

with California law, an adverse decision in this action or by the Supreme Court in the suit against Cole

might cause LensCrafters, EYEXAM and EyeMed to modify or close their activities in California. Further,

LensCrafters, EYEXAM and EyeMed might be required to pay damages and/or restitution, the amount

of which might have a material adverse effect on the Company’s Consolidated Financial Statements.

In February 2002, the State of California commenced an action in the California Superior Court for the

County of San Diego against Cole and certain of its subsidiaries, including Pearle Vision, Inc., and

Pearle Vision Care, Inc. The claims allege various statutory violations related to the operation of Pearle

Vision Centers in California including violations of California laws governing relationships among

opticians, optical retailers, manufacturers of frames and lenses and optometrists, false advertising and

other unlawful or unfair business practices. The action seeks unspecified damages, disgorgement and

restitution of allegedly unjustly obtained sums, civil penalties and injunctive relief, including an injunction