LensCrafters 2005 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 122 | ANNUAL REPORT 2005

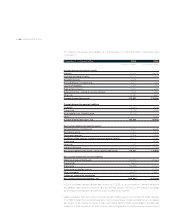

f) Pending acquisitions

• In July 2005, the Company announced that SPV Zeta S.r.l., a new wholly owned Italian subsidiary, will

acquire 100% of the equity interest in Beijing Xueliang Optical Technology Co. Ltd. (“Xueliang

Optical”) for a purchase price of Chinese Renminbi (“RMB”) 169 million (approximately Euro 17

million), plus RMB 40 million (approximately Euro 4 million) in assumed liabilities. Xueliang Optical

had unaudited sales for the 2004 fiscal year of RMB 102 million (approximately Euro 10 million).

Xueliang Optical has 79 stores in Beijing. Completion of the transaction remains subject to

customary approvals by the relevant Chinese governmental authorities. The Company has received

such approval and expects to close the transaction in the second quarter of 2006.

• In October 2005, the Company announced that its new wholly owned Italian subsidiary, SPV Eta

S.r.l., will acquire 100% of the equity interests in Ming Long Optical, the largest premium optical

chain in the province of Guangdong, China, for a purchase price of RMB 290 million (approximately

Euro 29 million). Completion of the transaction remains subject to customary approvals by the

relevant Chinese governmental authorities. The Company currently anticipates receiving such

approvals by June 2006.

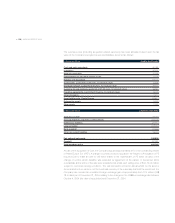

5. PROPERTY, PLANT AND EQUIPMENT - NET

Property, plant and equipment - net consisted of the following:

At December 31 - In thousands of Euro 2004 2005

Land and buildings, including leasehold improvements 475,605 563,535

Machinery and equipment 473,515 566,185

Aircraft 25,908 39,107

Other equipment 305,140 395,705

Building, held under capital lease 2,332 -

1,282,500 1,564,532

less: Accumulated depreciation and amortization 683,255 829,417

Total 599,245 735,115

Depreciation and amortization expense relating to property, plant and equipment for the years ended

December 31, 2003, 2004 and 2005 was Euro 92.2 million, Euro 101.1 million and Euro 129.6 million,

respectively. Included in other equipment is approximately Euro 26.6 million and Euro 69.9 million of

construction in progress as of December 31, 2004 and 2005, respectively.

The increase in the value of the aircraft is due to the purchase of a new aircraft in 2005 to replace the

previous aircraft which became obsolete. The net book value of the old aircraft of Euro 10.8 million is

included in “Asset held for sale” for a net book value, which is less then the fair value less cost to sell,

and the aircraft is expected to be sold in June 2006. The Company has stopped recording depreciation

expense on such asset beginning on the date that the asset was determined to be “held for sale.”