LensCrafters 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 140 | ANNUAL REPORT 2005

became probable that the incentive targets would be met and as such the Company has recorded

approximately Euro 1.8 million (or US$ 2.2 million) of compensation expense net of taxes during fiscal

2005 and recorded future unearned compensation expense in equity of approximately Euro 2.7 million

(US$ 3.2 million) with an offsetting increase in additional paid-in capital for such amounts. Pro forma

net income and earnings per share calculated as if the compensation costs of the plans had been

determined under a fair-value based method are reported in Note 1.

In September 2004, the Company’s Chairman and majority shareholder, Mr. Leonardo Del Vecchio,

allocated shares held through La Leonardo Finanziaria S.r.l., an Italian holding company of the Del

Vecchio family, representing 2.11% (or 9.6 million shares) of the Company’s currently authorized and

issued share capital, to a Stock Option plan for top management of the Company at an exercise price

of Euro 13.67 per share (the closing stock price at December 31, 2005 on the Milan Stock Exchange

was Euro 21.43 per share). The Stock Options to be issued under the Stock Option plan vest upon

meeting certain economic objectives. As such, compensation expense is recorded in accordance with

variable accounting under APB 25 for the options issued to management under the incentive plan

based on the market value of the underlying ordinary shares only when the number of shares to be

vested and issued is known. During 2005, it became probable that the incentive targets would be met

and, as such, the Company has recorded compensation expense of approximately Euro 19.9, net of

taxes and recorded future unearned compensation expense in equity of approximately Euro 45.8

million, net of taxes, with an offsetting increase in additional paid-in capital for such amounts. The

expense if calculated under SFAS 123-R would have been approximately Euro 16.9 million, net of

taxes, and is included in pro forma net income and earnings per share (see Note 1).

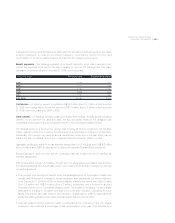

11. SHAREHOLDERS’ EQUITY

In June 2004 and June 2005, the Company’s Annual Shareholders Meetings approved cash dividends

of Euro 94.1 million and Euro 103.5 million, respectively. These amounts became payable in July 2004

and June 2005, respectively. Italian law requires that 5% of net income be retained as a legal reserve

until this reserve is equal to one-fifth of the issued share capital. As such, this legal reserve is not

available for dividends to the shareholders. Legal reserves of the Italian entities included in retained

earnings at December 31, 2004 and 2005, aggregated Euro 8.4 million and Euro 8.6 million,

respectively. In addition Euro 3.6 million of other legal reserves of foreign entities is not available for

dividends to the shareholders.

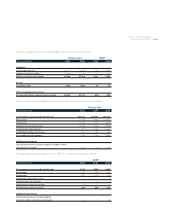

Luxottica Group’s legal reserve rollforward for fiscal period 2003-2005 is detailed as follows (in

thousand of Euro):

January 1, 2003 5,434

Increase in fiscal year 2003 17

December 31, 2003 5,451

Increase in fiscal year 2004 3

December 31, 2004 5,454

Increase in fiscal year 2005 23

December 31, 2005 5,477

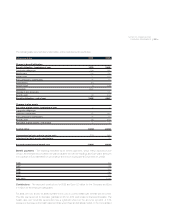

In accordance with SFAS No. 87, Employers’ accounting for pensions, Luxottica Group has recorded a

minimum pension liability for underfunded plan of Euro 30.7 million and Euro 30.9 million as of

December 31, 2004 and 2005, respectively, representing the excess of unfunded accumulated benefit

obligations over previously recorded pension cost liabilities. A corresponding amount is recognized as

an intangible asset except to the extent that these additional liabilities exceed related unrecognized

prior service cost and net obligation, in which case the offset to the increase in liability is charged