LensCrafters 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S

DISCUSSION AND ANALYSIS | 65 <

NON-GAAP FINANCIAL MEASURES

The Company uses certain measures of financial performance that exclude the impact of fluctuations

in currency exchange rates in the translation of operating results into Euro, and include the results of

operations of Cole National for the full year 2004. The Company believes that these adjusted financial

measures provide useful information to both management and investors by allowing a comparison of

operating performance on a consistent basis. In addition, since the Company has historically reported

such adjusted financial measures to the investment community, the Company believes that their

inclusion provides consistency in its financial reporting. Further, these adjusted financial measures are

one of the primary indicators management uses for planning and forecasting in future periods.

Operating measures that assume constant exchange rates between the full year 2005 and the full year

2004 are calculated using for each currency the average exchange rate for the full year 2004.

Operating measures that exclude the impact of fluctuation in currency exchange rates are not

measures of performance under U.S. GAAP. These non-GAAP measures are not meant to be

considered in isolation or as a substitute for results prepared in accordance with U.S. GAAP. In

addition, the Company’s method of calculating operating performance excluding the impact of

changes in exchange rates may differ from methods used by other companies. See the table below

for a reconciliation of the operating measures excluding the impact of fluctuations in currency

exchange rates to their most directly comparable U.S. GAAP financial measures. The adjusted financial

measures should be used as a supplement to results reported under U.S. GAAP to assist the reader in

better understanding the operational performance of the Company.

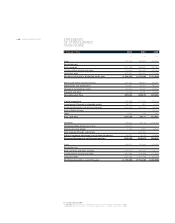

In millions of Euro FY 2004 FY 2005 FY 2005

U.S. GAAP results U.S. GAAP results Adjustment for constant adjusted results

exchange rates

Consolidated net sales 3,255.3 4,370.7 (16.9) 4,353.8

Manufacturing/Wholesale

net sales 1,094.8 1,310.3 (7.5) 1,302.8

Retail net sales 2,346.7 3,298.2 (10.3) 3,287.9

The Company has included the following table of consolidated adjusted sales and operating income for

2004. The Company believes that the adjusted amounts may be of assistance in comparing the

Company’s operating performance between the 2004 and 2005. However, adjusted financial information

should not be viewed as a substitute for measures of performance calculated in accordance with generally

accepted accounting principles. The consolidated adjusted amounts reflect the following adjustments:

1. the inclusion in the adjusted amounts of the consolidated results of Cole National for the full year

2004; and

2. the elimination of wholesale sales to Cole National from Luxottica Group entities for the full year 2004.

This information is being provided for comparison purposes only and does not purport to be

indicative of the actual results that would have been achieved had the Cole National acquisition

been completed as of January 1, 2004.

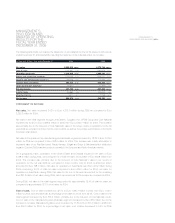

The following table reflects the Company’s consolidated net sales and income from operations for 2004

as reported and as adjusted:

In millions of Euro FY 2004 FY 2004 results

U.S. GAAP results Adjustment including Cole National

for Cole National

Consolidated sales 3,255.3 747.7 4,003.0

Consolidated income from operations 492.8 (10.6) 482.2