LensCrafters 2005 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

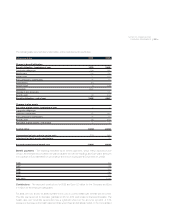

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 135 <

management tool to provide the framework within which the fiduciary’s investment decisions are made;

establish standards to measure investment managers’ performance; outline the roles and

responsibilities of the various parties involved; and describe the ongoing review process.

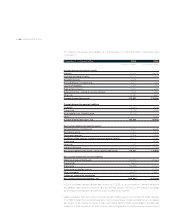

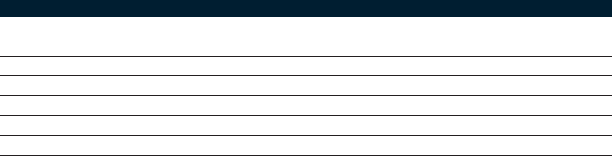

Benefit payments - The following estimated future benefit payments, which reflect expected future

service, are expected to be paid in the years indicated for both the US Holdings and Cole plans

(translated for convenience at the December 31, 2005 noon buying rate):

In thousands of Euro Pension plans Supplemental plans

2006 12,068 341

2007 10,707 226

2008 12,036 1,095

2009 12,998 388

2010 14,130 332

2011-2015 100,087 3,937

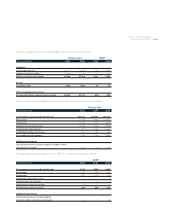

Contribution - US Holdings expects to contribute US$ 29.3 million (Euro 24.7 million at the December

31, 2005 noon buying rate) to its pension plan and US$ 0.4 million (Euro 0.3 million at the December

31, 2005 noon buying rate) to its SERP in 2006.

Other benefits - US Holdings provides certain post-employment medical, disability and life insurance

benefits. As of December 31, 2004 and 2005, the accrued liability related to this obligation was

immaterial and is included in accrued employee benefit on the Consolidated Balance Sheets.

US Holdings sponsors a tax incentive savings plan covering all full-time employees. US Holdings

makes quarterly contributions in cash to the plan based on a percentage of employees’ contributions.

Additionally, US Holdings may make an annual discretionary contribution to the plan which may be

made in the form of Luxottica Group S.p.A.’s American Depository Receipts (“ADRs”) or cash.

Aggregate contributions made to the tax incentive savings plan by US Holdings were US$ 8.3 million

(Euro 6.7 million) and US$ 11.5 million (Euro 9.2 million) for fiscal years 2004 and 2005, respectively.

Effective January 1, 2006, the Cole defined contribution plan was merged into the US Holding, tax

incentive savings plan.

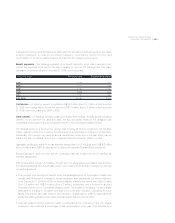

With the acquisition of Cole, US Holdings, through one of its wholly owned subsidiaries, now sponsors

the following additional other benefit plans which cover certain present and past employees of the Cole

companies acquired:

• Cole provides post-employment benefits under individual agreements for continuation of health care

benefits and life insurance coverage to former employees after employment but before retirement.

As of December 31, 2004 and 2005, the accrued liability related to this benefit was US$ 1.6 million

(Euro 1.2 million) and US$ 2.4 million (Euro 2.0 million), respectively, and is included in accrued

employee benefits on the Consolidated Balance Sheet. The increase in the liability in 2005 is largely

attributable to a change in the claims cost table used by the plan’s actuary in calculating the future

liability. This change was made because the Company’s medical plans in which the participants are

enrolled for 2006 generally provide better medical benefits than the previous plans.

• Cole has qualified defined contribution plans covering all full-time employees in the U.S. Eligible

employees may contribute a percentage of their compensation to the plan. Cole provides for a