LensCrafters 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LUXOTTICA GROUP • ANNUAL REPORT 2005

ANNUAL REPORT 2005

ENG

Table of contents

-

Page 1

ENG LUXOTTICA GROUP • ANNUAL REPORT 2005 ANNUAL REPORT 2005 -

Page 2

ANNUAL REPORT 2005 -

Page 3

All pictures in this Annual Report are from Give the Gift of Sight and are portraits of some of the over 600,000 people worldwide who received free eyecare from this Luxottica Group Foundation in 2005. Further information on the Give the Gift of Sight Foundation can be found in the section dedicated... -

Page 4

... with U.S. GAAP and IAS/IFRS 73 > Dividend proposal and related tax regime 77 > Annual Report on Corporate Governance 2005 and Sarbanes-Oxley project > Stock option and share buy back plans 91 > Luxottica Group capital stock information 93 94 95 Listings: 16 years on the NYSE and five on the MTA... -

Page 5

7 > Chairman's letter to Shareholders 8 > Profile of Luxottica Group 13 > Board of directors 15 > Key events of 2005 17 > Luxottica Group in 2005 25 > Distribution 33 39 House brands License brands 47 > Manufacturing 51 > Strategy 55 > Give the Gift of Sight, a Luxottica Group Foundation -

Page 6

Cambodia 2005 -

Page 7

-

Page 8

..., especially from Pearle Vision, for which we have high expectations. In 2005, our entry into the retail market in China was a key step in our strategy for growth. Today we manage the leading premium optical chain in China and Hong Kong. Our nearly 300 stores are only a starting point. In coming... -

Page 9

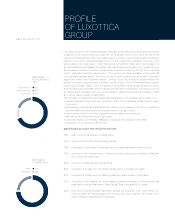

... retail market in North America with LensCrafters, Pearle Vision and Sunglass Hut and in Australia and New Zealand with OPSM, Laubman & Pank and Sunglass Hut. Luxottica Group is also the leader in premium and luxury optical retail in China and Hong Kong, with 276 stores. Luxottica Group's wholesale... -

Page 10

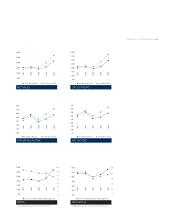

PROFILE OF LUXOTTICA GROUP | 9 < 6,000 5,000 4,000 3,000 2001 2003 2004 2005 2002 2,000 1,000 in millions of Euro in millions of US$ 4,000 3,500 3,000 2,500 2,000 2001 2003 2004 2002 2005 2005 30% 25% 20% 15% 1,500 1,000 500 in millions of Euro in millions of US$ NET SALES GROSS PROFIT 800 ... -

Page 11

> 10 | ANNUAL REPORT 2005 (Subject to limited auditing review) QUARTERLY RESULTS 2004-2005 2005 In thousands of Euro (1) FIRST QUARTER SECOND QUARTER THIRD QUARTER FOURTH QUARTER Net sales Gross profit Operating income Income before taxes Net income Earnings per: 1,037,001 702,943 136,448 ... -

Page 12

... (2) Average number of outstanding shares In accordance to U.S GAAP (1) 1 ADS = 1 ordinary share. (2) Proposed by the Board of Directors and to be submitted for approval at the Annual Shareholders' Meeting on June 14, 2006. (3) Figures include results of Sunglass Hut operations from the acquisition... -

Page 13

Morocco 2001 -

Page 14

CORPORATE BODIES BOARD OF DIRECTORS Leonardo Del Vecchio...HUMAN RESOURCES COMMITTEE Gianni Mion Leonardo Del Vecchio Sabina Grossi Andrea Guerra Lucio Rondelli Chairman INTERNAL CONTROL COMMITTEE Lucio Rondelli Tancredi Bianchi Mario Cattaneo Chairman (1) Executive Director. (2) Independent Director... -

Page 15

-

Page 16

... and Hong Kong, through the acquisition of Ming Long Optical, a leading premium optical retailer. Launch of the Dolce & Gabbana and D&G collections. December Ray-Ban surpasses the historic figure of over eleven millions units sold, making it the world's best selling prescription and sun brand. | 15... -

Page 17

Cambodia 2005 -

Page 18

... market, Luxottica Group in 2004 closed its acquisition of Cole National, the second largest optical retailer in that market, owner of retail brands such as Pearle Vision and its extensive network of own and franchise stores, as well as the in-store optical departments Sears Optical, Target Optical... -

Page 19

...18 | ANNUAL REPORT 2005 additional stores but also seven central labs, which, added to LensCrafters' in-store labs, form one of the largest lens finishing lab networks in North America. Lastly, with the integration of Cole National Managed Vision Care into EyeMed Vision Care, Luxottica Group became... -

Page 20

...2004 figures include Cole National result since the date of acquisition (October 4, 2004). WHOLESALE BRAND PORTFOLIO 2005 was a very good year for the Group's wholesale business, thanks to policies and strategies the Group started to implement years ago, the most significant being the strengthening... -

Page 21

...clients looking to benefit from a range of products and services of the highest possible quality. Even the acquisition of retail brands has benefited the level of service the Group is able to offer its clients. In fact, Luxottica Group's direct experience in retail in key markets has translated into... -

Page 22

.... In 2005, the Group continued to carry out the process started in 2004 of strengthening its organizational structure at the manufacturing level, which has already contributed good results in terms of production efficiency and flexibility as well as cost control. New staff roles were added at the... -

Page 23

... resulting shortening of the average life cycle of models, Measures were also taken to achieve closer coordination between the engineering and product departments. The new sampling unit, which came into service in June 2005, has a staff of 120 and is managed by engineering department. By the end of... -

Page 24

Panama 2005 -

Page 25

-

Page 26

...of products in the world's key markets. Luxottica Group nearly 5,700 sun and optical stores are mainly located in the United States, Canada, Australia, New Zealand, Singapore, Hong Kong and China. In Europe, the Group's retail presence is limited to approximately 100 Sunglass Hut stores, exclusively... -

Page 27

... gift retailers in the United States; it is controlled by Luxottica Group's retail structure but is managed independently as its business is non-core. GROUP RETAIL CHAINS WORLDWIDE Geographic area Retail chain LensCrafters Pearle Vision (*) Sunglass Hut Licensed brands: Sears Optical Target Optical... -

Page 28

... of elegant and refined frames. Today, Pearle Vision is the most recognized optical brand in the United States and synonymous with a trustworthy optometrist and personalized service. The brand operates 837 stores, of which 375 company-owned in the United States, Canada and Puerto Rico and 462 in... -

Page 29

... Luxottica Group manages one of the largest networks of optical manufacturing labs in the United States, with eight central labs nationwide and close to 900 lens finishing labs, mainly within LensCrafters stores. To support the growth in sales of anti-glare lenses, in 2005 a dedicated unit was added... -

Page 30

... the Group's brand portfolio. Over 60% of units sold through its stores in 2005 were Luxottica Group products. Fashion products were in particular demand thanks to the new Dolce & Gabbana and D&G collections and the ongoing success of Ray-Ban, Prada, Versace, Chanel and Bvlgari. MANAGED VISION CARE... -

Page 31

...what the Group considers a key area of future development. The stores of these two retail brands are managed as part of the Asia-Pacific retail structure, which controls 969 optical and sun retail locations in all, of which 615 in Australia, 74 in New Zealand, 4 in Singapore, 66 in Hong Kong and 210... -

Page 32

Dominican Republic 2003 -

Page 33

-

Page 34

HOUSE BRANDS -

Page 35

CHANGE YOUR VIEW -

Page 36

... joined Luxottica Group portfolio of brands in 1999. Worn by countless movie stars and show business celebrities since day one, Ray-Ban's are sunglasses par excellence, by far the top-selling, most famous sunglasses in the world. The Ray-Ban collection sets itself apart for the superior quality of... -

Page 37

...to extreme sports. www.arnette.com Making its debut in 1917, Persol was acquired by Luxottica Group in 1995. The brand has a heritage of design and elegance, high quality and everlasting Made in Italy style. Persol is a luxury eyewear brand: an icon of style, high quality and design, harkening back... -

Page 38

... the best sunglass lens technology, along with a cultivated design and strong personality, able to transcend seasonal styles. It is not by chance that REVO is short for "revolution". Models in the REVO collection feature multi-layer coated lenses equipped with the exclusive Light Management System... -

Page 39

...super light-weight frames of the highest quality and an elegant design. Created in 1989, Killer Loop became part of Luxottica Group portfolio in 1999. The Killer Loop brand evolved from a general sports image to a one that is more "urban style", perfect for any time of the day. Killer Loop is young... -

Page 40

LICENSE BRANDS -

Page 41

... comfort and practicality. The Byblos brand has been licensed to Luxottica Group since 1989. Byblos models reflect a fresh, modern, nonconformist style, with a cutting-edge design and a brilliant spectrum of colors for both the frames and lenses. Byblos customers prefer a lightweight product, not... -

Page 42

...and style. Creativity and cutting-edge design. Dolce & Gabbana and Luxottica, two market-leading companies, signed a new licensing agreement in October 2005. The Dolce & Gabbana brand was formed in 1985 by the famous designer duo, Domenico Dolce and Stefano Gabbana, who blended sensuality with their... -

Page 43

...production process, from design and materials selection to manufacturing, retail sales concepts, advertising campaigns and communication strategies, creating a chain of value that generates total quality. This meticulousness is never flaunted. Instead, it emerges in the attention to detail that make... -

Page 44

..., has been a licensed brand of Luxottica Group since 1993. Designed not only for those who love sports, but also for those who are looking for an eyewear for their free time. The collections are perfectly suited to the new trends which bring the athletic into the day-to-day. Sergio Tacchini eyewear... -

Page 45

Cambodia 2005 -

Page 46

...closely monitored distribution. The Group provides its wholesale division with thorough marketing and PR support, reinforcing brand image and coordinating the presentation of its brand portfolio at the international level. Luxottica Group plans to expand its distribution network over time by opening... -

Page 47

-

Page 48

...way to achieve the efficiency required by the type of products and services it wanted to offer. Control of the various phases of production allows the Group to closely monitor the quality of products and processes, maximize synergies and introduce new operating methods and other innovations. It also... -

Page 49

> 48 | ANNUAL REPORT 2005 to become the global leader in eyewear and one of the manufacturers of premium prescription and sun frames with the most efficient cost control and highest profitability. QUALITY: A KEY ASSET Product quality has always been Luxottica Group's main focus and has led to the ... -

Page 50

Thailand 2004 -

Page 51

-

Page 52

... this historic U.S. optical retail brand with Luxottica Group's unique retail know-how and quality products and services. The Group firmly believes that the Pearle Vision brand has significant growth opportunities in both the United States and Canada. Sunglass Hut Luxottica Group will continue down... -

Page 53

... well as in terms of product offerings, making EyeMed Vision Care services even more appealing for corporations and their employees. One result of this has been the increase in the number of consumers using vision benefits both at independent and Luxottica Group stores. ASIA-PACIFIC Today, the goal... -

Page 54

... and development to maintain the high value added levels of its products and service. Luxottica Group's growth in the retail segment in North America, especially in terms of volumes in the licensed brand segment, and in Asia-Pacific and the new licensing agreements entered in recent years are... -

Page 55

-

Page 56

... provide free eye exams and eyeglasses to communities in need. Since 1991, 101 international missions took place in over 27 countries. During this time, approximately 1,200 associates volunteered their services in these missions. Give the Gift of Sight also collects, through Luxottica Group's retail... -

Page 57

> 56 | ANNUAL REPORT 2005 helped perform Vision Screenings in schools and stores of the Group and provided eyeglasses in hospitals and retirement centers, helping a total of 199,412 people. Thanks to the strong dedication of the program to children, during the year its two vision vans provided new ... -

Page 58

Cambodia 2005 -

Page 59

.../IFRS Consolidated Balance Sheets 73 > Dividend proposal and related tax regime 77 > Annual Report on Corporate Governance 2005 and Sarbanes-Oxley project 91 > Stock option and share buy back plans 93 > Luxottica Group capital stock information 94 95 95 Listings: 16 years on the NYSE and five on the... -

Page 60

Thailand 2004 -

Page 61

-

Page 62

... 2003 (1) 2004 (1) (2) 2005 (1) (2) Net sales Cost of sales Purchases and inventory variance Manufacturing cost Manufacturing depreciation Manufacturing personnel cost Gross profit Operating expenses Selling expenses Royalties Advertising expenses General and administrative expenses Goodwill and... -

Page 63

... financial position, beginning of the year Net income before minority interests Depreciation and amortization Change in net working capital Provision and other Operating cash flow Capital expenditure (Investments)/Disposal in intangible assets Purchase of business net of cash acquired Sale of Pearle... -

Page 64

... was mainly attributable to increased sales of our Ray-Ban brand, Prada, Versace, Bvlgari and Dolce & Gabbana (which distribution began in October 2005) branded products, primarily in the European and North American markets. On a geographic basis, operations in the United States and Canada resulted... -

Page 65

...expenses). Operating margin in the retail segment decreased to 11.5% in 2005 from 13.2% for 2004 due to the inclusion of Cole National's results in the Group results of operations. Management expects that the North American retail operating margin levels will return to 2004 pre-acquisition operating... -

Page 66

... performance excluding the impact of changes in exchange rates may differ from methods used by other companies. See the table below for a reconciliation of the operating measures excluding the impact of fluctuations in currency exchange rates to their most directly comparable U.S. GAAP financial... -

Page 67

... on a consistent basis in 2005 as compared to 2004, as adjusted, is mainly attributable to the additional sales of Ray-Ban product lines, as well as to the additional sales of the Prada, (2) Versace and Bvlgari product lines and increased comparable store sales of the retail division. The following... -

Page 68

...with the gains or losses from the change in value reflected in current operations. In June 2005, the 2002 Swap expired. In December 2002, the Company entered into an unsecured credit facility with Banca Intesa S.p.A. The new unsecured credit facility provided borrowing availability of up to Euro 650... -

Page 69

... Company to require the cancellation of all the performance rights and options still outstanding. The aggregate purchase price was A$ 442.7 million (Euro 253.7 million), including acquisition expenses, and was paid for with the proceeds of a new credit facility with Banca Intesa S.p.A. of Euro 200... -

Page 70

... - New York Branch and UniCredit Banca d'Impresa S.p.A. act as Facility Agents. Under this credit facility, Euro 974.3 million was outstanding as of December 31, 2005. This agreement was amended in March 2006 (see "Subsequent events"). In June 2005, the Company entered into nine interest rate swap... -

Page 71

Panama 2005 -

Page 72

...IAS 19 Employee benefit IAS 38 Intangible depreciation IAS 39 Derivatives IFRS 2 IFRS 3 Other Total Stock Business minor & adjustments Option combination reclassifications IAS / IFRS IAS / IFRS December 31, 2005 4,370,744 Net sales Cost of sales Gross profits Operating expenses Selling expenses... -

Page 73

-

Page 74

... DECEMBER 31, 2005 To our shareholders At the Annual Ordinary Shareholders' Meeting of Luxottica Group S.p.A. to be held in Milan on June 14, 2006 on first call, the Board of Directors of the Company, taking into consideration the foreseeable growth and profit prospects of the Group, will submit... -

Page 75

... which the U.S. resident carries on a business or with a fixed base in Italy through which the U.S. resident performs independent personal services. The substitute tax regime does not apply if ordinary shares representing a "non-qualified" interest in Luxottica Group are held by a shareholder in... -

Page 76

... Depositary has mailed to all ADS holders a document and necessary forms setting forth the detailed procedure to be used by ADS holders for the purpose of obtaining the direct application of the reduced tax rate. You can download those documents also here: Deutche Bank Trust Company Americas Reclaim... -

Page 77

-

Page 78

..., North America, Australia and Asia. 3. Luxottica Group, the Parent Company, is listed on both the NYSE and the telematic stock market organized and managed by Borsa Italiana, and must therefore comply with the U.S. and Italian requirements applicable to companies listed on these exchanges and, in... -

Page 79

... interests of shareholders, employees, customers, suppliers, sales and financial partners as well as of the communities in which Luxottica Group operates. II. BOARD OF DIRECTORS Role and duties. The Board of Directors plays a central role in Luxottica Group's Corporate Governance framework. It... -

Page 80

... Member of the Board of Directors of Luxottica S.r.l., Luxottica U.S. Holdings, LensCrafters Inc., Sunglass Hut Inc. and OPSM Group Pty Ltd. Mr. Roberto Chemello Chief Executive Officer of Luxottica S.r.l. Mr. Claudio Del Vecchio Chairman and Chief Executive Officer of Retail Brand Alliance Inc. and... -

Page 81

... Executive Officer, Mr. Andrea Guerra, has full day to day authority in respect of Luxottica Group. His authority is set out in the resolutions made and the guidelines issued by the Board of Directors, although it does not extend to those powers reserved to the Board either at law, by the Company... -

Page 82

... the internal control system and assesses its adequacy by taking account of the views and reports made by those individuals, departments and committees tasked with ensuring that the organizational, administrative and accounting structure is appropriate to the Group's nature and size. This process is... -

Page 83

... of the Internal Auditing Department's activity; • the performance of any additional tasks assigned to it by the Board, such as checking whether the Code of Ethics has been duly circulated and enforced and the prior evaluation of any non-audit assignments to the Auditing Company, in agreement with... -

Page 84

...to reform the Corporate Governance system of companies listed in the United States and to protect investors through more accurate and reliable company reporting, has provided added motivation to ensure the quality of internal controls. Luxottica Group, as a New York Stock Exchange-listed company, is... -

Page 85

... with the principles of transparency, fairness and loyalty underpin the Group's Corporate Governance framework. Code of Ethics. The Group's Code of Ethics identifies the values supporting all business activity, and is continuously reviewed and updated to take account of suggestions made in the... -

Page 86

... of the companies of the Group makes any transactions with related parties "which, because of their purposes, considerations, methods or time of execution, may affect the protection of corporate assets or the completeness and correctness of information, including accounting information," concerning... -

Page 87

... and information obligations relating to dealings in financial instruments performed by socalled "relevant parties", of which a list is provided. "Relevant parties" shall notify the Company, CONSOB and the public of any transactions involving purchase, sale, subscription or exchange of shares or... -

Page 88

... force in Italy and the U.S., in view of the fact that Luxottica Group shares are listed both on the telematic stock market organized and managed by Borsa Italiana and on the New York Stock Exchange. Any further constraints imposed by any local laws applicable to individual non-Italian subsidiaries... -

Page 89

... 27, 2006, the Board of Directors: (i) adopted the new Guidelines concerning transactions with related parties; (ii) adopted the new procedure concerning Internal Dealing; (iii) adopted the new procedure for handling privileged information; (iv) updated the Code of Ethics as a result of adoption... -

Page 90

Cambodia 2005 -

Page 91

-

Page 92

...of Luxottica Group, approved the purchase of up to 11,500,000 Luxottica Group's ADS, representing an equal number of ordinary shares, equivalent to 2.5% of Luxottica Group's authorized and issued share capital. This plan required that the purchase be carried out on the New York Stock Exchange within... -

Page 93

Cambodia 2005 -

Page 94

..., 1990. At the time of the Initial Public Offering 10,350,000 ordinary shares were sold, equivalent to 5,175,000 American Depositary Shares (each ADS equals two ordinary shares). The issue price was US$ 19 per ADS. In June 1992 Luxottica Group's Board of Directors approved a change in the conversion... -

Page 95

> 94 | ANNUAL REPORT 2005 16 YEARS ON THE NYSE AND FIVE YEARS ON THE MTA NYSE Quarterly ADS prices - In US$ (1) 2005 High Low Close High 2004 Low Close High 2003 Low Close High 2002 Low Close First Second Third Fourth Full year 21.99 21.32 25.35 25.83 25.83 20.06 19.69 20.61 23.75... -

Page 96

... < ADS AND ORDINARY SHARE PERFORMANCE ON NYSE AND MTA AND MAIN INDEXES 30 25 20 15 10 5 jan-01 jan-02 jan-03 jan-04 jan-05 jul-01 jul-02 jul-03 jul-04 jul-05 MTA (in Euro) NYSE (in US$) S&P Mib (rebased) Dow Jones Industrial Average (rebased) AVERAGE EURO/US$ EXCHANGE RATE: 1995-2005... -

Page 97

...public accounting firm 100 102 103 104 Consolidated Balance Sheets Statements of Consolidated Income Statements of Consolidated Shareholders' Equity Statements of Consolidated Cash Flows 107 > Notes to the Consolidated Financial Statements 151 > Key contacts and addresses 153 > Luxottica Group main... -

Page 98

Dominican Republic 2003 -

Page 99

-

Page 100

... the standards of the Public Company Accounting Over-sight Board (United States of America). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the Financial Statements are free of material misstatements. The Company is not required to have, nor... -

Page 101

...accounts, Euro 23.4 million in 2004 and Euro 7.6 million in 2005, US$ 32.6 million in 2005) Sales and income taxes receivable Inventories Prepaid expenses and other Asset held for sale Deferred tax assets Total... at the New York City Noon Buying Rate as determined in Note 1 See notes to Consolidated... -

Page 102

... (Euro/000) REPORT OF INDEPENDENT PUBLIC ACCOUNTING FIRM | 101 < 2005 2005 (US$/000) (1) CURRENT LIABILITIES Bank overdrafts Current portion of long-term debt Accounts payable Accrued expenses: • Payroll and related • Customers' right of return • Other Income taxes payable Total current... -

Page 103

...102 | ANNUAL REPORT 2005 STATEMENTS OF CONSOLIDATED INCOME FOR THE YEARS ENDED DECEMBER 31, 2003, 2004 AND 2005 (*) 2003 2004 (Euro/000) 2005 2005 (US$/000) (1) NET SALES COST OF SALES GROSS PROFIT OPERATING EXPENSES Selling and advertising General and administrative Total INCOME FROM OPERATIONS... -

Page 104

... liability, net of taxes of Euro 1.6 million Tax benefit on stock options Change in fair value of derivative instruments, net of taxes of Euro 2.3 million Dividends declared (Euro 0.23 per share) Net income Comprehensive income BALANCES DECEMBER 31, 2005 457,975,723 27,479 150,179 2,050,883 (48... -

Page 105

... CHANGES IN OPERATING ASSETS AND LIABILITIES, NET OF ACQUISITION OF BUSINESSES: Accounts receivable Prepaid expenses and other Inventories Accounts payable Accrued expenses and other Accrual for customers' right of return Income taxes payable Total adjustments Cash provided by operating activities... -

Page 106

.../000) REPORT OF INDEPENDENT PUBLIC ACCOUNTING FIRM | 105 < 2005 2005 (US$/000) (1) CASH FLOWS FROM FINANCING ACTIVITIES Long-term debt: • Proceeds • Repayments Swap termination fees (Decrease) increase in overdraft balances Investment in treasury shares Exercise of Stock Options Dividends... -

Page 107

Thailand 2004 -

Page 108

... in Australia, New Zealand, Hong Kong, Singapore and Malaysia; and Cole National operated 2,388 owned stores and 462 franchised specialty retailers of optical products and personalized gifts located in the United States of America and Canada. Certain of the Company's U.S. subsidiaries also... -

Page 109

... are stated at the lower of cost, at FIFO or weighted-average cost, or market value. As of January 2, 2005, the Company changed its method of valuing certain of its retail inventory from the last-in, first-out method ("LIFO") to FIFO in order to reduce the number of valuation methods among retail... -

Page 110

... 2005, the result of this process was the determination that the carrying value of each reporting unit of the Company was not impaired and, as a result, the Company has not recorded a goodwill impairment charge. Trade names and other intangibles - In connection with various acquisitions, Luxottica... -

Page 111

... | ANNUAL REPORT 2005 Store opening and closing costs - Store opening costs are charged to operations as incurred in accordance with Statement of Position No. 98-5, Accounting for the cost of start-up activities. The costs associated with closing stores or facilities are recorded at fair value as... -

Page 112

... of a promotional offer are recorded in cost of sales at the time they are delivered to the customer. Discounts and coupons tendered by customers are recorded as a reduction of revenue at the date of sale. Managed vision care underwriting and expenses - The Company sells vision insurance plans which... -

Page 113

... in 2004, derivative financial instruments which are either accounted for as fair value or cash flow hedges. Luxottica Group estimates the fair value of cash, cash equivalents and marketable securities based on interest rates available to the Company and by comparison to quoted market prices and its... -

Page 114

... compensation costs of the plans been determined under a fair-value based method as stated in SFAS 123: Year ended December 31 - In thousands of Euro, except share data 2003 267,343 2004 286,874 2005 342,294 Net income as reported add: Stock-based compensation cost included in the reported net... -

Page 115

.... Luxottica Group uses derivative financial instruments, principally interest rate and currency swap agreements, as part of its risk management policy to reduce its exposure to market risks from changes in interest and foreign exchange rates. Although it has not done so in the past, the Company may... -

Page 116

... asset retirement obligation" if the fair value of the liability can be reasonably estimated. FIN 47 is effective for reporting periods beginning after December 15, 2005. The adoption of FIN 47 is not expected to have a material effect on the Company's Consolidated Financial Statements. In May 2005... -

Page 117

...million shares) of the Company's currently authorized and issued share capital, to a Stock Option plan for top management of the Company at an exercise price of Euro 13.67 per share (the closing stock price at December 31, 2005 on the Milan Stock Exchange was Euro 21.43 per share). The Stock Options... -

Page 118

... of the Company's strategy to expand its retail business in Asia Pacific area. The purchase price (including direct acquisition-related expenses) has been allocated based upon the valuation of the Company's acquired assets and liabilities, assumed as follows (reported at the exchange rate on the... -

Page 119

... accrued expenses Other current liabilities Deferred tax liabilities Minority interests Bank overdraft Fair value of net assets Goodwill Total purchase price The following unaudited pro forma information for the year ended December 31, 2003 summarizes the results of operations as if the acquisition... -

Page 120

... IC Optics through a 50/50 joint venture. The acquisition was accounted for in accordance with SFAS 141 and, accordingly, the purchase price has been allocated to the fair market value of the assets and liabilities of the company acquired including an intangible asset for the license agreement for... -

Page 121

... non current liabilities Fair value of net assets Goodwill Total purchase price As part of the acquisition of Cole, the Company acquired approximately 21% of the outstanding shares of Pearle Europe B.V. ("PE"). A change of control provision included in the Articles of Association of PE required... -

Page 122

... SunShade Holding Corporation and Hao's International. The acquisition was accounted for under SFAS 141 and, accordingly, the purchase price of Euro 11.1 million has been allocated to the fair market value of the assets and liabilities of the company as defined by the asset purchase agreement. All... -

Page 123

> 122 | ANNUAL REPORT 2005 f) Pending acquisitions • In July 2005, the Company announced that SPV Zeta S.r.l., a new wholly owned Italian subsidiary, will acquire 100% of the equity interest in Beijing Xueliang Optical Technology Co. Ltd. ("Xueliang Optical") for a purchase price of Chinese ... -

Page 124

... Cole's final purchase price allocation Change in exchange rates (b) Balance as of December 31, 2005 (a) Goodwill acquired in 2004 consisted primarily of the retail acquisitions of OPSM and Cole and the wholesale acquisitions of the EID companies and IC Optics. Goodwill acquired in 2005 consisted... -

Page 125

...) and, as such, balances may fluctuate due to changes in exchange rates. Estimated annual amortization expense relating to identifiable assets, including the identifiable intangibles attributable to recent acquisitions for which the purchase price allocation is not final, is shown below: Years... -

Page 126

... differences, principally losses in subsidiary companies funded through capital contributions, net of non-deductible goodwill Aggregate other effects Effective rate (6.3%) 30.1% (2.4%) 35.4% 2.1% 37.0% The 2005 aggregate Italian tax benefit is caused by the Company complying with an Italian law... -

Page 127

... of the change in the Italian tax rate was immaterial and has been included in deferred tax expense. Italian companies' taxes are subject to review pursuant to Italian law. As of December 31, 2005, tax years from 1999 through the most recent year were open for such review. Certain Luxottica Group... -

Page 128

... for as a liability. Management believes no significant unaccrued liabilities will arise from the related tax reviews. The Company generally does not provide for an accrual for income taxes on undistributed earnings of its foreign operations to the related Italian Parent Company that are intended to... -

Page 129

... and more than 90% of the performance rights and options of OPSM for an aggregate of A$ 442.7 million (Euro 253.7 million), including acquisition expenses. The purchase price was paid for with the proceeds of a new credit facility with Banca Intesa S.p.A. of Euro 200 million, in addition to other... -

Page 130

... by the Company and Luxottica S.r.l., a wholly owned subsidiary. The notes contain certain financial and operating covenants. The Company was in compliance with those covenants as of December 31, 2005. In December 2005, the Company terminated the fair value interest rate swap agreement described... -

Page 131

... benefit accrued by an employee for service to date is payable immediately upon separation. Accordingly, the undiscounted value of that benefit payable exceeds the actuarial present value of that benefit because payment is estimated to occur at the employee's expected termination date. The Company... -

Page 132

... upon retirement. Pension benefits are accrued based on length of service and annual compensation under a cash balance formula. This pension plan was amended effective January 1, 2006, granting eligibility to associates who work in the Cole Vision stores, field management, and the related labs and... -

Page 133

> 132 | ANNUAL REPORT 2005 Obligations and funded status Pension plan 2004 2005 SERP 2004 2005 In thousands of Euro Change in benefit obligations Benefit obligation at beginning of period Translation differences Service cost Interest cost Actuarial loss (gain) Acquisition Benefits paid Benefit ... -

Page 134

... 221 287 115 12 635 2005 5,549 218 318 10 125 671 Components of net periodic benefit cost Service cost Interest cost Expected return on plan assets Amortization of actuarial loss Amortization of prior service cost Net periodic pension expense Additional information (Decrease)/Increase in minimum... -

Page 135

... class and manager level by assigning benchmarks and excess return targets. The investment managers are monitored on a ongoing basis to evaluate performance against the established market benchmarks and targets. Each of the defined benefit pension plans has an investment policy that was developed... -

Page 136

... companies acquired: • Cole provides post-employment benefits under individual agreements for continuation of health care benefits and life insurance coverage to former employees after employment but before retirement. As of December 31, 2004 and 2005, the accrued liability related to this benefit... -

Page 137

... to new participants at the time of Cole's acquisition of Pearle. Under this plan, the eligible former employees are provided life insurance and certain health care benefits which are partially subsidized by Cole. Medical benefits under this plan can be maintained past age 65. Net periodic cost of... -

Page 138

... Service cost Interest cost Plan participants' contributions Amendments Actuarial gain Acquisition Change in plan provisions Benefits paid Benefits obligation - end of year Changes in plan assets Fair value of plan assets - beginning of year Translation differences Company contribution Plan... -

Page 139

... 2005. The weighted-average discount rate used in determining the net periodic benefit cost for 2004 and 2005 was 5.75% and 6.0%, respectively. Certain of the Company's non-Italian and non-U.S. subsidiaries provide limited non-pension benefits to retirees in addition to government sponsored programs... -

Page 140

... closing ADR price at December 31, 2005 on the New York Stock Exchange was US$ 25.31 per share) at an exercise price of US$ 18.59 per share. Compensation expense is recorded in accordance with variable accounting under APB 25 for the options issued under the incentive plan based on the market value... -

Page 141

... and issued share capital, to a Stock Option plan for top management of the Company at an exercise price of Euro 13.67 per share (the closing stock price at December 31, 2005 on the Milan Stock Exchange was Euro 21.43 per share). The Stock Options to be issued under the Stock Option plan vest upon... -

Page 142

...' equity. In September 2002, the Board of Directors authorized US Holdings to repurchase through the open market up to 11,500,000 ADRs of Luxottica Group S.p.A., representing 2.5% of the authorized and issue share capital, during an 18-month period starting in September 2002. In March 2003... -

Page 143

...geographic segments include Italy, the main manufacturing and distribution base, United States and Canada (which includes the United States of America, Canada and Caribbean islands), AsiaPacific (which includes Australia, New Zealand, Singapore, Malaysia, Thailand, China, Hong Kong, Japan and Taiwan... -

Page 144

... and accounts receivable. Concentration of sales under license agreement In February 2004, the Company renewed its license agreement for the design, production and distribution of frames under the Chanel trade name. Chanel sales represent approximately 4.4% and 3.8% of total sales in 2004 and 2005... -

Page 145

... meeting certain targets. In October 2005, the Company announced the signing of a 10-year license agreement for the design, production and worldwide distribution of prescription frames and sunglasses under the Burberry name. The agreement began on January 1, 2006. Minimum payments required in each... -

Page 146

... the acquisition of Cole, the Company operates departments in various host stores paying occupancy costs solely as a percentage of sales. Certain agreements which provide for operations of departments in a major retail chain in the United States contain short-term cancellation clauses. Total rental... -

Page 147

> 146 | ANNUAL REPORT 2005 Cole has guaranteed future minimum lease payments for certain store locations leased directly by franchisees. These guarantees aggregated approximately Euro 7.3 million at December 31, 2005. Performance under a guarantee by the Company is triggered by default of a ... -

Page 148

..., EYEXAM and EyeMed Vision Care, LLC, allege various statutory violations relating to the operation of LensCrafters' stores in California, including violations of California laws governing relationships among opticians, optical retailers, manufacturers of frames and lenses and optometrists, false... -

Page 149

... Court granted Cole's petition for review of the portion of the appellate court's decision stating that California law prohibited defendants from providing eye examinations and other optometric services at Pearle Vision Centers. The appellate court's decision directing the trial court to enjoin... -

Page 150

... financial position or results of operations. 15. SUBSEQUENT EVENTS On February 27, 2006, the Company announced a ten-year license agreement with Polo Ralph Lauren Corp. for the design, production and worldwide distribution of prescription frames and sunglasses under the Polo Ralph Lauren... -

Page 151

Romania 2005 -

Page 152

...- USA Deutsche Bank Trust Co. Americas Deutsche Bank Trust Co. Americas - c/o Mellon Investor Services Transfer Department - ADRs - 480 Washington Boulevard Jersey City, NJ 07310 - United States of America Toll free (in US): +1 (800) 749 1873 or Toll: +1 (866) 249-2593 International callers: +1 (201... -

Page 153

-

Page 154

LUXOTTICA GROUP MAIN OPERATING COMPANIES IN THE WORLD EUROPA Luxottica Srl Agordo, Belluno - Italy Luxottica Vertriebsgesellschaft mbH Klosterneuburg - Austria Luxottica Belgium NV Deurne - Belgium Oy Luxottica Finland AB Espoo - Finland Luxottica France SÃ rl Valbonne - France Luxottica Fashion ... -

Page 155

> 154 | ANNUAL REPORT 2005 AMERICAS Luxottica Argentina Srl Buenos Aires - Argentina Luxottica Do Brasil Ltda São Paulo - Brazil Luxottica Canada Inc Toronto - Canada Luxottica Mexico SA de CV Mexico City - Mexico Eyemed Vision Care LLC Wilmington, Delaware - USA Luxottica U.S. Holdings Corp ... -

Page 156

... GROUP MAIN OPERATING COMPANIES IN THE WORLD | 155 < MIDDLE AND FAR EAST Luxottica Australia Pty Ltd Sydney - Australia OPSM Group Pty Ltd Sydney - Australia Luxottica Tristar (Dongguan) Optical Co Dong Guan City, Guangdong - China Luxottica Middle East Fze Dubai - Dubai Luxottica Retail Hong Kong... -

Page 157

Pictures Pictures of Give the Gift of Sight missions at home and abroad printed in this Annual Report are by Lyons Photography, Inc. Graphic art Letizia Marino 19Novanta comunication partners Consultancy and co-ordination Ergon Comunicazione Printing Grafiche Antiga - Italy -

Page 158