Kroger 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-42

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

To the extent interest and penalties would be assessed by taxing authorities on any underpayment

of income tax, such amounts have been accrued and classified as a component of income tax expense.

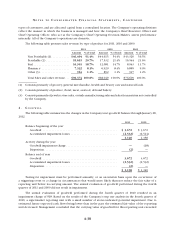

During the years ended January 28, 2012, January 29, 2011 and January 30, 2010, the Company recognized

approximately $(24), $(2) and $4 respectively, in interest and penalties (recoveries). The Company had

accrued approximately $54 and $101 for the payment of interest and penalties as of January 28, 2012 and

January 29, 2011, respectively.

The IRS concluded a field examination of the Company’s 2005 – 2007 U.S. tax returns during the second

quarter of 2010 and is currently auditing years 2008 – 2009. The audit is expected to be completed in the

next twelve months. Additionally, the Company has a case in the U.S. Tax Court. A favorable ruling on the

Company’s motion for partial summary judgment was issued on January 27, 2011. A final decision in the

case, and the filing of any appeals, should occur within the next 12 months. Refer to Note 11 for additional

information regarding this U.S. Tax Court case. In connection with this case, the Company has extended the

statute of limitations on our tax years after 1991 and those years remain open to examination. States have

a limited time frame to review and adjust federal audit changes reported. Assessments made and refunds

allowed are generally limited to the federal audit changes reported.

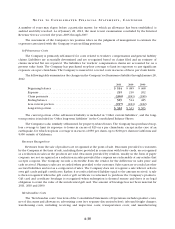

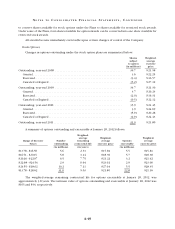

5. DE B T OB L I G A T I O N S

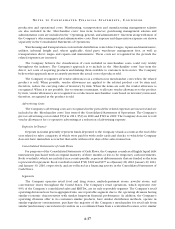

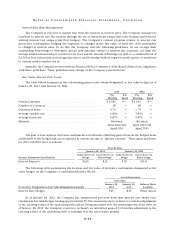

Long-term debt consists of:

2011 2010

Commercial paper .......................................... 370 —

2.20% to 8.00% Senior notes and debentures due through 2040 . . . . . . 7,078 7,106

5.00% to 9.50% Mortgages due in varying amounts through 2034 . . . . . 65 73

Other ..................................................... 230 255

Total debt ................................................. 7,743 7,434

Less current portion ......................................... (1,275) (549)

Total long-term debt ......................................... $ 6,468 $ 6,885

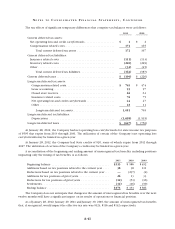

In 2010, the Company issued $300 of senior notes bearing an interest rate of 5.40% due in 2040. In 2010,

the Company repaid $500 of senior notes bearing an interest rate of 8.05%.

In 2011, the Company issued $450 of senior notes bearing an interest rate of 2.20% due in fiscal year

2016. The proceeds of this issuance of senior notes were used to fund a portion of the Company’s obligations

under the UFCW consolidated multi-employer pension fund. In 2011, the Company repaid $478 of senior

notes bearing an interest rate of 6.80%.

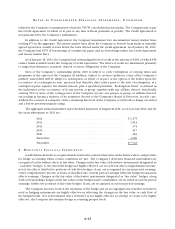

On January 25, 2012, the Company amended and extended its $2,000 unsecured revolving credit facility.

The Company entered into the amended credit facility to amend and extend the Company’s existing credit

facility which would have terminated on May 15, 2014. The amended credit facility provides for a $2,000

unsecured revolving credit facility (the “Credit Agreement”), with a termination date of January 25, 2017,

unless extended as permitted under the Credit Agreement. The Company has the ability to increase the size

of the Credit Agreement by up to an additional $500, subject to certain conditions.

Borrowings under the Credit Agreement bear interest at the Company’s option, at either (i) LIBOR plus

a market rate spread, based on the Company’s Leverage Ratio or (ii) the base rate, defined as the highest

of (a) the Bank of America prime rate, (b) the Federal Funds rate plus 0.5%, and (c) one-month LIBOR plus

1.0%, plus a market rate spread based on the Company’s Leverage Ratio. The Company will also pay a

Commitment Fee based on the Leverage Ratio and Letter of Credit fees equal to a market rate spread based on

the Company’s Leverage Ratio. The Credit Agreement contains covenants, which, among other things, require

the maintenance of a Leverage Ratio of not greater than 3.50:1.00 and a Fixed Charge Coverage Ratio of not

less than 1.70:1.00. Subsequent to year-end, the covenants were amended to exclude up to $1,000 in expense