Kroger 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

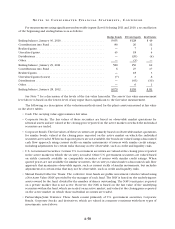

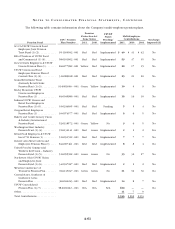

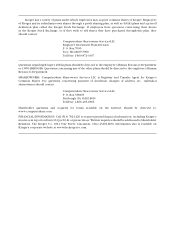

A-62

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

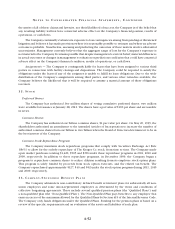

(1) The Company’s multi-employer contributions to these respective funds represent more than 5% of the

total contributions received by the pension funds.

(2) The information for this fund was obtained from the Form 5500 filed for the plan’s year-end at March 31,

2011 and March 31, 2010.

(3) The information for this fund was obtained from the Form 5500 filed for the plan’s year-end at

September 30, 2010 and September 30, 2009.

(4) The information for this fund was obtained from the Form 5500 filed for the plan’s year-end at June 30,

2010 and June 30, 2009.

(5) The information for this fund was obtained from the Form 5500 filed for the plan’s year-end at June 30,

2010 and June 30, 2009.

(6) As of December 31, 2011, these four pension funds were consolidated into the UFCW consolidated

pension plan. See the above information regarding this multi-employer pension fund consolidation.

(7) The UFCW consolidated pension plan was formed on January 1, 2012, as the result of the merger of four

existing multi-employer pension plans. See the above information regarding this multi-employer pension

fund consolidation.

(8) Under the Pension Protection Act, a surcharge may be imposed when employers make contributions under

a collective bargaining agreement that is not in compliance with a rehabilitation plan. As of January 28,

2012, the collective bargaining agreements under which the Company was making contributions were

in compliance with rehabilitation plans adopted by the applicable pension fund, except for the pension

fund noted above with an imposed surcharge.