Kroger 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-65

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

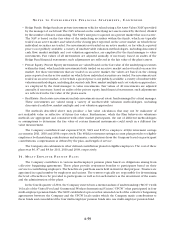

16 . I N V E S T M E N T IN VA R I A B L E IN T E R E S T EN T I T Y

In February 2010, the Company purchased the remaining interest of The Little Clinic LLC for $86. Since

The Little Clinic LLC was consolidated as a VIE prior to the February 2010 purchase, the Company recorded

the additional investment as an equity transaction. Accordingly, no gain or loss was recorded on the additional

investment. As of the purchase date, the Company continued to consolidate The Little Clinic LLC as a wholly-

owned subsidiary.

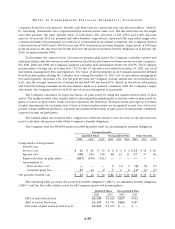

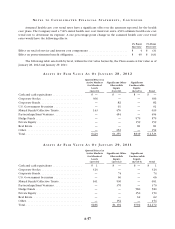

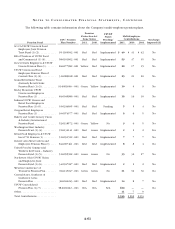

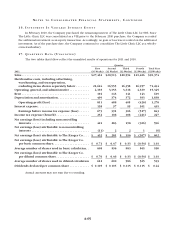

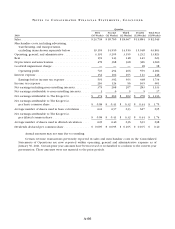

17. QU A R T E R L Y DA T A (UN A U D I T E D )

The two tables that follow reflect the unaudited results of operations for 2011 and 2010.

Quarter

2011

First

(16 Weeks)

Second

(12 Weeks)

Third

(12 Weeks)

Fourth

(12 Weeks)

Total Year

(52 Weeks)

Sales ......................................... $27,461 $20,913 $20,594 $21,406 $90,374

Merchandise costs, including advertising,

warehousing, and transportation,

excluding items shown separately below ........ 21,624 16,555 16,358 16,957 71,494

Operating, general, and administrative ............ 4,335 3,353 3,318 4,339 15,345

Rent ......................................... 192 143 141 143 619

Depreciation and amortization ................... 499 374 372 393 1,638

Operating profit (loss) ....................... 811 488 405 (426) 1,278

Interest expense ............................... 138 97 99 101 435

Earnings before income tax expense (loss) ...... 673 391 306 (527) 843

Income tax expense (benefit) .................... 252 108 108 (221) 247

Net earnings (loss) including noncontrolling

interests ................................... 421 283 198 (306) 596

Net earnings (loss) attributable to noncontrolling

interests ................................... (11) 2 2 1 (6)

Net earnings (loss) attributable to The Kroger Co. ... $ 432 $ 281 $ 196 $ (307) $ 602

Net earnings (loss) attributable to The Kroger Co.

per basic common share...................... $ 0.71 $ 0.47 $ 0.33 $ (0.54) $ 1.01

Average number of shares used in basic calculation.. 608 596 583 565 590

Net earnings (loss) attributable to The Kroger Co.

per diluted common share .................... $ 0.70 $ 0.46 $ 0.33 $ (0.54) $ 1.01

Average number of shares used in diluted calculation 612 600 586 565 593

Dividends declared per common share ............ $ 0.105 $ 0.105 $ 0.115 $ 0.115 $ 0.44

Annual amounts may not sum due to rounding.