Kroger 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

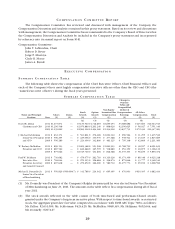

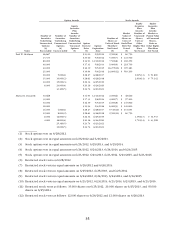

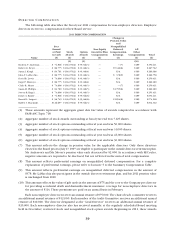

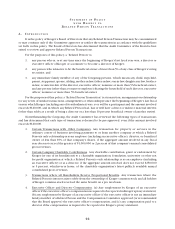

OU T S T A N D I N G EQ U I T Y AW A R D S A T FI S C A L YE A R -EN D

The following table discloses outstanding equity-based incentive compensation awards for the named

executive officers as of the end of fiscal year 2011. Each outstanding award is shown separately. Option awards

include performance-based nonqualified stock options. The vesting schedule for each award is described in

the footnotes to this table. Market value of unvested shares is based on Kroger’s closing stock price of $24.30

on January 27, 2012, the last trading day of the 2011 fiscal year.

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or

Units of Stock

That Have

Not Vested

(#)

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

($)

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights That

Have

Not Vested

Equity

Incentive

Plan

Awards:

Market or

Payout Value

of Unearned

Shares,

Units or

Other Rights

That Have

Not Vested

David B. Dillon 70,000 $23.00 5/9/2012 22,000(6) $ 534,600

35,000 $23.00 5/9/2012 46,000(7) $1,117,800

210,000 $14.93 12/12/2012 69,000(8) $1,676,700

300,000 $17.31 5/6/2014 69,000(9) $1,676,700

300,000 $16.39 5/5/2015 106,350(10) $2,584,305

240,000 $19.94 5/4/2016 15,525(13) $397,130

176,000 44,000(1) $28.27 6/28/2017 19,143(14) $491,018

135,000 90,000(2) $28.61 6/26/2018

90,000 135,000(3) $22.34 6/25/2019

46,000 184,000(4) $20.16 6/24/2020

283,600(5) $24.74 6/23/2021

J. Michael Schlotman 40,000 $17.31 5/6/2014 2,000(6) $ 48,600

40,000 $16.39 5/5/2015 4,000(7) $ 97,200

20,000 $19.94 5/4/2016 6,000(8) $ 145,800

16,000 4,000(1) $28.27 6/28/2017 7,500(9) $ 182,250

12,000 8,000(2) $28.61 6/26/2018 17,115(10) $ 415,895

8,000 12,000(3) $22.34 6/25/2019 1,688(13) $ 43,166

5,000 20,000(4) $20.16 6/24/2020 3,081(14) $ 79,020

45,640(5) $24.74 6/23/2021

W. Rodney McMullen 50,000 $23.00 5/9/2012 6,000(6) $ 145,800

25,000 $23.00 5/9/2012 14,000(7) $ 340,200

150,000 $14.93 12/12/2012 21,000(8) $ 510,300

75,000 $17.31 5/6/2014 21,000(9) $ 510,300

75,000 $16.39 5/5/2015 34,290(10) $ 833,247

60,000 $19.94 5/4/2016 70,000(11) $1,701,000

48,000 12,000(1) $28.27 6/28/2017 4,725(13) $120,866

39,000 26,000(2) $28.61 6/26/2018 6,172(14) $158,317

26,000 39,000(3) $22.34 6/25/2019

14,000 56,000(4) $20.16 6/24/2020

91,440(5) $24.74 6/23/2021