Kroger 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-21

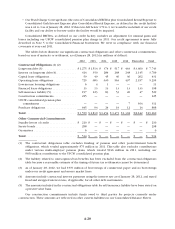

Our purchase obligations include commitments to be utilized in the normal course of business, such

as several contracts to purchase raw materials utilized in our manufacturing plants and several contracts to

purchase energy to be used in our stores and manufacturing facilities. Our obligations also include management

fees for facilities operated by third parties. Any upfront vendor allowances or incentives associated with

outstanding purchase commitments are recorded as either current or long-term liabilities in our Consolidated

Balance Sheets.

As of January 28, 2012, we maintained a $2 billion (with the ability to increase by $500 million),

unsecured revolving credit facility that, unless extended, terminates on January 25, 2017. We amended

the credit agreement subsequent to year-end 2011 to update our covenants for the exclusion of the UFCW

consolidated pension plan charge. All other terms remained the same. Outstanding borrowings under the

credit agreement and commercial paper borrowings, and some outstanding letters of credit, reduce funds

available under the credit agreement. In addition to the credit agreement, we maintained two uncommitted

money market lines totaling $75 million in the aggregate. The money market lines allow us to borrow from

banks at mutually agreed upon rates, usually at rates below the rates offered under the credit agreement. As

of January 28, 2012, we had $370 million of borrowings of commercial paper and no borrowings under our

credit agreement and money market lines. The outstanding letters of credit that reduce funds available under

our credit agreement totaled $19 million as of January 28, 2012.

In addition to the available credit mentioned above, as of January 28, 2012, we had authorized for issuance

$1.6 billion of securities under a shelf registration statement filed with the SEC and effective on December 15,

2010.

We also maintain surety bonds related primarily to our self-insured workers’ compensation claims. These

bonds are required by most states in which we are self-insured for workers’ compensation and are placed with

third-party insurance providers to insure payment of our obligations in the event we are unable to meet our

claim payment obligations up to our self-insured retention levels. These bonds do not represent liabilities

of Kroger, as we already have reserves on our books for the claims costs. Market changes may make the

surety bonds more costly and, in some instances, availability of these bonds may become more limited, which

could affect our costs of, or access to, such bonds. Although we do not believe increased costs or decreased

availability would significantly affect our ability to access these surety bonds, if this does become an issue,

we would issue letters of credit, in states where allowed, against our credit facility to meet the state bonding

requirements. This could increase our cost and decrease the funds available under our credit facility.

We have guaranteed half of the indebtedness of two real estate entities in which we have a 50%

ownership interest. Our share of the responsibility for this indebtedness, should the entities be unable to

meet their obligations, totals approximately $6 million. Based on the covenants underlying this indebtedness

as of January 28, 2012, we believe that it is unlikely that we will be responsible for repayment of these

obligations.

We also are contingently liable for leases that have been assigned to various third parties in connection

with facility closings and dispositions. We could be required to satisfy obligations under the leases if any of

the assignees are unable to fulfill their lease obligations. Due to the wide distribution of our assignments

among third parties, and various other remedies available to us, we believe the likelihood that we will be

required to assume a material amount of these obligations is remote. We have agreed to indemnify certain

third-party logistics operators for certain expenses, including pension trust fund contribution obligations and

withdrawal liabilities.

In addition to the above, we enter into various indemnification agreements and take on indemnification

obligations in the ordinary course of business. Such arrangements include indemnities against third party

claims arising out of agreements to provide services to Kroger; indemnities related to the sale of our securities;

indemnities of directors, officers and employees in connection with the performance of their work; and

indemnities of individuals serving as fiduciaries on benefit plans. While Kroger’s aggregate indemnification

obligation could result in a material liability, we are not aware of any current matter that could result in a

material liability.