Kroger 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

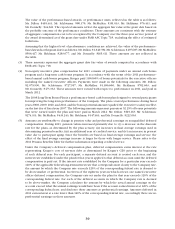

2011. In no event can any participant receive a performance-based long-term cash bonus in excess of the lesser

of $5,000,000 and the participant’s salary at the end of fiscal year 2011. In addition to a cash bonus, under the

2012 plan participants also receive performance units, more particularly described under “Equity” below.

In adopting new long-term plans, the Committee has made adjustments to the percentage payouts for

the components of the long-term plans to account for the increasing difficulty of achieving compounded

improvement.

The Committee anticipates adopting a new plan each year, measuring improvement over successive

three-year periods.

EQ U I T Y

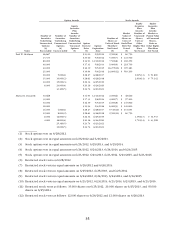

Awards based on Kroger’s common shares are granted periodically to the named executive officers

and a large number of other employees. Equity participation aligns the interests of employees with your

interest as shareholders, and Kroger historically has distributed equity awards widely. In 2011, Kroger granted

3,912,405 stock options to approximately 7,650 employees, including the named executive officers, under one

of Kroger’s long-term incentive plans. The options permit the holder to purchase Kroger common shares at

an option price equal to the closing price of Kroger common shares on the date of the grant. The Committee

adopted a policy of granting options only at one of the four Committee meetings conducted within a week

following Kroger’s public release of its quarterly earnings results.

Kroger’s long-term incentive plans also provide for other equity-based awards, including restricted stock.

During 2011, Kroger awarded 2,556,490 shares of restricted stock to approximately 18,325 employees, including

the named executive officers. This amount is comparable to amounts awarded over the past few years as we

began reducing the number of stock options granted and increasing the number of shares of restricted stock

awards. The change in Kroger’s broad-based equity program from predominantly stock options to a mixture

of options and restricted shares was precipitated by (a) the perception of increased value that restricted shares

offer, (b) the retention benefit to Kroger of restricted shares, and (c) changes in accounting conventions that

permitted the change without added cost.

Beginning in 2010, as a part of the 2010 long-term plan, the Committee also awarded performance units

to the same individuals that receive the long-term performance-based cash bonus described in the previous

section. Performance units are earned based on performance over a three year period on metrics established by

the Committee at the beginning of the performance period. During 2011, Kroger awarded 415,007 performance

units to 139 employees, including the named executive officers. The number of shares of restricted stock

that participants otherwise would have received was reduced by 50% in order to make a larger share of the

participants’ equity compensation be tied to Kroger performance. Under the 2011 plan, participants receive a

2% payout for each point by which the performance in the key categories increases, a 0.50% payout for each

percentage reduction in operating costs, and a 2% payout based on improvement in associate engagement

measures. Total operating costs as a percentage of sales, excluding fuel, at the commencement of the 2011

plan were 27.51%. Actual payouts are based on the degree to which improvements are achieved, will be

earned in Kroger common shares, and cannot exceed 100% of the number of performance units awarded.

In addition to shares earned under performance units, participants receive a cash payment equal to the cash

dividends that would have been earned on that number of shares had the participant owned the shares during

the performance period.

The Committee considers several factors in determining the amount of options, restricted shares, and

performance units awarded to the named executive officers or, in the case of the CEO, recommending to the

independent directors the amount awarded. These factors include:

• The compensation consultant’s benchmarking report regarding equity-based and other long-term

compensation awarded by our competitors;

• The officer’s level in the organization and the internal relationship of equity-based awards within

Kroger;