Kroger 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-50

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

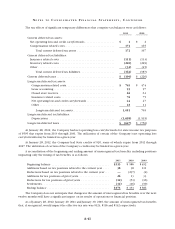

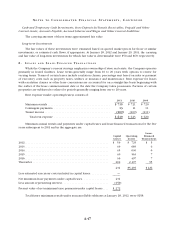

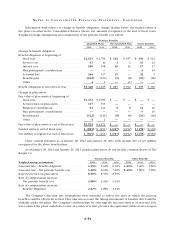

Restricted stock

Restricted

shares

outstanding

(in millions)

Weighted-

average

grant-date

fair value

Outstanding, year-end 2008 ...................................... 4.1 $27.22

Granted .................................................... 2.6 $22.22

Lapsed ..................................................... (2.2) $27.33

Canceled or Expired .......................................... (0.1) $25.33

Outstanding, year-end 2009 ...................................... 4.4 $24.25

Granted .................................................... 2.4 $20.25

Lapsed ..................................................... (2.3) $23.62

Canceled or Expired .......................................... (0.1) $23.13

Outstanding, year-end 2010....................................... 4.4 $22.39

Granted .................................................... 2.5 $24.63

Lapsed ..................................................... (2.5) $21.96

Canceled or Expired .......................................... (0.2) $23.80

Outstanding, year-end 2011....................................... 4.2 $23.92

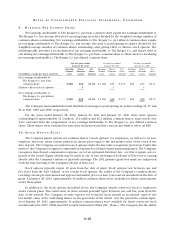

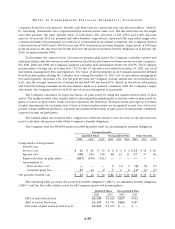

The weighted-average fair value of stock options granted during 2011, 2010 and 2009 was $6.00, $5.12

and $6.29, respectively. The fair value of each stock option grant was estimated on the date of grant using the

Black-Scholes option-pricing model, based on the assumptions shown in the table below. The Black-Scholes

model utilizes extensive judgment and financial estimates, including the term employees are expected

to retain their stock options before exercising them, the volatility of the Company’s stock price over that

expected term, the dividend yield over the term and the number of awards expected to be forfeited before

they vest. Using alternative assumptions in the calculation of fair value would produce fair values for stock

option grants that could be different than those used to record stock-based compensation expense in the

Consolidated Statements of Operations. The increase in the fair value of the stock options granted in 2011,

compared to 2010, resulted primarily from an increase in the Company’s share price. The decrease in the fair

value of the stock options granted during 2010, compared to 2009, resulted primarily from a decrease in the

Company’s share price.

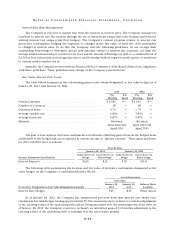

The following table reflects the weighted-average assumptions used for grants awarded to option

holders:

2011 2010 2009

Weighted average expected volatility .................. 26.31% 26.87% 28.06%

Weighted average risk-free interest rate ................ 2.16% 2.57% 3.17%

Expected dividend yield ............................ 1.90% 2.00% 1.80%

Expected term (based on historical results) . . . . . . . . . . . . 6.9 years 6.9 years 6.8 years

The weighted-average risk-free interest rate was based on the yield of a treasury note as of the grant date,

continuously compounded, which matures at a date that approximates the expected term of the options.

The dividend yield was based on our history and expectation of dividend payouts. Expected volatility was

determined based upon historical stock volatilities; however, implied volatility was also considered. Expected

term was determined based upon a combination of historical exercise and cancellation experience as well as

estimates of expected future exercise and cancellation experience.