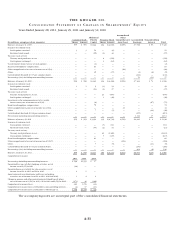

Kroger 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-40

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

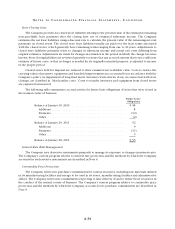

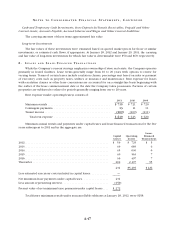

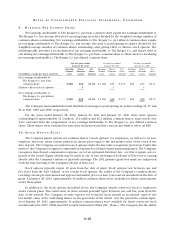

4. TA X E S BA S E D O N IN C O M E

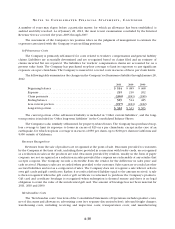

The provision for taxes based on income consists of:

2011 2010 2009

Federal

Current ........................................... $146 $ 697 $193

Deferred .......................................... 78 (136) 275

224 561 468

State and local

Current ........................................... 42 95 41

Deferred .......................................... (19) (55) 23

23 40 64

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $247 $ 601 $532

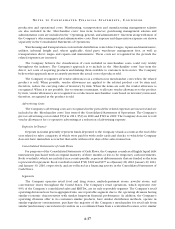

A reconciliation of the statutory federal rate and the effective rate follows:

2011 2010 2009

Statutory rate .................................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit . . . . . . . . . . 1.8% 1.5% 7.1%

Credits ......................................... (3.6)% (1.3)% (3.4)%

Favorable resolution of issues ....................... (3.4)% (.8)% (2.5 )%

Goodwill impairment ............................. — — 53.9%

Other changes, net ............................... (0.5)% 0.3% 0.3%

29.3% 34.7% 90.4%

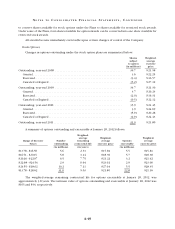

The 2011 effective tax rate was significantly lower than 2010 due to the effect on pre-tax income of

the UFCW consolidated pension plan charge of $953 ($591 after-tax). The effect of the UFCW consolidated

pension plan charge on our effective tax rate is reflected in the increased percentages for credits and favorable

resolution of issues.