Kroger 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-23

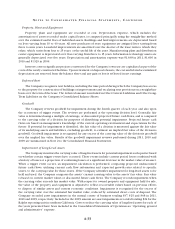

• Weexpectnetearningsperdilutedshareintherangeof$2.28-$2.38for2012.Thisguidanceassumesthe

benefit of the 53rd week, a lower expected LIFO charge, the benefit of our share buyback program during

2011, the benefit from the pension plan consolidation and the benefit from transfers of prescriptions to

our stores from customers that previously used a former third party pharmacy provider to obtain their

Express Scripts benefits.

• Weexpectidenticalsupermarketsalesgrowth,excludingfuelsales,of3.0%-3.5%in2012.Thisguidance

contemplates the effect of several brand prescription drugs coming off patent during 2012, which will

reduce sales because generic equivalents have a lower retail price.

• Our business model is designed to produce annual earnings per diluted share growth on average of

6.0% to 8.0% over a rolling three to five year time horizon. Including our dividend, our business model

is designed to generate total shareholder return on average of 8.0% to 10.0% over a rolling three to five

year time period. In 2012, annual earnings per diluted share growth are expected to be higher than this

due to a combination of the benefit of the 53rd week, a lower expected LIFO charge, the benefit of our

share buyback program during 2011, the benefits from the pension plan consolidation and the benefit

from Express Scripts prescription transfers.

• For2012,weintendtocontinuetofocusonimprovingsalesgrowth,inaccordancewithourCustomer

1st strategy, by making investments in gross margin and customer shopping experiences. We expect to

finance these investments primarily with operating cost reductions. We expect FIFO non-fuel operating

margins for 2012 to expand slightly compared to 2011, excluding the UFCW consolidated pension plan

charge in 2011.

• For2012,weexpectourannualizedLIFOchargetobeapproximately$140millionto$190million.This

forecast is based on estimated cost changes for products in our inventory.

• For2012,weexpectinterestexpensetobeapproximately$450million.

• Weplantousecashflowprimarilyforcapitalinvestments,tomaintainourcurrentdebtcoverageratios,

to pay cash dividends, and to repurchase stock. As market conditions change, we re-evaluate these uses

of cash flow.

• Weexpecttoobtainsalesgrowthfromnewsquarefootage,aswellasfromincreasedproductivityfrom

existing locations.

• Capitalexpendituresreflectourstrategyofgrowththroughexpansion,aswellasfocusingonproductivity

increases from our existing store base through remodels. In addition, we intend to continue our

emphasis on self-development and ownership of real estate, and logistics and technology improvements.

The continued capital spending in technology is focused on improving store operations, logistics,

manufacturing procurement, category management, merchandising and buying practices, and should

reduce merchandising costs. We intend to continue using cash flow from operations to finance capital

expenditure requirements. We expect capital investments for 2012 to be in the range of $1.9-$2.2 billion,

excluding acquisitions and purchases of leased facilities. We expect total food store square footage to

grow approximately 1.3%-1.5% before acquisitions and operational closings.

• Based on current operating trends, we believe that cash flow from operations and other sources of

liquidity, including borrowings under our commercial paper program and bank credit facility, will be

adequate to meet anticipated requirements for working capital, capital expenditures, interest payments

and scheduled principal payments for the foreseeable future. We also believe we have adequate coverage

of our debt covenants to continue to respond effectively to competitive conditions.

• Webelievewehaveadequatesourcesofcash,ifneeded,underourcreditfacilityandotherborrowing

sources for the next twelve months and for the foreseeable future beyond the next twelve months.

• WeexpectthatourOG&Aresultswillbeaffectedbyincreasedcosts,suchashigheremployeebenefit

costs and credit card fees, offset by improved productivity from process changes and leverage gained

through sales increases.