Kroger 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

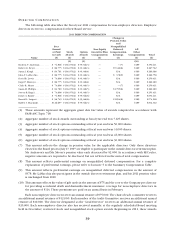

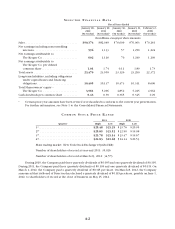

DI S C L O S U R E O F AU D I T O R FE E S

The following describes the fees billed to Kroger by PricewaterhouseCoopers LLP related to the fiscal

years ended January 28, 2012 and January 29, 2011:

Fiscal Year 2011 Fiscal Year 2010

Audit Fees .................................................. $4,163,571 $4,035,300

Audit-Related Fees ............................................ — —

Tax Fees .................................................... 75,819 140,476

All Other Fees ............................................... — —

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,239,390 $4,175,776

Audit Fees for the years ended January 28, 2012 and January 29, 2011, respectively, were for professional

services rendered for the audits of Kroger’s consolidated financial statements, the issuance of comfort letters

to underwriters, consents, and assistance with the review of documents filed with the SEC.

Audit-Related Fees. We did not engage PricewaterhouseCoopers LLP for any audit-related services for the

years ended January 28, 2012 and January 29, 2011.

Tax Fees for the year ended January 28, 2012 were for an analysis of sales tax, and tax fees for the year

ended January 29, 2011 were for an analysis of Kroger’s contribution of inventory to non-profit entities.

All Other Fees. We did not engage PricewaterhouseCoopers LLP for other services for the years ended

January 28, 2012 and January 29, 2011.

The Audit Committee requires that it approve in advance all audit and non-audit work performed by

PricewaterhouseCoopers LLP. On March 7, 2012, the Audit Committee approved services to be performed

by PricewaterhouseCoopers LLP for the remainder of fiscal year 2012 that are related to the audit of Kroger

or involve the audit itself. In 2007, the Audit Committee adopted an audit and non-audit service pre-approval

policy. Pursuant to the terms of that policy, the Committee will annually pre-approve certain defined services

that are expected to be provided by the independent auditors. If it becomes appropriate during the year

to engage the independent accountant for additional services, the Audit Committee must first approve the

specific services before the independent accountant may perform the additional work.

PricewaterhouseCoopers LLP has advised the Audit Committee that neither the firm, nor any member of

the firm, has any financial interest, direct or indirect, in any capacity in Kroger or its subsidiaries.

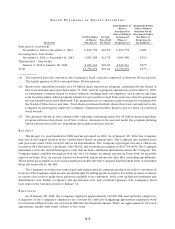

SH A R E H O L D E R PR O P O S A L

(IT E M NO. 4)

We have been notified by six shareholders, the names and shareholdings of which will be furnished

promptly to any shareholder upon written or oral request to Kroger’s Secretary at Kroger’s executive offices,

that they intend to propose the following resolution at the annual meeting:

KR O G E R CO M P A N Y – HU M A N RI G H T S ST A N D A R D S

Whereas, we believe Kroger purchases significant amounts of produce, such as tomatoes, and

Whereas, the United States Department of Justice has successfully prosecuted several cases of modern-

day slavery in the U.S. agricultural industry since 1996, involving over 1,000 workers, (see, for example, US

v. Ramos; US v. Lee; US v. Flores; US v. Cuello; U.S. v. Navarrete) and there are additional modern-day slavery

cases involving agricultural workers in the U.S. currently under federal prosecution (see, for example, US v.

Bontemps, US v. Global Horizons), and

Whereas, there is increasing public awareness and media coverage of modern-day slavery, sweatshop

conditions and abuses that many agricultural workers face, and