Kroger 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-2

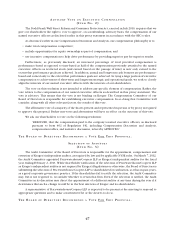

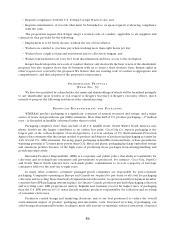

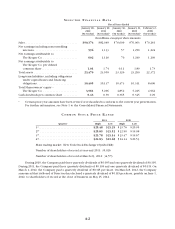

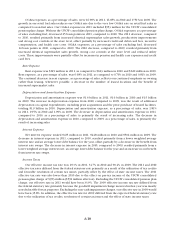

SE L E C T E D FI N A N C I A L DA T A

Fiscal Years Ended

January 28,

2012

(52 weeks)

January 29,

2011

(52 weeks)*

January 30,

2010

(52 weeks)*

January 31,

2009

(52 weeks)*

February 2,

2008

(52 weeks)*

(In millions, except per share amounts)

Sales .................................. $90,374 $82,049 $76,609 $76,063 $70,261

Net earnings including noncontrolling

interests ............................ 596 1,133 57 1,250 1,224

Net earnings attributable to

The Kroger Co. ...................... 602 1,116 70 1,249 1,209

Net earnings attributable to

The Kroger Co. per diluted

common share ....................... 1.01 1.74 0.11 1.89 1.73

Total assets ............................ 23,476 23,505 23,126 23,290 22,372

Long-term liabilities, including obligations

under capital leases and financing

obligations .......................... 10,405 10,137 10,473 10,311 8,696

Total Shareowners’ equity –

The Kroger Co. ...................... 3,981 5,296 4,852 5,225 4,962

Cash dividends per common share . . . . . . . . . 0.43 0.39 0.365 0.345 0.29

* Certain prior year amounts have been revised or reclassified to conform to the current year presentation.

For further information, see Note 1 to the Consolidated Financial Statements.

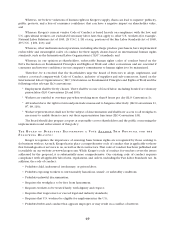

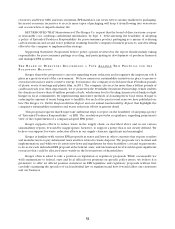

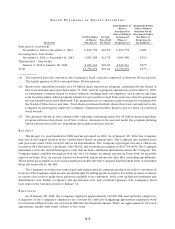

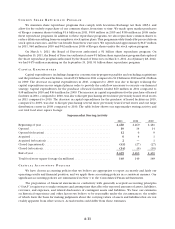

CO M M O N ST O C K PR I C E RA N G E

2011 2010

Quarter High Low High Low

1st ................................. $25.48 $21.29 $ 23.76 $ 20.95

2nd ................................ $25.85 $21.52 $ 22.50 $ 19.08

3rd. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23.78 $21.14 $ 23.47 $ 19.67

4th ................................. $24.83 $21.68 $ 24.14 $ 20.53

Main trading market: New York Stock Exchange (Symbol KR)

Number of shareholders of record at year-end 2011: 35,026

Number of shareholders of record at March 23, 2012: 34,573

During 2010, the Company paid three quarterly dividends of $0.095 and one quarterly dividend of $0.105.

During 2011, the Company paid three quarterly dividends of $0.105 and one quarterly dividend of $0.115. On

March 1, 2012, the Company paid a quarterly dividend of $0.115 per share. On March 8, 2012, the Company

announced that its Board of Directors has declared a quarterly dividend of $0.115 per share, payable on June 1,

2012, to shareholders of record at the close of business on May 15, 2012.