Kroger 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

AD V I S O R Y VO T E O N EX E C U T I V E CO M P E N S A T I O N

(IT E M NO. 2)

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, requires that we

give our shareholders the right to vote to approve, on a nonbinding, advisory basis, the compensation of our

named executive officers as disclosed earlier in this proxy statement in accordance with the SEC’s rules.

As discussed earlier in our Compensation Discussion and Analysis, our compensation philosophy is to:

• make total compensation competitive;

• include opportunities for equity ownership as part of compensation; and

• use incentive compensation to help drive performance by providing superior pay for superior results.

Furthermore, as previously disclosed, an increased percentage of total potential compensation is

performance-based as opposed to time-based as half of the compensation previously awarded to the named

executive officers as restricted stock (and earned based on the passage of time) is now only earned to the

extent that performance goals are achieved. In addition, annual and long-term cash bonuses are performance-

based and earned only to the extent that performance goals are achieved. In tying a large portion of executive

compensation to achievement of short-term and long-term strategic and operational goals, we seek to closely

align the interests of our named executive officers with the interests of our shareholders.

The vote on this resolution is not intended to address any specific element of compensation. Rather, the

vote relates to the compensation of our named executive officers as described in this proxy statement. The

vote is advisory. This means that the vote is not binding on Kroger. The Compensation Committee of our

Board of Directors is responsible for establishing executive compensation. In so doing that Committee will

consider, along with all other relevant factors, the results of this vote.

The affirmative vote of a majority of the shares present and represented in person or by proxy is required

to approve this proposal. Broker non-votes and abstentions will have no effect on the outcome of this vote.

We ask our shareholders to vote on the following resolution:

“RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed

pursuant to Item 402 of Regulation S-K, including Compensation Discussion and Analysis,

compensation tables, and narrative discussion, is hereby APPROVED.”

TH E BO A R D O F DI R E C T O R S RE C O M M E N D S A VO T E F O R TH I S PR O P O S A L .

SE L E C T I O N O F AU D I T O R S

(IT E M NO. 3)

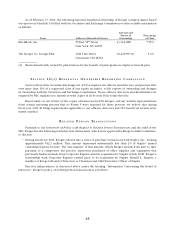

The Audit Committee of the Board of Directors is responsible for the appointment, compensation and

retention of Kroger’s independent auditor, as required by law and by applicable NYSE rules. On March 7, 2012,

the Audit Committee appointed PricewaterhouseCoopers LLP as Kroger’s independent auditor for the fiscal

year ending February 2, 2013. While shareholder ratification of the selection of PricewaterhouseCoopers LLP

as Kroger’s independent auditor is not required by Kroger’s Regulations or otherwise, the Board of Directors is

submitting the selection of PricewaterhouseCoopers LLP to shareholders for ratification, as it has in past years,

as a good corporate governance practice. If the shareholders fail to ratify the selection, the Audit Committee

may, but is not required to, reconsider whether to retain that firm. Even if the selection is ratified, the Audit

Committee in its discretion may direct the appointment of a different auditor at any time during the year if it

determines that such a change would be in the best interests of Kroger and its shareholders.

A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting to respond to

appropriate questions and to make a statement if he or she desires to do so.

TH E BO A R D O F DI R E C T O R S RE C O M M E N D S A VO T E F O R TH I S PR O P O S A L .