Kroger 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

CO M P E N S A T I O N C O M M I T T E E R E P O R T

The Compensation Committee has reviewed and discussed with management of the Company the

Compensation Discussion and Analysis contained in this proxy statement. Based on its review and discussions

with management, the Compensation Committee has recommended to the Company’s Board of Directors that

the Compensation Discussion and Analysis be included in the Company’s proxy statement and incorporated

by reference into its annual report on Form 10-K.

Compensation Committee:

John T. LaMacchia, Chair

Robert D. Beyer

Jorge P. Montoya

Clyde R. Moore

James A. Runde

EX E C U T I V E CO M P E N S A T I O N

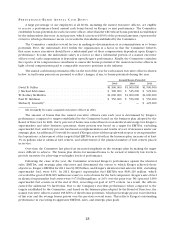

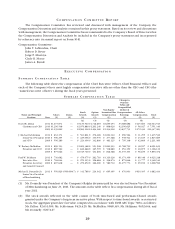

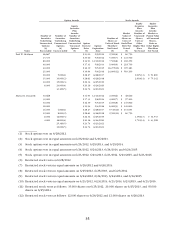

SU M M A R Y CO M P E N S A T I O N TA B L E

The following table shows the compensation of the Chief Executive Officer, Chief Financial Officer and

each of the Company’s three most highly compensated executive officers other than the CEO and CFO (the

“named executive officers”) during the fiscal years presented:

SU M M A R Y CO M P E N S A T I O N TA B L E

Name and Principal

Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

(2) (3) (4) (5) (6)

David B. Dillon 2011 $1,273,871 — $3,130,540 $1,716,693 $2,699,153 $3,088,686 $115,600 $12,024,543

Chairman and CEO 2010 $1,256,548 — $2,070,880 $1,201,240 $ 808,020 $2,156,625 $ 58,027 $ 7,551,340

2009 $1,239,822 — $2,569,100 $1,494,000 $1,234,000 $3,637,731 $172,430 $10,347,083

J. Michael Schlotman 2011 $ 631,371 — $ 503,801 $ 276,269 $1,002,310 $ 990,524 $ 31,255 $ 3,435,530

Senior Vice President 2010 $ 590,295 — $ 225,096 $ 130,570 $ 277,368 $ 578,541 $ 13,815 $ 1,815,685

and CFO 2009 $ 556,280 — $ 223,400 $ 132,800 $ 461,125 $ 795,146 $ 42,609 $ 2,211,360

W. Rodney McMullen 2011 $ 899,113 — $1,009,368 $ 553,506 $1,821,903 $1,768,792 $ 38,957 $ 6,091,639

President and COO 2010 $ 887,562 — $ 630,268 $ 365,595 $ 538,680 $ 953,159 $ 20,875 $ 3,396,139

2009 $ 875,062 — $2,345,700 $ 431,600 $ 846,368 $1,335,103 $ 56,639 $ 5,890,472

Paul W. Heldman 2011 $ 730,682 — $ 479,075 $ 262,710 $1,110,126 $1,374,309 $ 68,346 $ 4,025,248

Executive Vice 2010 $ 716,044 — $ 270,115 $ 156,684 $ 296,274 $ 875,646 $ 33,777 $ 2,348,540

President, Secretary 2009 $ 697,638 — $ 279,250 $ 166,000 $ 580,730 $1,275,773 $ 99,199 $ 3,098,590

and General Counsel

Michael J. Donnelly(1) 2011 $ 550,820 $500,000(7) $ 341,788 $ 214,042 $ 695,395 $ 470,003 $910,395 $ 3,682,443

Senior Vice President

of Merchandising

(1) Mr. Donnelly was President of the Company’s Ralphs division until he was elected Senior Vice President

of Merchandising on June 23, 2011. The amounts in the table reflect his compensation during all of fiscal

year 2011.

(2) The stock awards reflected in the table consist of both time-based and performance-based awards

granted under the Company’s long-term incentive plans. With respect to time-based awards, or restricted

stock, the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 is as follows:

Mr. Dillon: $2,631,099; Mr. Schlotman: $423,425; Mr. McMullen: $848,335; Mr. Heldman: $402,644, and

Mr. Donnelly: $297,127.