Kroger 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

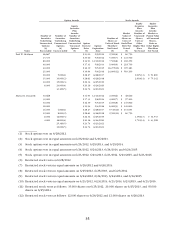

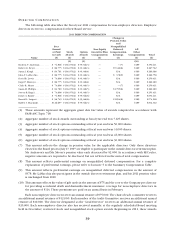

were made at the regularly scheduled Board meeting held in June, as this is the date for general awards to be

made to Kroger employees. Accordingly, on June 23, 2011, each non-employee director received 5,500 shares

of restricted stock and an award of 6,500 nonqualified stock options.

Non-employee directors first elected prior to July 17, 1997 receive a major medical plan benefit as well

as an unfunded retirement benefit. The retirement benefit equals the average cash compensation for the five

calendar years preceding retirement. Participants who retire from the Board prior to age 70 will be credited

with 50% vesting after five years of service, and 10% for each additional year up to a maximum of 100%.

Benefits for participants who retire prior to age 70 begin at the later of actual retirement or age 65.

We also maintain a deferred compensation plan, in which all non-employee members of the Board are

eligible to participate. Participants may defer up to 100% of their cash compensation. They may elect from

either or both of the following two alternative methods of determining benefits:

• interest accrues until paid out at the rate of interest determined prior to the beginning of the deferral

year to represent Kroger’s cost of ten-year debt; and

• amounts are credited in “phantom” stock accounts and the amounts in those accounts fluctuate with the

price of Kroger common shares.

In both cases, deferred amounts are paid out only in cash, based on deferral options selected by the

participants at the time the deferral elections are made. Participants can elect to have distributions made in

a lump sum or in quarterly installments, and may make comparable elections for designated beneficiaries

who receive benefits in the event that deferred compensation is not completely paid out upon the death of

the participant.

The Board has determined that compensation of non-employee directors must be competitive on an

on-going basis to attract and retain directors who meet the qualifications for service on Kroger’s Board. Non-

employee director compensation will be reviewed from time to time as the Corporate Governance Committee

deems appropriate.

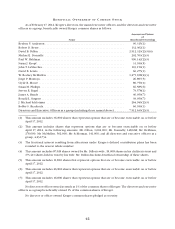

PO T E N T I A L PA Y M E N T S U P O N TE R M I N A T I O N O R CH A N G E I N CO N T R O L

Kroger has no contracts, agreements, plans or arrangements that provide for payments to the named

executive officers in connection with resignation, severance, retirement, termination, or change in control,

except for those available generally to salaried employees. The Kroger Co. Employee Protection Plan, or

KEPP, applies to all management employees and administrative support personnel who are not covered by

a collective bargaining agreement, with at least one year of service, and provides severance benefits when

a participant’s employment is terminated actually or constructively within two years following a change in

control of Kroger. For purposes of KEPP, a change in control occurs if:

• any person or entity (excluding Kroger’s employee benefit plans) acquires 20% or more of the voting

power of Kroger;

• a merger, consolidation, share exchange, division, or other reorganization or transaction with Kroger

results in Kroger’s voting securities existing prior to that event representing less than 60% of the

combined voting power immediately after the event;

• Kroger’s shareholders approve a plan of complete liquidation or winding up of Kroger or an agreement

for the sale or disposition of all or substantially all of Kroger’s assets; or

• during any period of 24 consecutive months, individuals at the beginning of the period who constituted

Kroger’s Board of Directors cease for any reason to constitute at least a majority of the Board

of Directors.