Kroger 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

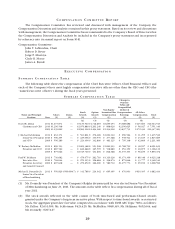

• Recommended share ownership guidelines, adopted by the Board of Directors. These guidelines require

directors, officers and some other key executives to acquire and hold a minimum dollar value of Kroger

shares. The guidelines require the CEO to acquire and maintain ownership of Kroger shares equal to

5 times his base salary; the Chief Operating Officer at 4 times his base salary; Executive Vice Presidents,

Senior Vice Presidents and non-employee directors at 3 times their base salaries or annual base cash

retainers; and other officers and key executives at 2 times their base salaries.

RE S U L T S O F 2011 AD V I S O R Y VO T E T O AP P R O V E EX E C U T I V E CO M P E N S A T I O N

At the 2011 Annual Meeting of Shareholders, we held our first advisory vote on executive compensation.

Over 97% of the votes cast were in favor of this advisory proposal. The Committee considered this favorable

outcome and believed it conveyed our shareholders’ support of the Committee’s decisions and the existing

executive compensation programs. As a result, the Committee made no material changes in the structure of our

compensation programs or pay for performance philosophy. At the 2012 Annual Meeting of Shareholders, as

requested by the shareholders, we will again hold an annual advisory vote to approve executive compensation

(see page 46). The Committee will continue to consider the results from this year’s and future advisory votes

on executive compensation.

ES T A B L I S H I N G EX E C U T I V E CO M P E N S A T I O N

The independent members of the Board have the exclusive authority to determine the amount of the

CEO’s salary; the bonus potential for the CEO; the nature and amount of any equity awards made to the

CEO; and any other compensation questions related to the CEO. In setting the annual bonus potential for

the CEO, the independent directors determine the dollar amount that will be multiplied by the percentage

payout under the annual bonus plan generally applicable to all corporate management, including the named

executive officers. The independent directors retain discretion to reduce the percentage payout the CEO

would otherwise receive. The independent directors thus make a separate determination annually concerning

both the CEO’s bonus potential and the percentage of bonus paid.

The Committee performs the same function and exercises the same authority as to the other named

executive officers. The Committee’s annual review of compensation for the named executive officers includes

the following:

• A detailed report, by officer, that describes current compensation, the value of equity compensation

previously awarded, the value of retirement benefits earned, and any severance or other benefits payable

upon a change of control.

• An internal equity comparison of compensation at various senior levels. This current and historical

analysis is undertaken to ensure that the relationship of CEO compensation to other senior officer

compensation, and senior officer compensation to other levels in the organization, is equitable.

• A report from the Committee’s compensation consultants (described below) comparing named executive

officer and other senior executive compensation with that of other companies, primarily our competitors,

to ensure that the Committee’s objectives of competitiveness are met.

• A recommendation from the CEO (except in the case of his own compensation) for salary, bonus

potential, and equity awards for each of the senior officers including the other named executive officers.

The CEO’s recommendation takes into consideration the objectives established by and the reports

received by the Committee as well as his assessment of individual job performance and contribution to

our management team.

• Historical information regarding salary, bonus and equity compensation for a 3-year period.

In considering each of the factors above, the Committee does not make use of a formula, but rather

subjectively reviews each in making its compensation determination.