Kroger 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-49

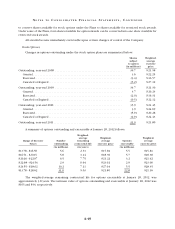

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

to convert shares available for stock options under the Plans to shares available for restricted stock awards.

Under some of the Plans, four shares available for option awards can be converted into one share available for

restricted stock awards.

All awards become immediately exercisable upon certain changes of control of the Company.

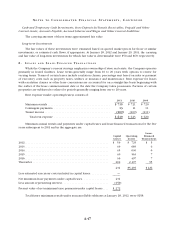

Stock Options

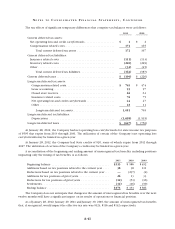

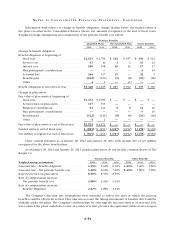

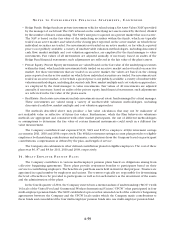

Changes in options outstanding under the stock option plans are summarized below:

Shares

subject

to option

(in millions)

Weighted-

average

exercise

price

Outstanding, year-end 2008 ........................................... 39.7 $ 21.58

Granted ......................................................... 3.6 $ 22.25

Exercised........................................................ (3.4) $ 16.57

Canceled or Expired ............................................... (5.2) $ 27.12

Outstanding, year-end 2009 ........................................... 34.7 $ 21.30

Granted ......................................................... 3.7 $ 20.23

Exercised........................................................ (2.0) $ 16.31

Canceled or Expired ............................................... (0.5) $ 22.12

Outstanding, year-end 2010 ........................................... 35.9 $ 21.45

Granted ......................................................... 3.9 $ 24.69

Exercised........................................................ (5.9) $ 20.28

Canceled or Expired ............................................... (2.9) $ 24.43

Outstanding, year-end 2011............................................ 31.0 $ 21.80

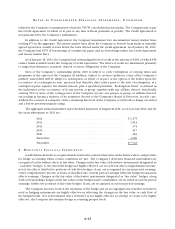

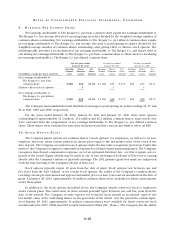

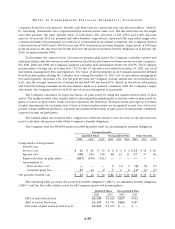

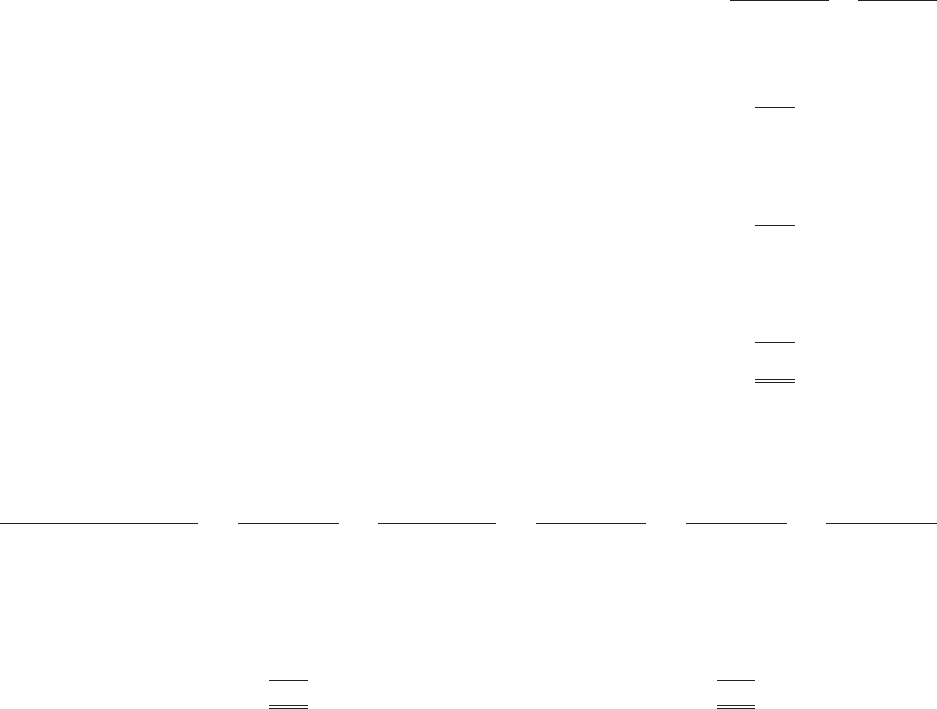

A summary of options outstanding and exercisable at January 28, 2012 follows:

Range of Exercise

Prices

Number

outstanding

Weighted-

average

remaining

contractual life

Weighted-

average

exercise price

Options

exercisable

Weighted-

average

exercise price

(in millions) (in years) (in millions)

$13.78 - $16.50 5.6 2.33 $15.81 5.5 $15.81

$16.51 - $20.15 5.8 3.14 $18.39 5.7 $18.38

$20.16 - $22.97 6.5 7.75 $21.22 3.2 $21.42

$22.98 - $24.54 2.9 0.64 $23.02 2.9 $23.00

$24.55 - $28.62 10.2 7.11 $27.04 5.5 $28.35

$13.78 - $28.62 31.0 5.03 $21.80 22.8 $21.16

The weighted-average remaining contractual life for options exercisable at January 28, 2012, was

approximately 3.8 years. The intrinsic value of options outstanding and exercisable at January 28, 2012 was

$105 and $94, respectively.