Kroger 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-59

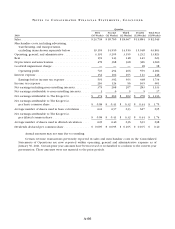

NO T E S T O CO N S O L I D A T E D FI N A N C I A L ST A T E M E N T S , CO N T I N U E D

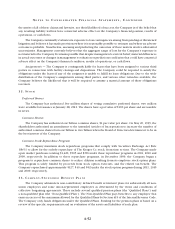

• HedgeFunds:HedgefundsareprivateinvestmentvehiclesvaluedusingaNetAssetValue(NAV)provided

by the manager of each fund. The NAV is based on the underlying net assets owned by the fund, divided

by the number of shares outstanding. The NAV’s unit price is quoted on a private market that is not active.

The NAV is based on the fair value of the underlying securities within the funds, which are typically

traded on an active market, and valued at the closing price reported on the active market on which those

individual securities are traded. For investments not traded on an active market, or for which a quoted

price is not publicly available, a variety of unobservable valuation methodologies, including discounted

cash flow, market multiple and cost valuation approaches, are employed by the fund manager to value

investments. Fair values of all investments are adjusted annually, if necessary, based on audits of the

Hedge Fund financial statements; such adjustments are reflected in the fair value of the plan’s assets.

• PrivateEquity:PrivateEquityinvestmentsarevaluedbasedonthefairvalueoftheunderlyingsecurities

within the fund, which include investments both traded on an active market and not traded on an active

market. For those investments that are traded on an active market, the values are based on the closing

price reported on the active market on which those individual securities are traded. For investments not

traded on an active market, or for which a quoted price is not publicly available, a variety of unobservable

valuation methodologies, including discounted cash flow, market multiple and cost valuation approaches,

are employed by the fund manager to value investments. Fair values of all investments are adjusted

annually, if necessary, based on audits of the private equity fund financial statements; such adjustments

are reflected in the fair value of the plan’s assets.

• RealEstate:Realestateinvestmentsincludeinvestmentsinrealestatefundsmanagedbyafundmanager.

These investments are valued using a variety of unobservable valuation methodologies, including

discounted cash flow, market multiple and cost valuation approaches.

The methods described above may produce a fair value calculation that may not be indicative of

net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuations

methods are appropriate and consistent with other market participants, the use of different methodologies

or assumptions to determine the fair value of certain financial instruments could result in a different fair

value measurement.

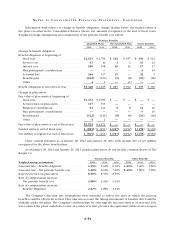

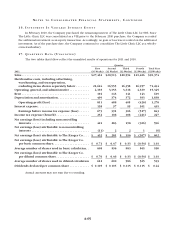

The Company contributed and expensed $130, $119 and $115 to employee 401(k) retirement savings

accounts in 2011, 2010 and 2009, respectively. The 401(k) retirement savings account plan provides to eligible

employees both matching contributions and automatic contributions from the Company based on participant

contributions, compensation as defined by the plan, and length of service.

The Company also administers other defined contribution plans for eligible employees. The cost of these

plans was $6, $7 and $8 for 2011, 2010 and 2009, respectively.

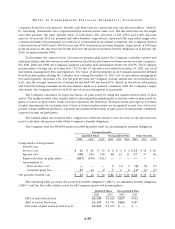

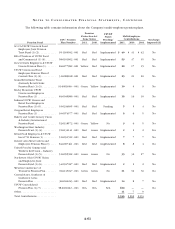

14. M U L T I -EM P L O Y E R PE N S I O N PL A N S

The Company contributes to various multi-employer pension plans based on obligations arising from

collective bargaining agreements. These plans provide retirement benefits to participants based on their

service to contributing employers. The benefits are paid from assets held in trust for that purpose. Trustees are

appointed in equal number by employers and unions. The trustees typically are responsible for determining

the level of benefits to be provided to participants as well as for such matters as the investment of the assets

and the administration of the plans.

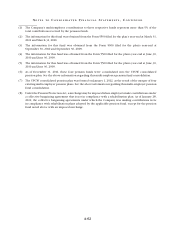

In the fourth quarter of 2011, the Company entered into a memorandum of understanding (“MOU”) with

14 locals of the United Food and Commercial Workers International Union (“UFCW”) that participated in four

multi-employer pension funds. The MOU established a process that amended each of the collective bargaining

agreements between the Company and the UFCW locals under which the Company made contributions to

these funds and consolidated the four multi-employer pension funds into one multi-employer pension fund.