Kroger 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

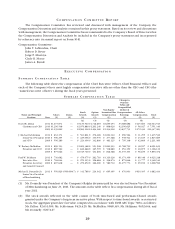

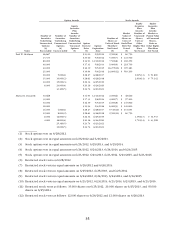

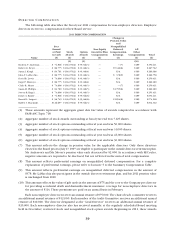

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or

Units of Stock

That Have

Not Vested

(#)

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

($)

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights That

Have

Not Vested

Equity

Incentive

Plan

Awards:

Market or

Payout Value

of Unearned

Shares,

Units or

Other Rights

That Have

Not Vested

Paul W. Heldman 26,667 $23.00 5/9/2012 2,500(6) $ 60,750

13,333 $23.00 5/9/2012 5,000(7) $ 121,500

80,000 $14.93 12/12/2012 7,500(8) $ 182,250

40,000 $17.31 5/6/2014 9,000(9) $ 218,700

40,000 $16.39 5/5/2015 16,275(10) $ 395,483

25,000 $19.94 5/4/2016 24,000(12) $ 583,200

20,000 5,000(1) $28.27 6/28/2017 2,025(13) $ 51,800

15,000 10,000(2) $28.61 6/26/2018 2,930(14) $ 75,142

10,000 15,000(3) $22.34 6/25/2019

6,000 24,000(4) $20.16 6/24/2020

43,400(5) $24.74 6/23/2021

Michael J. Donnelly 30,668 $14.93 12/12/2012 2,000(6) $ 48,600

30,000 $17.31 5/6/2014 4,000(7) $ 97,200

30,000 $16.39 5/5/2015 6,000(8) $ 145,800

18,000 $19.94 5/4/2016 6,000(9) $ 145,800

16,000 4,000(1) $28.27 6/28/2017 9,510(10) $ 231,093

12,000 8,000(2) $28.61 6/26/2018 2,500(10) $ 60,750

8,000 12,000(3) $22.34 6/25/2019 1,350(13) $ 34,533

4,000 16,000(4) $20.16 6/24/2020 1,712(14) $ 43,908

25,360(5) $24.74 6/23/2021

10,000(5) $24.74 6/23/2021

(1) Stock options vest on 6/28/2012.

(2) Stock options vest in equal amounts on 6/26/2012 and 6/26/2013.

(3) Stock options vest in equal amounts on 6/25/2012, 6/25/2013, and 6/25/2014.

(4) Stock options vest in equal amounts on 6/24/2012, 6/24/2013, 6/24/2014, and 6/24/2015.

(5) Stock options vest in equal amounts on 6/23/2012, 6/23/2013, 6/23/2014, 6/23/2015, and 6/23/2016.

(6) Restricted stock vests on 6/28/2012.

(7) Restricted stock vests in equal amounts on 6/26/2012 and 6/26/2013.

(8) Restricted stock vests in equal amounts on 6/25/2012, 6/25/2013, and 6/25/2014.

(9) Restricted stock vests in equal amounts on 6/24/2012, 6/24/2013, 6/24/2014, and 6/24/2015.

(10) Restricted stock vests in equal amounts on 6/23/2012, 6/23/2013, 6/23/2014, 6/23/2015, and 6/23/2016.

(11) Restricted stock vests as follows: 15,000 shares on 6/25/2012, 20,000 shares on 6/25/2013, and 35,000

shares on 6/25/2014.

(12) Restricted stock vests as follows: 12,000 shares on 6/26/2012 and 12,000 shares on 6/26/2013.