Kodak 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

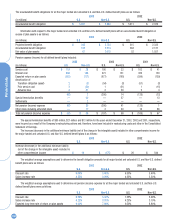

Financials

78

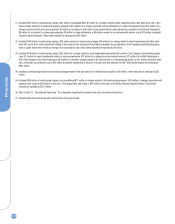

NOTE 25: SUBSEQUENT EVENTS

On October 22, 2003, the Company announced that it signed a 20-year

agreement with China Lucky Film Corp. On February 10, 2004, the

Chinese government approved the Company’s acquisition of 20 percent of

Lucky Film Co. Ltd. (Lucky Film), the largest maker of photographic film in

China, in exchange for approximately $100 million in cash, plus approxi-

mately $30 million in additional net cash to build and upgrade manufac-

turing assets, and other Kodak assets. Also, under the arrangement, the

Company will provide Lucky Film with technical support, training and

equipment upgrades, and Lucky Film will pay Kodak a royalty fee for the

use of certain of the Company’s technologies as well as dividends on the

Lucky Film shares that Kodak will acquire.

On November 25, 2003, the Company announced that it had entered

an agreement to acquire the assets of Scitex Digital Printing (SDP) from its

parent for $250 million, net of any cash on hand at closing which totaled

approximately $13 million, resulting in a net cash price of $237 million.

SDP is the leading supplier of high-speed, continuous inkjet printing sys-

tems, primarily serving the commercial and transactional printing sectors.

Customers use SDP’s products to print utility bills, banking and credit card

statements, direct mail materials, as well as invoices, financial statements

and other transactional documents. The acquisition will provide the

Company with additional capabilities in the transactional printing and

direct mail sectors while creating another path to commercialize propri-

etary inkjet technology. The acquisition was completed on January 5,

2004. Kodak is in the process of obtaining a third-party valuation to assist

in the purchase price allocation.

On February 9, 2004, the Company announced its intent to sell the

assets and business of the Remote Sensing Systems operation, including

the stock of Kodak’s wholly owned subsidiary, Research Systems, Inc.,

collectively known as RSS, to ITT Industries for $725 million in cash. RSS,

a leading provider of specialized imaging solutions to the aerospace and

defense community, is part of the Company’s commercial & government

systems’ operation within the Commercial Imaging segment and its cus-

tomers include NASA, other U.S. government agencies, and aerospace and

defense companies. Kodak’s RSS operation had sales in 2003 of approxi-

mately $425 million. The sale of RSS is expected to result in an after-tax

gain of approxiamately $390 million (unaudited). The after-tax gain

excludes the potential impacts from any settlement or curtailment gains or

losses that may be incurred in connection with the Company’s pension

and postretirement benefit plans, as these amounts are not currently

determinable. The Company is currently evaluating whether the sale of

RSS will be accounted for as a discontinued operation beginning in the

first quarter of 2004 in accordance with SFAS No. 144.

On March 8, 2004, the Company announced that it had agreed with

Heidelberger Druckmaschinen AG (Heidelberg) to purchase Heidelberg’s 50

percent interest in NexPress, a 50/50 joint venture of Kodak and

Heidelberg that makes high-end, on-demand digital color printing sys-

tems, and the equity of Heidelberg Digital LLC, a leading maker of digital

black-and-white variable-data printing systems. Kodak also will acquire

NexPress GmbH, a German subsidiary of Heidelberg that provides engi-

neering and development support, and certain inventory, assets, and

employees of Heidelberg’s regional operations or market centers. The

Company will not pay any cash at closing for the businesses being

acquired. Under the terms of the acquisition, Kodak and Heidelberg agreed

to use a performance-based earn-out formula whereby Kodak will make

periodic payments to Heidelberg over a two-year period, if certain sales

goals are met. If all sales goals are met during the next two calendar

years ending December 31, 2005, the Company will pay a maximum of

$150 million in cash. Additional payments may also be made if certain

sales goals are met during a five-year period following the closing of the

transaction. This acquisition, which is expected to close in May 2004,

advances the Company’s strategy of diversifying its business portfolio, and

accelerates its participation in the digital commercial printing industry.