Kodak 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

42

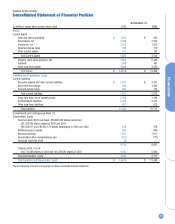

Eastman Kodak Company

Consolidated Statement of Shareholders’ Equity

Accumulated

Additional Other

Common Paid in Retained Comprehensive Treasury

(in millions, except share and per share data) Stock* Capital Earnings (Loss) Income Stock Total

Shareholders’ Equity December 31, 2000 $ 978 $ 871 $ 7,869 $ (482) $(5,808) $ 3,428

Net earnings — — 76 — — 76

Other comprehensive income (loss):

Unrealized losses on available-for-sale securities

($34 million pre-tax) — — — (21) — (21)

Reclassification adjustment for gains on available-for-sale

securities included in net earnings ($13 million pre-tax) — — — 8 — 8

Unrealized gain arising from hedging activity

($6 million pre-tax) — — — 4 — 4

Reclassification adjustment for hedging related losses

included in net earnings ($48 million pre-tax) — — — 29 — 29

Currency translation adjustments — — — (98) — (98)

Minimum pension liability adjustment ($60 million pre-tax) — — — (37) — (37)

Other comprehensive loss — — — (115) — (115)

Comprehensive loss (39)

Cash dividends declared ($2.21 per common share) — — (514) — — (514)

Treasury stock repurchased (947,670 shares) — — — — (41) (41)

Treasury stock issued under employee plans

(1,393,105 shares) — (25) — — 82 57

Tax reductions—employee plans — 3 — — — 3

Shareholders’ Equity December 31, 2001 978 849 7,431 (597) (5,767) 2,894

Net earnings — — 770 — — 770

Other comprehensive income (loss):

Unrealized gains on available-for-sale securities

($11 million pre-tax) — — — 6 — 6

Unrealized loss arising from hedging activity

($27 million pre-tax) — — — (19) — (19)

Reclassification adjustment for hedging related

losses included in net earnings ($24 million pre-tax) — — — 15 — 15

Currency translation adjustments — — — 218 — 218

Minimum pension liability adjustment

($577 million pre-tax) — — — (394) — (394)

Other comprehensive loss — — — (174) — (174)

Comprehensive income 596

Cash dividends declared ($1.80 per common share) — — (525) — — (525)

Treasury stock repurchased (7,354,316 shares) — — — — (260) (260)

Treasury stock issued under employee plans

(2,357,794 shares) — (1) (65) — 137 71

Tax reductions—employee plans — 1 — — — 1

Shareholders’ Equity December 31, 2002 $ 978 $ 849 $ 7,611 $ (771) $(5,890) $ 2,777