Kodak 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

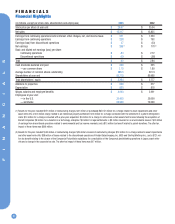

Financials

14

write-offs for purchased in-process R&D associated with two acquisitions

made in 2003. These charges were partially offset by cost savings realized

from position eliminations associated with ongoing focused cost reduction

programs. As a percentage of sales, R&D costs remained flat at 5.9% for

both the current and prior years.

Earnings from continuing operations before interest, other charges,

net, and income taxes for 2003 were $371 million as compared with

$1,220 million for 2002, representing a decrease of $849 million, or 70%.

The decrease is primarily the result of (1) the decline in gross profit mar-

gin and an increase in SG&A, and (2) net focused cost reduction charges

of $484 million incurred during 2003 as compared with $98 million for

2002, an increase of $386 million which was primarily due to the costs

incurred under the Third Quarter, 2003 Restructuring Program.

Interest expense for 2003 was $148 million as compared with $173

million for 2002, representing a decrease of $25 million, or 14%. The

decrease in interest expense is almost entirely attributable to lower aver-

age interest rates in 2003 relative to 2002, which was driven mainly by

the refinancing of the Company’s $144 million 9.38% Notes due March

2003 and the $110 million 7.36% Notes due April 2003 with lower inter-

est rate medium term notes and lower average interest rates on commer-

cial paper during 2003.

The other charges, net component includes principally investment

income, income and losses from equity investments, foreign exchange,

and gains and losses on the sales of assets and investments. Other

charges for the current year were a net charge of $51 million as com-

pared with a net charge of $101 million for 2002. The decrease in other

charges is primarily attributable to increased income from the Company’s

equity investment in Kodak Polychrome Graphics, reduced losses from the

Company’s NexPress joint venture, the elimination of losses from the

Company’s equity investment in the Phogenix joint venture due to its dis-

solution in the second quarter of 2003, and lower non-strategic venture

investment impairments.

The Company’s effective tax benefit from continuing operations was

$66 million for the year ended December 31, 2003, representing an effec-

tive tax benefit rate from continuing operations of 38%, despite the fact

that the Company had positive earnings from continuing operations before

income taxes. The effective tax benefit rate from continuing operations of

38% differs from the U.S. statutory tax rate of 35% primarily due to earn-

ings from operations in certain lower-taxed jurisdictions outside the U.S.,

coupled with losses incurred in certain jurisdictions that are benefited at a

rate equal to or greater than the U.S. federal income tax rate.

The Company’s effective tax rate from continuing operations was

16% for the year ended December 31, 2002. The effective tax rate from

continuing operations of 16% is less than the U.S. statutory rate of 35%

primarily due to the charges for the focused cost reductions and asset

impairments being deducted in jurisdictions that have a higher tax rate

than the U.S. federal income tax rate, and also due to discrete period tax

benefits of $45 million in connection with the closure of the Company’s

PictureVision subsidiary and $46 million relating to the consolidation of the

Company’s photofinishing operations in Japan and the loss realized from

the liquidation of a subsidiary as part of that consolidation. These benefits

were partially offset by the impact of recording a valuation allowance to

provide for certain tax benefits that the Company would be required to

forgo in order to fully realize the benefits of its foreign tax credit carryfor-

wards.

Excluding the effect of discrete period items, the effective tax rate

from continuing operations was 19.5% and 27% in 2003 and 2002,

respectively. The decrease from 27% in 2002 to 19.5% in 2003 is primari-

ly due to increased earnings in certain lower-taxed jurisdictions outside

the U.S. relative to total consolidated earnings.

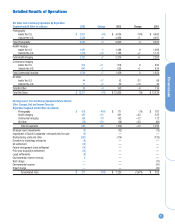

Net earnings from continuing operations for 2003 were $238 million,

or $.83 per basic and diluted share, as compared with net earnings from

continuing operations for 2002 of $793 million, or $2.72 per basic and

diluted share, representing a decrease of $555 million, or 70%. The

decrease in net earnings from continuing operations is primarily attributa-

ble to the reasons outlined above.

Photography Net worldwide sales for the Photography segment were

$9,232 million for 2003 as compared with $9,002 million for 2002, repre-

senting an increase of $230 million, or 3% as reported, or a decrease of

3% excluding the favorable impact of exchange. Approximately 1.9 per-

centage points of the increase in net sales was attributable to increases

related to volume, driven primarily by consumer digital cameras, Printer

Dock products, inkjet media and entertainment print films, partially offset

by volume declines for traditional consumer film products, and approxi-

mately 5.9 percentage points of the increase was attributable to favorable

exchange. These increases were partially offset by price/mix declines, pri-

marily driven by consumer digital cameras and traditional products and

services, which reduced net sales by approximately 5.0 percentage points.

Photography segment net sales in the U.S. were $3,812 million for

the current year as compared with $4,034 million for the prior year, repre-

senting a decrease of $222 million, or 6%. Photography segment net sales

outside the U.S. were $5,420 million for the current year as compared

with $4,968 million for the prior year, representing an increase of $452

million, or 9% as reported, or a decrease of 1% excluding the favorable

impact of exchange.

Net worldwide sales of consumer film products, including 35mm

film, Advantix film and one-time-use cameras, decreased 9% in 2003 as

compared with 2002, reflecting declines due to lower volumes of 12% and

price/mix declines of 3%, partially offset by favorable exchange of 6%.

Sales of the Company’s consumer film products within the U.S. decreased

18% in the current year as compared with the prior year, reflecting

declines due to lower volumes of 17% and price/mix declines of 1%. Sales

of the Company’s consumer film products outside the U.S. decreased 2%

in 2003 compared with 2002, reflecting declines in volume of 9% and

price/mix declines of 2%, partially offset by favorable exchange of 9%. The

lower film product sales are attributable to a declining industry demand

driven primarily by the impact of digital substitution and retailer inventory

reductions.

The U.S. film industry sell-through volumes decreased approximately

8% in 2003 as compared with 2002 primarily due to the impact of digital

substitution. The Company’s current estimate of worldwide consumer film

industry volumes for 2003 is a decrease of approximately 8%. The

Company maintained approximately flat year-over-year blended U.S. con-

sumer film share as it has done for the past several consecutive years.

Net worldwide sales for photofinishing services (excluding equip-

ment), including Qualex in the U.S. and Consumer Imaging Services (CIS)