Kodak 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

61

During 2003, the Company recorded a tax benefit of $13 million

related to the donation of intellectual property in the form of technology

patents to a tax-qualified organization.

During 2002, the Company recorded a tax benefit of $91 million

relating to business closures and restructuring of certain subsidiaries.

Additionally, the Company recorded a tax benefit of $8 million relating to a

land donation. Also, during the fourth quarter of 2002, the Company

recorded an adjustment of $22 million to reduce its income tax provision

due to a decrease in the estimated effective tax rate for the full year. The

decrease in the effective tax rate was attributable to an increase in earn-

ings in lower tax rate jurisdictions relative to original estimates.

During 2001, the Company reached a favorable tax settlement, which

resulted in a tax benefit of $11 million. In addition, during the fourth quar-

ter of 2001, the Company recorded an adjustment of $20 million to reduce

its income tax provision due to a decrease in the estimated effective tax

rate for the full year. The decrease in the effective tax rate was primarily

attributable to an increase in earnings in lower tax rate jurisdictions rela-

tive to original estimates, and an increase in creditable foreign tax credits

as compared to estimates.

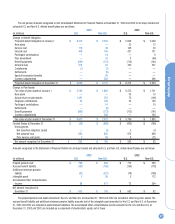

The significant components of deferred tax assets and liabilities were

as follows:

(in millions) 2003 2002

Deferred tax assets

Pension and postretirement

obligations $ 892 $ 988

Restructuring programs 69 144

Foreign tax credit 137 99

Employee deferred compensation 162 187

Inventories 82 75

Tax loss carryforwards 258 16

Other 637 558

Total deferred tax assets 2,237 2,067

Deferred tax liabilities

Depreciation 663 700

Leasing 135 156

Other 475 341

Total deferred tax liabilities 1,273 1,197

Valuation allowance 101 72

Net deferred tax assets $ 863 $ 798

Deferred tax assets (liabilities) are reported in the following compo-

nents within the Consolidated Statement of Financial Position:

(in millions) 2003 2002

Deferred income taxes (current) $ 610 $ 512

Other long-term assets 378 421

Accrued income taxes (44) (83)

Other long-term liabilities (81) (52)

Net deferred tax assets $ 863 $ 798

At December 31, 2003, the Company had available net operating

loss carryforwards of approximately $704 million for income tax purposes,

of which approximately $237 million has an indefinite carryforward period.

The remaining $467 million expires between years 2004 and 2023. The

Company has $137 million of unused foreign tax credits at December 31,

2003, with various expiration dates through 2008.

The valuation allowances as of December 31, 2003 and 2002 of

$101 million and $72 million, respectively, are attributable to both foreign

tax credits and certain net operating loss carryforwards outside the U.S.

Based on projections of future taxable income, the Company would be

able to utilize the foreign tax credits only if it were to forgo other tax bene-

fits. Accordingly, a valuation allowance of $56 million has been recorded

against these credits, as management believes it is more likely than not

that the Company will be unable to realize these other tax benefits. The

remaining $45 million of valuation allowance is attributable to net operat-

ing losses in jurisdictions outside the U.S. During 2003, the Company

increased the valuation allowance by $29 million on these net operating

losses, as management believes it is more likely than not that the

Company will be unable to realize these net operating losses.

During 2002, the Company reduced the valuation allowance that had

been provided for as of December 31, 2001 by $40 million. The $40 mil-

lion decrease included $34 million related to net operating loss carryfor-

wards in non-U.S. jurisdictions that expired in 2002. The balance of the

reduction of $6 million related to net operating loss carryforwards for cer-

tain of its subsidiaries in Japan for which management believed that it

was more likely than not that the Company would generate sufficient tax-

able income to realize these benefits.

The Company is currently utilizing net operating loss carryforwards

to offset taxable income from its operations in China that have become

profitable. The Company has been granted a tax holiday in China that

becomes effective once the net operating loss carryforwards have been

fully utilized. When the tax holiday becomes effective, the Company’s tax

rate in China will be zero percent for the first two years. For the following

three years, the Company’s tax rate will be 50% of the normal tax rate for

the jurisdiction in which Kodak operates, which is currently 15%.

Thereafter, the Company’s tax rate will be 15%.

Retained earnings of subsidiary companies outside the U.S. were

approximately $1,955 million and $1,817 million at December 31, 2003

and 2002, respectively. Deferred taxes have not been provided on such

undistributed earnings, as it is the Company’s policy to permanently rein-

vest its retained earnings, and it is not practicable to determine the

deferred tax liability on such undistributed earnings in the event they were

to be remitted. However, the Company periodically repatriates a portion of

these earnings to the extent that it can do so tax-free.

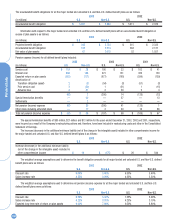

NOTE 16: RESTRUCTURING COSTS

AND OTHER

Currently, the Company is being adversely impacted by the progressing

digital substitution. As the Company continues to adjust its operating

model in light of changing business conditions, it is probable that ongoing

cost reduction activities will be required from time to time.

In accordance with this, the Company periodically announces

planned restructuring programs (Programs), which often consist of a num-

ber of restructuring initiatives. These Program announcements provide

estimated ranges relating to the number of positions to be eliminated and

the total restructuring charges to be incurred. The actual charges for ini-

tiatives under a Program are recorded in the period in which the Company

commits to formalized restructuring plans or executes the specific actions

contemplated by the Program and all criteria for restructuring charge

recognition under the applicable accounting guidance have been met.