Kodak 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

107

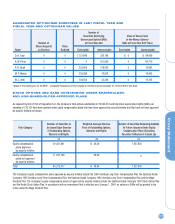

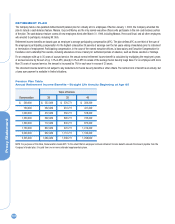

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION/SAR VALUES

Number of

Securities Underlying Value of Unexercised

Unexercised Options/SARs In-the-Money Options/

Number of at Fiscal Year-End SARs at Fiscal Year-End* Value

Shares Acquired Value

Name on Exercise Realized Exercisable Unexercisable Exercisable Unexercisable

D. A. Carp 0 0 1,157,848 326,190 $ 0 $ 84,960

A. M. Perez 0 0 0 551,500 0 60,770

R. H. Brust 0 0 233,808 128,592 0 16,992

M. P. Morley 0 0 292,889 76,878 0 16,992

W. C. Shih 0 0 104,554 53,296 0 19,765

*Based on the closing price on the NYSE – Composite Transactions of the Company’s common stock on December 31, 2003 of $25.67 per share.

STOCK OPTIONS AND SARS OUTSTANDING UNDER SHAREHOLDER-

AND NON-SHAREHOLDER-APPROVED PLANS

As required by Item 201(d) of Regulation S-K, the Company’s total options outstanding of 39,549,310 and total stock appreciation rights (SARs) out-

standing of 730,107 have been granted under equity compensation plans that have been approved by security holders and that have not been approved

by security holders as follows:

Number of Securities to Weighted-Average Exercise Number of Securities Remaining Available

Plan Category be Issued Upon Exercise Price of Outstanding Options, for Future Issuance Under Equity

of Outstanding Options, Warrants and Rights Compensation Plans (Excluding

Warrants and Rights Securities Reflected in Column (a))

Equity compensation 29,031,681 $ 46.39 7,927,850

plans approved

by security holders

Equity compensation 11,247,736 54.08 0

plans not approved

by security holders

Total 40,279,417 $ 48.54 7,927,850

The Company’s equity compensation plans approved by security holders include the 2000 Omnibus Long-Term Compensation Plan, the Eastman Kodak

Company 1995 Omnibus Long-Term Compensation Plan, the Eastman Kodak Company 1990 Omnibus Long-Term Compensation Plan and the Wage

Dividend Plan. The Company’s equity compensation plans not approved by security holders include the Eastman Kodak Company 1997 Stock Option Plan

and the Kodak Stock Option Plan. In accordance with an amendment that is effective as of January 1, 2004, no options or SARs will be granted in the

future under the Wage Dividend Plan.

(a) (b) (c)