Kodak 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

17

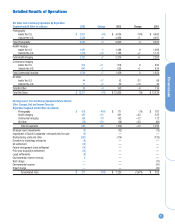

Gross profit for the Commercial Imaging segment for 2003

decreased $25 million, or 6%, from $449 million for 2002 to $424 million

for 2003. The gross profit margin was 27.2% for 2003 as compared with

30.8% for 2002. The decrease in the gross profit margin of 3.6 percent-

age points was attributable to: (1) an increase in manufacturing cost,

which negatively impacted gross profit margins by approximately 2.1 per-

centage points, primarily as a result of moving certain manufacturing

processes to new facilities during 2003, (2) declines attributable to

price/mix, which reduced gross profit margins by approximately 1.3 per-

centage points primarily due to declining contributions from traditional

graphic arts products for the reasons outlined above, and (3) unfavorable

exchange, which negatively impacted gross profit margins by 0.2 percent-

age points.

SG&A expenses for the Commercial Imaging segment increased $13

million, or 7%, from $194 million for 2002 to $207 million for 2003. The

increase in SG&A expense was primarily due to the impact of unfavorable

exchange, which accounted for $7 million of the increase, and an increase

in the benefit rate. As a percentage of sales, SG&A expenses remained

constant at 13.3% for both years.

R&D costs for the Commercial Imaging segment decreased $12 mil-

lion, or 19%, from $63 million for 2002 to $51 million for 2003. As a per-

centage of sales, R&D costs decreased from 4.3% in 2002 to 3.3% in

2003. The decline was primarily related to a decrease of approximately $9

million in ENCAD Inc.’s R&D spending in 2003 as compared with 2002.

Earnings from continuing operations before interest, other charges,

net, and income taxes for the Commercial Imaging segment decreased

$26 million, or 14%, from $192 million in 2002 to $166 million in 2003.

The decrease in earnings from operations is primarily attributable to the

reasons outlined above.

NexPress, the unconsolidated joint venture between Kodak and

Heidelberg in which the Company has a 50% ownership interest, contin-

ues to increase unit placements of the NexPress 2100 Digital Production

Color Press despite a weak printing market, with good customer accept-

ance.

On February 9, 2004, the Company announced its intent to sell the

assets and business of the Remote Sensing Systems operation, including

the stock of Kodak’s wholly owned subsidiary, Research Systems, Inc.,

collectively known as RSS, to ITT Industries for $725 million in cash. RSS,

a leading provider of specialized imaging solutions to the aerospace and

defense community, is part of the Company’s commercial and government

systems’ operation within the Commercial Imaging segment and its cus-

tomers include NASA, other U.S. government agencies, and aerospace and

defense companies. Kodak’s RSS operation had sales in 2003 of approxi-

mately $425 million. The sale of RSS is expected to result in an after-tax

gain of approximately $390 million. Taking into account both the after-tax

gain on the sale and the loss of operational results of RSS, the Company

expects that the sale will positively impact earnings by approximately

$1.31 per share in 2004. The after-tax gain and expected impact to earn-

ings per share for 2004 as a result of the RSS sale excludes the potential

impacts from any settlement or curtailment gains or losses that may be

incurred in connection with the Company’s pension and postretirement

benefit plans, as these amounts are not currently determinable. The

Company is currently evaluating whether the sale of RSS will be account-

ed for as a discontinued operation beginning in the first quarter of 2004 in

accordance with SFAS No. 144, "Accounting for the Impairment or

Disposal of Long-Lived Assets."

On March 8, 2004, the Company announced that it had agreed with

Heidelberger Druckmaschinen AG (Heidelberg) to purchase Heidelberg’s 50

percent interest in NexPress, a 50/50 joint venture of Kodak and

Heidelberg that makes high-end, on-demand digital color printing sys-

tems, and the equity of Heidelberg Digital LLC, a leading maker of digital

black-and-white variable-data printing systems. Kodak also will acquire

NexPress GmbH, a German subsidiary of Heidelberg that provides engi-

neering and development support, and certain inventory, assets, and

employees of Heidelberg’s regional operations or market centers. The

Company will not pay any cash at closing for the businesses being

acquired. Under the terms of the acquisition, Kodak and Heidelberg agreed

to use a performance-based earn-out formula whereby Kodak will make

periodic payments to Heidelberg over a two-year period, if certain sales

goals are met. If all sales goals are met during the next two calendar

years ending December 31, 2005, the Company will pay a maximum of

$150 million in cash. Additional payments may also be made if certain

sales goals are met during a five-year period following the closing of the

transaction. This acquisition, which is expected to close in May 2004,

advances the Company’s strategy of diversifying its business portfolio, and

accelerates its participation in the digital commercial printing industry.

The Company expects this acquisition to incrementally increase revenue

by approximately $175 million over the remainder of 2004. The impact of

these acquisitions to 2004 net earnings can not be accurately estimated

until the Company completes the acquisition.

Other Net worldwide sales for All Other were $95 million for 2003 as

compared with $103 million for 2002, representing a decrease of $8 mil-

lion, or 8%. Net sales in the U.S. were $44 million in 2003 as compared

with $53 million for 2002, representing a decrease of $9 million, or 17%.

Net sales outside the U.S. were $51 million in the current year as com-

pared with $50 million in the prior year, representing an increase of $1

million, or 2%.

SK Display Corporation, the OLED panel manufacturing joint venture

between Kodak and Sanyo, supplies OLED screens to the Company for its

digital camera manufacturing, and continues to focus on improving manu-

facturing yields. Kodak supplies OLED chemicals and materials to SK

Display, and has created a new generation of chemistry that is currently

being tested.

Loss from continuing operations before interest, other charges, net,

and income taxes for All Other increased $50 million from a loss of $28

million in 2002 to a loss of $78 million in 2003. Increased levels of invest-

ment for the Company’s display business primarily drove the increase in

the loss from operations.

Results of Operations— Discontinued Operations

Earnings from discontinued operations were $.09 per basic and diluted

share for 2003, as compared with a loss from discontinued operations for

2002 of $.08 per basic and diluted share.

During the first quarter of 2003, the Company reversed a tax reserve

of $15 million through discontinued operations. The reversal of the tax

reserve was triggered by the Company’s repurchase of certain properties

that were initially sold in connection with the 1994 divestiture of Sterling