Kodak 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

72

NOTE 21: ACQUISITIONS

2003

The Company had a commitment under a put option arrangement with the

Burrell Companies, unaffiliated entities, whereby the shareholders of those

Burrell Companies had the ability to put 100% of the stock to Kodak for a

fixed price plus the assumption of debt. The option first became exercis-

able on October 1, 2002 and was ultimately exercised during the

Company’s fourth quarter ended December 31, 2002. Accordingly, on

February 5, 2003, the Company acquired the Burrell Companies for a total

purchase price of approximately $63 million, which was composed of

approximately $54 million in cash and $9 million in assumed debt. As the

Company did not want to operate the business, they immediately entered

into negotiations to sell the operations. As negotiations proceeded, the

Company determined that the consideration expected in connection with

the sale would not be sufficient to recover the carrying value of the

assets. Accordingly, the Company recorded an impairment charge of $9

million in the second quarter of 2003. This charge is reflected in the sell-

ing, general and administrative component within the accompanying

Consolidated Statement of Earnings for the year ended December 31,

2003. The Company ultimately closed on the sale of the Burrell Companies

on October 6, 2003. The difference between the sale proceeds and the

carrying value of the net assets in the Burrell Companies upon disposition

was not material.

During the first quarter, the Company paid approximately $21 million

for the rights to certain technology. As this technology was still in the

development phase and not yet ready for commercialization, it qualified as

in-process research and development. Additionally, management deter-

mined that there are no alternative future uses for this technology beyond

its initial intended application. Accordingly, the entire purchase price was

expensed in the year ended December 31, 2003 as research and develop-

ment costs in the accompanying Consolidated Statement of Earnings.

During the second quarter, the Company purchased Applied Science

Fiction’s proprietary rapid film processing technology and other assets for

approximately $32 million in cash. Of the $32 million in purchase price,

approximately $16 million represented goodwill. The balance of the pur-

chase price of approximately $16 million was allocated to the acquired

intangible assets, consisting of developed technologies, which have useful

lives ranging from two to six years.

On October 7, 2003, Kodak acquired all of the outstanding shares of

PracticeWorks, Inc. (PracticeWorks), a leading provider of dental practice

management software (DPMS) and digital radiographic imaging systems,

for approximately $475 million in cash, inclusive of transaction costs.

Accordingly, Kodak also became the 100% owner of Paris-based sub-

sidiary, Trophy Radiologie, S.A., a developer and manufacturer of dental

digital radiography equipment, which PracticeWorks acquired in December

2002. This acquisition will enable Kodak’s Health Imaging business to offer

its customers a full spectrum of dental imaging products and services

from traditional film to digital radiography and photography. Earnings from

continuing operations for 2003 include the results of PracticeWorks from

the date of acquisition.

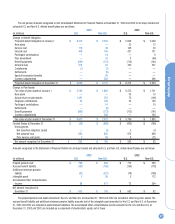

The following table summarizes the estimated fair value of the

assets acquired and liabilities assumed at the date of acquisition. The allo-

cation of the purchase price presented below is subject to refinement.

(in millions) At October 7, 2003

Current assets $ 52

Intangible assets (including in-process R&D) 179

Other non-current assets (including PP&E) 53

Goodwill 350

Total assets acquired $ 634

Current liabilities $ 71

Long-term debt 23

Other non-current liabilities 65

Total liabilities assumed $ 159

Net assets acquired $ 475

Of the $179 million of acquired intangible assets, $10 million was

assigned to research and development assets that were written off at the

date of acquisition. This amount was determined by identifying research

and development projects that had not yet reached technological feasibili-

ty and for which no alternative future uses exist. As of the acquisition

date, there were two projects that met these criteria. The value of the

projects identified to be in progress was determined by estimating the

future cash flows from the projects once commercialized, less costs to

complete development, and discounting these net cash flows back to their

present value. The discount rate used for these projects was 14%. The

charges for the write-off were included as research and development

costs in the Company’s Consolidated Statement of Earnings for the year

ended December 31, 2003.

The remaining $169 million of intangible assets have useful lives

ranging from three to eighteen years. The intangible assets that make up

that amount include customer relationships of $123 million (eighteen-year

weighted-average useful life), developed technology of $44 million (seven-

year weighted-average useful life), and other assets of $2 million (three-

year weighted-average useful life). The $350 million of goodwill will be

assigned to the Health Imaging segment and is not expected to be

deductible for tax purposes.

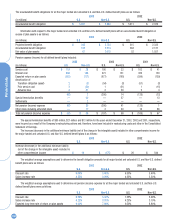

The unaudited pro forma combined historical results, as if

PracticeWorks had been acquired at the beginning of 2003 and 2002,

respectively, are estimated to be:

(in millions, except per share data) 2003 2002

Net sales $ 13,447 $ 12,922

Earnings from continuing operations $ 232 $ 766

Basic and diluted earnings per share

from continuing operations $.81 $ 2.63

The pro forma results include amortization of the intangible assets

presented above and interest expense on debt assumed to finance the

purchase. The interest expense was calculated based on the assumption

that approximately $450 million of the purchase price was financed

through debt with an annual interest rate of approximately 5%. The pro

forma results exclude the write-off of research and development assets

that were acquired from the acquisition. The number of common shares

used in basic earnings per share for 2003 and 2002 were 286.5 million

and 291.5 million, respectively. The number of common shares used in

diluted earnings per share for 2003 and 2002 were 286.6 million and

291.7 million, respectively. The pro forma results are not necessarily

indicative of what actually would have occurred if the acquisition had