Kodak 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S LETTER

2

MANAGEMENT’S LETTER

To Our Shareholders

Kodak took aggressive steps in 2003 to remake itself into a leaner,

stronger, more diversified company as fundamental structural change con-

tinued to reshape the global imaging industry. As we sharpened our focus

on the commercial, consumer and health imaging markets, we imple-

mented a digitally oriented strategy to support revenue and sustainable

earnings growth. To deliver on our strategy, we exercised prudent cost

management and put in place an experienced leadership team.

Our strategy is firmly rooted in Kodak’s core businesses: digital and

traditional imaging. Continued success in both components of the busi-

ness is vital to the Company’s future as the merger of information and

imaging technologies (infoimaging) accelerates the demand for digital

imaging solutions. The Company is expanding the horizon for imaging

services while implementing an improved business model for its tradition-

al and digital businesses.

This environment required an aggressive leveraging of our strength

in digital imaging while at the same time maintaining our historic leader-

ship in maturing traditional businesses. In 2003, our digital businesses

accelerated smartly in key world markets. Several of our traditional silver

halide markets showed volume declines in developed countries, although

the growth opportunity for traditional products in emerging market coun-

tries improved during the year.

Because of Kodak’s proven success in digital imaging—already a $4

billion business for Kodak—our customers look to us for leadership as

market dynamics evolve. In fact, a Forrester Technology Brand Scorecard

placed Kodak number two in trust among 58 major technology brands. We

have the market knowledge, the technical assets and the global brand

strength to succeed.

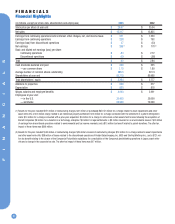

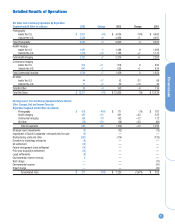

FINANCIAL PERFORMANCE

As the world economy slowly gained momentum during the year, our

financial strategy was characterized by strict cost control, an improving

cash position and a selective acquisition strategy for key businesses. We

ended the year on a positive note financially, the result of solid progress

on our overall business strategy.

Increased sales volumes were driven primarily by consumer digital

cameras, printer dock products, inkjet media and motion picture print

films in the Photography segment, digital products in Health Imaging and

imaging services and document scanners in the Commercial Imaging seg-

ment. Earnings from continuing operations were impacted by declines in

price/mix for traditional businesses, and costs related to restructuring.

Investable cash flow throughout the year was on target. Inventory turns

improved, reflecting revenue growth in our digital businesses. We contin-

ued strict control of capital spending, which was on plan.

Our action on the dividend was not an easy decision. But given the

choices, including higher debt levels, we believe it was a prudent way to

help fund growth and generate shareholder value over time.

Internal and external investments will fuel our growth. Internal invest-

ments focused on technical core competencies that play well in the future

digital systems world. R&D investments leveraged Kodak’s deep knowl-

edge in materials science, imaging science and coating technologies. This

expertise supports the rapid growth of Kodak digital systems and enables

cash generation through reduced cost of traditional products.

In 2003, Kodak delivered breakthrough technology in silver halide

film systems for entertainment and consumer imaging, while accomplish-

ing significant cost reductions for all of our traditional products. Kodak

innovators contributed to leadership imaging systems for markets such as

wide-format inkjet, digital cinema and document scanning. New products

in computed radiography, computer-aided diagnostics and picture archiv-

ing and communications (PACS) are based on Kodak innovations. Our

technical core competencies are the foundation for successful products,

such as the EasyShare printer dock, inkjet photo paper with ColorLast

technology, picture maker imaging kiosks and the new mobile imaging

service—not to mention exciting future imaging systems now in our

research laboratories.

Kodak inventors around the world filed more than 900 patent appli-

cations in 2003, and received 748 U.S. patents—an increase of 11% over

2002. The Company’s overall strength in intellectual property includes new

areas such as inkjet, where the Company has more than 700 patents, and

new display technology such as our world-leading organic light emitting

diodes (OLED).

The second investment component involves acquisition of external

capabilities that complement our existing businesses. An example is the

acquisition of PracticeWorks, the world leader in digital dental imaging,

and a leading provider of management software for dental offices. This

acquisition intelligently expands our Health Imaging digital portfolio for

dental markets. In 2003, we made six such targeted acquisitions in

Health, Entertainment Imaging and Commercial Printing. Our Digital and

Film Imaging Systems business acquired a 20% share of China Lucky Film

Corp., the largest photo film manufacturer headquartered in China. This

investment will help Kodak and Lucky Film expand the traditional film

market in China.

“In 2003, our digital businesses accelerated smartly in key world markets.”

“Because of Kodak’s proven success in digital imaging — already a $4 billion business for Kodak—

our customers look to us for leadership as market dynamics evolve.”

“Our technical core competencies are the foundation for successful

products, such as the EasyShare printer dock, inkjet photo paper with ColorLast

technology, picture maker imaging kiosks and the new mobile imaging service …”