Kodak 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

60

KPG has used aluminum forward contracts that are designated as

cash flow hedges of price risk related to forecasted aluminum purchases.

At December 31, 2003, there were no open contracts, and the losses

reclassified into KPG’s cost of goods sold during 2003 were negligible.

Hedge ineffectiveness was insignificant.

KPG has interest rate swap agreements, maturing in December

2005, designated as cash flow hedges of floating-rate interest payments.

At December 31, 2003, Kodak’s share of its fair value was a gain of less

than $1 million (pre-tax), recorded in accumulated other comprehensive

(loss) income, and increasing Kodak’s investment in KPG. If realized, nearly

half of this amount would be reclassified into KPG’s interest expense dur-

ing the next twelve months. During 2003, a pre-tax loss of $1 million

(Kodak’s share) was reclassified from accumulated other comprehensive

(loss) income to KPG’s interest expense. Hedge ineffectiveness was

insignificant.

KPG has an interest rate swap agreement, maturing in December

2007, designated as a cash flow hedge of variable rental payments. At

December 31, 2003, Kodak’s share of its fair value was a $1 million loss

(pre-tax), recorded in accumulated other comprehensive (loss) income,

and reducing Kodak’s investment in KPG. If realized, less than half of this

amount would be reclassified into KPG’s rental expense during the next

twelve months. During 2003, a pre-tax loss of $1 million (Kodak’s share)

was reclassified from accumulated other comprehensive (loss) income to

KPG’s rental expense. There was no hedge ineffectiveness.

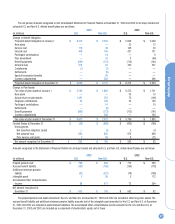

NOTE 14: OTHER CHARGES, NET

(in millions) 2003 2002 2001

(Income)/charges:

Investment income $ (19) $ (20) $ (15)

Loss on foreign exchange transactions 11 19 9

Equity in losses of unconsolidated

affiliates 41 106 79

Gain on sales of investments —— (18)

Gain on sales of capital assets (13) (24) (3)

Interest on past-due receivables

and finance revenue on sales (5) (6) (10)

Minority interest 24 17 (11)

Non-strategic venture investment

impairments 418 3

Other 8(9) (16)

Total $ 51 $ 101 $ 18

NOTE 15: INCOME TAXES

The components of earnings from continuing operations before income

taxes and the related (benefit) provision for U.S. and other income taxes

were as follows:

(in millions) 2003 2002 2001

Earnings (loss) before income

taxes

U.S. $ (124) $ 217 $ (266)

Outside the U.S. 296 729 381

Total $ 172 $ 946 $ 115

U.S. income taxes

Current (benefit) provision $ (69) $ 56 $ (65)

Deferred benefit (38) (31) (67)

Income taxes outside the U.S.

Current provision 133 101 177

Deferred (benefit) provision (90) 22 (5)

State and other income taxes

Current (benefit) provision (6) 12 3

Deferred provision (benefit) 4(7) (9)

Total $ (66) $ 153 $ 34

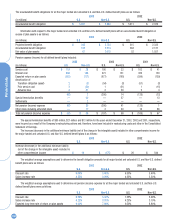

The Company recognized net income of $27 million from discontin-

ued operations for 2003, which included a tax benefit of $13 million. This

tax benefit included $18 million related to the reversal of tax reserves

upon elimination of uncertainties surrounding the realizability of such ben-

efits. The net losses from discontinued operations for 2002 and 2001 were

$23 million and $5 million, respectively, which included tax benefits of $15

million and $2 million, respectively.

The differences between income taxes computed using the U.S. fed-

eral income tax rate and the (benefit) provision for income taxes for con-

tinuing operations were as follows:

(in millions) 2003 2002 2001

Amount computed using the statutory

rate $ 60 $ 331 $ 40

Increase (reduction) in taxes

resulting from:

State and other income taxes,

net of federal (1) 3 (4)

Goodwill amortization ——45

Export sales and manufacturing

credits (25) (23) (19)

Operations outside the U.S. (99) (96) (10)

Valuation allowance 29 56 (18)

Business closures, restructuring

and land donation (13) (99) —

Tax settlement —— (11)

Other, net (17) (19) 11

(Benefit) provision for

income taxes $ (66) $ 153 $ 34