Kodak 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

74

million in cash. The acquisition was accounted for as a purchase with $10

million allocated to tangible net assets, $37 million allocated to goodwill

and $11 million allocated to other intangible assets. The acquisition of

Ofoto has accelerated Kodak’s growth in the online photography market

and has helped drive more rapid adoption of digital and online services.

Ofoto offers digital processing of digital images and traditional film, top-

quality prints, private online image storage, sharing, editing and creative

tools, frames, cards and other merchandise.

On February 7, 2001, the Company completed its acquisition of sub-

stantially all of the imaging services operations of Bell & Howell Company.

The purchase price of this stock and asset acquisition was $141 million in

cash, including acquisition and other costs of $6 million. The acquisition

was accounted for as a purchase with $15 million allocated to tangible net

assets, $70 million allocated to goodwill, and $56 million allocated to

other intangible assets, primarily customer contracts. The acquired units

provide customers worldwide with maintenance for document imaging

components, micrographic-related equipment, supplies, parts and service.

During 2001, the Company also completed additional acquisitions

with an aggregate purchase price of approximately $122 million in cash

and stock, none of which were individually material to the Company’s

financial position, results of operations or cash flows.

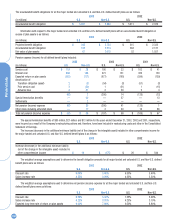

NOTE 22: DISCONTINUED OPERATIONS

2003

During the three-month period ended March 31, 2003, the Company

repurchased certain properties that were initially sold in connection with

the 1994 divestiture of Sterling Winthrop Inc., which represented a portion

of the Company’s non-imaging health businesses. The repurchase of these

properties allows the Company to directly manage the environmental

remediation that the Company is required to perform in connection with

those properties, which will result in better overall cost control (see Note

11, “Commitments and Contingencies”). In addition, the repurchase elimi-

nated the uncertainty regarding the recoverability of tax benefits associat-

ed with the indemnification payments that were previously being made to

the purchaser. Accordingly, the Company reversed a tax reserve of approx-

imately $15 million through earnings from discontinued operations in the

accompanying Consolidated Statement of Earnings for the twelve months

ended December 31, 2003, which was previously established through dis-

continued operations.

During the three-month period ended March 31, 2003, the Company

received cash relating to the favorable outcome of litigation associated

with the 1994 sale of Sterling Winthrop Inc. The related gain of $19 million

was recognized in loss from discontinued operations in the Consolidated

Statement of Earnings for the year ended December 31, 2002. The cash

receipt is reflected in the net cash provided by (used in) discontinued

operations component in the accompanying Consolidated Statement of

Cash Flows for the twelve months ended December 31, 2003.

During the fourth quarter of 2003, the Company recorded a net of tax

credit of $7 million through discontinued operations for the reversal of an

environmental reserve, which was primarily attributable to positive devel-

opments in the Company’s remediation efforts relating to a formerly

owned manufacturing site in the U.S. In addition, during the fourth quarter

of 2003, the Company reversed state income tax reserves of $3 million,

net of tax, through discontinued operations due to the favorable outcome

of tax audits in connection with a formerly owned business.

2002

The net loss from discontinued operations of $23 million in the

accompanying Consolidated Statement of Earnings for the twelve months

ended December 31, 2002 reflects losses incurred from the shutdown of

Kodak Global Imaging, Inc., which amounted to $35 million net of tax, par-

tially offset by net of tax earnings of $12 million related to the favorable

outcome of litigation associated with the 1994 sale of Sterling Winthrop

Inc.

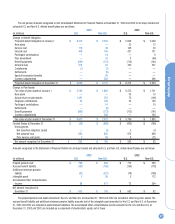

NOTE 23: SEGMENT INFORMATION

Current Segment Reporting Structure

The Company currently reports financial information for three reportable

segments (Photography, Health Imaging and Commercial Imaging) and All

Other. This operational structure, which is centered around strategic prod-

uct groups, reflects how senior management reviews the business, makes

investing and resource allocation decisions, and assesses operating per-

formance. The strategic product groups from existing businesses and

geographies have been integrated into segments that share common

technology, manufacturing and product platforms, and customer sets.

The Photography segment derives revenues from consumer film

products, sales of origination and print film to the entertainment industry,

sales of professional film products, traditional and inkjet photo paper,

chemicals, traditional and digital cameras, photoprocessing equipment

and services, and digitization services, including online services. The

Health Imaging segment derives revenues from the sale of digital prod-

ucts, including laser imagers, media, computed and direct radiography

equipment and healthcare information systems, as well as traditional

medical products, including analog film, equipment, chemistry, services

and specialty products for the mammography, oncology and dental fields.

The Commercial Imaging segment derives revenues from microfilm equip-

ment and media, wide-format inkjet printers, inks and media, scanners,

other business equipment, media sold to commercial and government

customers, long-term government contracts, and graphics film products

sold to the Kodak Polychrome Graphics joint venture. The All Other group

derives revenues from the sale of OLED displays, imaging sensor solutions

and optical products to other manufacturers.

Transactions between segments, which are immaterial, are made on

a basis intended to reflect the market value of the products, recognizing

prevailing market prices and distributor discounts. Differences between

the reportable segments’ operating results and net assets and the

Company’s consolidated financial statements relate primarily to items held

at the corporate level, and to other items excluded from segment operat-

ing measurements.

No single customer represented 10% or more of the Company’s total

net sales in any period presented.

Segment financial information is shown on the following page.