Kodak 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

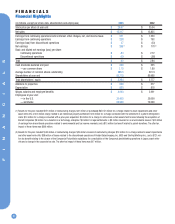

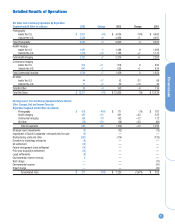

Financials

7

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

CRITICAL ACCOUNTING POLICIES

AND ESTIMATES

The accompanying consolidated financial statements and notes to consoli-

dated financial statements contain information that is pertinent to man-

agement’s discussion and analysis of the financial condition and results of

operations. The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenue and expenses, and the

related disclosure of contingent assets and liabilities.

The Company believes that the critical accounting policies and esti-

mates discussed below involve additional management judgment due to

the sensitivity of the methods and assumptions necessary in determining

the related asset, liability, revenue and expense amounts.

REVENUE RECOGNITION

Kodak recognizes revenue when it is realized or realizable and earned.

For the sale of multiple-element arrangements whereby equipment is

combined with services, including maintenance and training, and other

elements, including software and products, the Company allocates to, and

recognizes revenue from, the various elements based on verifiable objec-

tive evidence of fair value (if software is not included or is incidental to the

transaction) or Kodak-specific objective evidence of fair value if software

is included and is other than incidental to the sales transaction as a

whole. For full service solutions sales, which consist of the sale of equip-

ment and software which may or may not require significant production,

modification or customization, there are two acceptable methods of

accounting: percentage of completion accounting and completed contract

accounting. For certain of the Company’s full service solutions, the com-

pleted contract method of accounting is being followed by the Company.

This is due to insufficient historical experience resulting in the inability to

provide reasonably dependable estimates of the revenues and costs appli-

cable to the various stages of such contracts as would be necessary

under the percentage of completion methodology. When the Company

does have sufficient historical experience and the ability to provide rea-

sonably dependable estimates of the revenues and the costs applicable to

the various stages of these contracts, the Company will account for these

full service solutions under the percentage of completion methodology.

At the time revenue is recognized, the Company also records reduc-

tions to revenue for customer incentive programs in accordance with the

provisions of Emerging Issues Task Force (EITF) Issue No. 01-09,

“Accounting for Consideration Given from a Vendor to a Customer

(Including a Reseller of the Vendor’s Products).” Such incentive programs

include cash and volume discounts, price protection, promotional, cooper-

ative and other advertising allowances, and coupons. For those incentives

that require the estimation of sales volumes or redemption rates, such as

for volume rebates or coupons, the Company uses historical experience

and internal and customer data to estimate the sales incentive at the time

revenue is recognized. In the event that the actual results of these items

differ from the estimates, adjustments to the sales incentive accruals

would be recorded.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

Kodak regularly analyzes its customer accounts and, when it becomes

aware of a specific customer’s inability to meet its financial obligations to

the Company, such as in the case of bankruptcy filings or deterioration in

the customer’s overall financial condition, records a specific provision for

uncollectible accounts to reduce the related receivable to the amount that

is estimated to be collectible. The Company also records and maintains a

provision for doubtful accounts for customers based on a variety of factors

including the Company’s historical experience, the length of time the

receivable has been outstanding and the financial condition of the cus-

tomer. If circumstances related to specific customers were to change, the

Company’s estimates with respect to the collectibility of the related receiv-

ables could be further adjusted. However, losses in the aggregate have not

exceeded management’s expectations.

INVENTORIES

Kodak reduces the carrying value of its inventory based on estimates of

what is excess, slow-moving and obsolete, as well as inventory whose

carrying value is in excess of net realizable value. These write-downs are

based on current assessments about future demands, market conditions

and related management initiatives. If, in the future, the Company deter-

mined that market conditions and actual demands are less favorable than

those projected and, therefore, inventory was overvalued, the Company

would be required to further reduce the carrying value of the inventory

and record a charge to earnings at the time such determination was

made. If, in the future, the Company determined that inventory write-

downs were overstated and, therefore, inventory was undervalued, the

Company would recognize the increase to earnings through higher gross

profit at the time the related undervalued inventory was sold. However,

actual results have not differed materially from management’s estimates.

VALUATION OF LONG-LIVED ASSETS,

INCLUDING GOODWILL AND PURCHASED

INTANGIBLE ASSETS

The Company reviews the carrying value of its long-lived assets, including

goodwill and purchased intangible assets, for impairment whenever

events or changes in circumstances indicate that the carrying value may

not be recoverable. The Company assesses the recoverability of the carry-

ing value of long-lived assets, other than goodwill and purchased intangi-

ble assets with indefinite useful lives, by first grouping its long-lived

assets with other assets and liabilities at the lowest level for which identi-

fiable cash flows are largely independent of the cash flows of other assets

and liabilities (the asset group) and, secondly, estimating the undiscounted

future cash flows that are directly associated with and expected to arise

from the use of and eventual disposition of such asset group. The

Company estimates the undiscounted cash flows over the remaining use-

ful life of the primary asset within the asset group. If the carrying value of

the asset group exceeds the estimated undiscounted cash flows, the

Company records an impairment charge to the extent the carrying value of

the long-lived asset exceeds its fair value. The Company determines fair

value through quoted market prices in active markets or, if quoted market

prices are unavailable, through the performance of internal analyses of

discounted cash flows or external appraisals. The undiscounted and dis-

counted cash flow analyses are based on a number of estimates and

assumptions, including the expected period over which the asset will be