Kodak 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

20

continued promotional activity at key accounts and success in broadening

channel distribution.

Net worldwide sales of professional sensitized products, including

color negative, color reversal and commercial black and white films and

sensitized paper, decreased 13% in 2002 as compared with 2001, reflect-

ing primarily a decline in volume, with no impact from exchange. Overall

sales declines were primarily the result of ongoing digital substitution and

continued economic weakness in markets worldwide.

Net worldwide sales of origination and print film to the entertainment

industry remained flat in 2002 as compared with 2001, with a 1% favor-

able impact from exchange offset by a 1% decline attributable to lower

volumes. The decrease in volumes of net worldwide film sales was prima-

rily attributable to economic factors impacting origination film for com-

mercials and independent feature films, partially offset by an increase in

print film volumes.

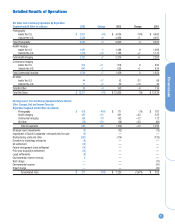

Gross profit for the Photography segment was $3,219 million for

2002 as compared with $3,402 million for 2001, representing a decrease

of $183 million or 5%. The gross profit margin was 35.8% in the current

year as compared with 36.2% in the prior year. The 0.4 percentage point

decrease was primarily attributable to decreases due to price/mix that

impacted gross profit margins by approximately 3.0 percentage points,

partially offset by an increase due to productivity/cost improvements that

impacted gross margins by approximately 2.6 percentage points.

SG&A expenses for the Photography segment were $1,935 million

for 2002 as compared with $1,963 million for 2001, representing a

decrease of $28 million or 1%. The net decrease in SG&A spending is pri-

marily attributable to cost reduction activities and expense management,

partially offset by increases in SG&A expense related to CIS photofinishing

acquisitions in Europe. As a percentage of sales, SG&A expense increased

from 20.9% in the prior year to 21.5% in the current year.

R&D costs for the Photography segment decreased $29 million or

5% from $542 million in 2001 to $513 million in 2002. As a percentage of

sales, R&D costs decreased slightly from 5.8% in the prior year to 5.7% in

the current year.

Earnings from continuing operations before interest, other charges,

net, and income taxes for the Photography segment decreased $16 mil-

lion, or 2%, from $787 million in 2001 to $771 million in 2002, reflecting

the combined effects of lower sales and a lower gross profit margin, par-

tially offset by SG&A and R&D cost reductions and the elimination of good-

will amortization in 2002, which was $110 million in 2001.

Health Imaging Net worldwide sales for the Health Imaging segment

were $2,274 million for 2002 as compared with $2,262 million for 2001,

representing an increase of $12 million, or 1% as reported, or an increase

of 2% excluding the negative net impact of exchange. The increase in

sales was attributable to an increase in price/mix and volume of approxi-

mately 0.4 and 1.1 percentage points, respectively, primarily due to laser

imaging systems and equipment services, partially offset by a decrease

from negative exchange of approximately 0.8 percentage points.

Net sales in the U.S. decreased slightly from $1,089 million for the

prior year to $1,088 million for the current year. Net sales outside the U.S.

were $1,186 million for 2002 as compared with $1,173 million for 2001,

representing an increase of $13 million, or 1% as reported, or an increase

of 2% excluding the negative impact of exchange.

Net worldwide sales of digital products, which include laser printers

(DryView imagers and wet laser printers), digital media (DryView and wet

laser media), digital capture equipment (computed radiography capture

equipment and digital radiography equipment), services and Picture

Archiving and Communications Systems (PACS), increased 5% in 2002 as

compared with 2001. The increase in digital product sales was primarily

attributable to higher digital media, service, digital capture and PACS vol-

umes as the market for these products continues to grow.

Net worldwide sales of traditional products, including analog film,

equipment, chemistry and services, decreased 4% in 2002 as compared

with 2001. The decrease in sales was primarily attributable to a net

decline in sales of analog film products. This net decrease was partly miti-

gated by an increase in sales of Mammography and Oncology (M&O) ana-

log film products. Analog film products (excluding M&O) decreased 8% in

2002 as compared with 2001, reflecting declines due to volume, exchange

and price/mix of approximately 5%, 2% and 1%, respectively. Although

analog film volumes declined on a worldwide basis, current sales levels

reflect an increase in traditional film market share. M&O sales increased

6% in the current year as compared with the prior year, reflecting higher

volumes of approximately 8%, partially offset by decreases in price/mix

and exchange of approximately 1% and 1%, respectively.

Gross profit for the Health Imaging segment was $930 million for

2002 as compared with $869 million for 2001, representing an increase of

$61 million, or 7%. The gross profit margin was 40.9% in 2002 as com-

pared with 38.4% in 2001. The 2.5 percentage point increase was attrib-

utable to productivity/cost improvements, which increased gross profit

margins by 2.9 percentage points due to favorable media and equipment

manufacturing cost led by DryView digital media, analog medical film,

laser imaging equipment and PACS, which were complemented by lower

service costs and improved supply chain management. The positive

effects of productivity/cost on gross profit margins were partially offset by

a decrease in price/mix that impacted margins by approximately 0.5 per-

centage points due to declining digital laser media and analog medical

film prices.

SG&A expenses for the Health Imaging segment decreased $20 mil-

lion, or 5%, from $367 million for 2001 to $347 million for 2002. As a per-

centage of sales, SG&A expenses decreased from 16.2% for 2001 to

15.3% for 2002. The decrease in SG&A expenses is primarily a result of

cost reduction activities and expense management.

R&D costs for the Health Imaging segment remained constant at

$152 million for 2002 and 2001. As a percentage of sales, R&D costs

remained unchanged at 6.7% for both years.

Earnings from continuing operations before interest, other charges,

net, and income taxes for the Health Imaging segment increased $108

million, or 33%, from $323 million for 2001 to $431 million for 2002. The

increase in earnings from operations and the resulting operational earn-

ings margin are primarily attributable to the combined effects of improve-

ments in gross profit margins, lower SG&A expense, and the elimination of

goodwill amortization in 2002, which was $28 million in 2001.

Commercial Imaging Net worldwide sales for the Commercial Imaging

segment for 2002 increased slightly from $1,454 million for 2001 to

$1,456 million for 2002, representing an increase of $2 million, with no

net impact from exchange. The slight increase in sales was attributable to