Kodak 2003 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

103

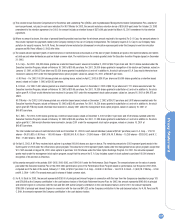

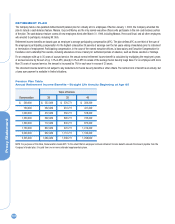

Under Mr. Brust’s December 20, 1999 offer letter, the Company loaned Mr. Brust, Chief Financial Officer and Executive Vice President, the sum of

$3,000,000 at an annual interest rate of 6.21%, the applicable federal rate for mid-term loans, compounded annually, in effect for January 2000. The

unsecured loan is evidenced by a promissory note dated January 6, 2000. Under Mr. Brust’s November 12, 2001 amended offer letter, a portion of the

principal and all of the accrued interest on the loan is to be forgiven on each of the first seven anniversaries of the loan. Mr. Brust is not entitled to for-

giveness on any anniversary date if he voluntarily terminates his employment or is terminated for cause on or before the anniversary date. The principal

balance due under the loan on December 31, 2003 was $1,800,000.

In March 2001, the Company loaned Mr. Carp, Chairman, President and Chief Executive Officer, $1,000,000 for the purchase of a home. The loan is

unsecured and bears interest at 5.07% per year, the applicable federal rate for mid-term loans, compounded annually, in effect for March 2001. The

entire amount of the loan and all accrued interest is due upon the earlier of March 1, 2006 or the date of Mr. Carp’s termination of employment from the

Company. The loan is evidenced by a promissory note dated March 2, 2001. The balance due under the loan on December 31, 2003 was $1,150,587.

Transactions with Management