Kodak 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

58

ed guarantee mature on December 31, 2005, but may be renewed at

KPG’s, the joint venture partners’ and the bank’s discretion. The guaran-

tees for the other unconsolidated affiliates and third party debt mature

between January 2004 and May 2006. The customer financing agree-

ments and related guarantees typically have a term of 90 days for product

and short-term equipment financing arrangements, and up to 5 years for

long-term equipment financing arrangements. These guarantees would

require payment from Kodak only in the event of default on payment by

the respective debtor. In some cases, particularly for guarantees related to

equipment financing, the Company has collateral or recourse provisions to

recover and sell the equipment to reduce any losses that might be

incurred in connection with the guarantee. Management believes the like-

lihood is remote that material payments will be required under any of the

guarantees disclosed above. With respect to the guarantees that the

Company issued in the year ended December 31, 2003, the Company

assessed the fair value of its obligation to stand ready to perform under

these guarantees by considering the likelihood of occurrence of the speci-

fied triggering events or conditions requiring performance, as well as other

assumptions and factors. Through internal analyses and external valua-

tions, the Company determined that the fair value of the guarantees was

not material to the Company’s financial position, results of operations or

cash flows.

The Company also guarantees debt owed to banks for some of its

consolidated subsidiaries. The maximum amount guaranteed is $592 mil-

lion, and the outstanding debt under those guarantees, which is recorded

within the short-term borrowings and long-term debt, net of current por-

tion components in the accompanying Consolidated Statement of Financial

Position, is $423 million. These guarantees expire in 2004 and 2005, with

the majority expiring in 2004.

The Company may provide up to $100 million in loan guarantees to

support funding needs for SK Display Corporation, an unconsolidated affili-

ate in which the Company has a 34% ownership interest. As of December

31, 2003, the Company has not been required to guarantee any of SK

Display Corporation’s outstanding debt.

Indemnifications The Company issues indemnifications in certain

instances when it sells businesses and real estate, and in the ordinary

course of business with its customers, suppliers, service providers and

business partners. Further, the Company indemnifies its directors and offi-

cers who are, or were, serving at Kodak’s request in such capacities.

Historically, costs incurred to settle claims related to these indemnifica-

tions have not been material to the Company’s financial position, results of

operations or cash flows. Additionally, the fair value of the indemnifications

that the Company issued during the year ended December 31, 2003 was

not material to the Company’s financial position, results of operations or

cash flows.

Warranty Costs The Company has warranty obligations in connection

with the sale of its equipment. The original warranty period for equipment

products is generally one year. The costs incurred to provide for these

warranty obligations are estimated and recorded as an accrued liability at

the time of sale. The Company estimates its warranty cost at the point of

sale for a given product based on historical failure rates and related costs

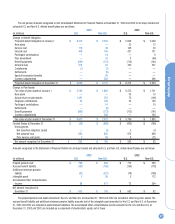

to repair. The change in the Company’s accrued warranty obligations bal-

ance, which is reflected in accounts payable and other current liabilities in

the accompanying Consolidated Statement of Financial Position, was as

follows:

(in millions)

Accrued warranty obligations at December 31, 2001 $ 50

Actual warranty experience during 2002 (47)

2002 warranty provisions 48

Adjustment for changes in estimates (8)

Accrued warranty obligations at December 31, 2002 $ 43

Actual warranty experience during 2003 (53)

2003 warranty provisions 59

Accrued warranty obligations at December 31, 2003 $49

The Company also offers extended warranty arrangements to its cus-

tomers, which are generally one year in duration beginning after the origi-

nal warranty period. The Company provides both repair services and rou-

tine maintenance services under these arrangements. The Company has

not separated the extended warranty revenues and costs from the routine

maintenance service revenues and costs, as it is not practicable to do so.

Costs incurred under these extended warranty arrangements for the year

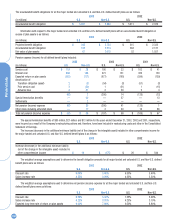

ended December 31, 2003 amounted to $198 million. The change in the

Company’s deferred revenue balance in relation to these extended war-

ranty arrangements, which is reflected in accounts payable and other cur-

rent liabilities in the accompanying Consolidated Statement of Financial

Position, was as follows:

(in millions)

Deferred revenue at December 31, 2001 $ 91

New extended warranty arrangements in 2002 330

Recognition of extended warranty arrangement

revenue in 2002 (318)

Deferred revenue at December 31, 2002 $ 103

New extended warranty arrangements in 2003 372

Recognition of extended warranty arrangement

revenue in 2003 (355)

Adjustments for changes in estimates (2)

Deferred revenue at December 31, 2003 $ 118

NOTE 13: FINANCIAL INSTRUMENTS

The following table presents the carrying amounts of the assets (liabilities)

and the estimated fair values of financial instruments at December 31,

2003 and 2002:

2003 2002

Carrying Fair Carrying Fair

(in millions) Amount Value Amount Value

Marketable securities:

Current $11 $11 $9 $9

Long-term 26 32 25 26

Long-term borrowings (2,302) (2,450) (1,164) (1,225)

Foreign currency forwards (1) (1) 22

Silver forwards 1122