Kodak 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

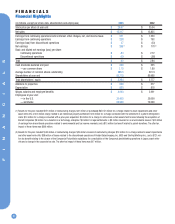

Financials

16

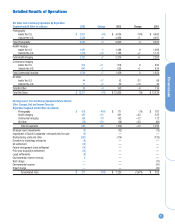

Net worldwide sales for the Health Imaging segment were $2,431

million for 2003 as compared with $2,274 million for 2002, representing

an increase of $157 million, or 7% as reported, or an increase of 2%

excluding the favorable impact of exchange. The increase in sales was

comprised of: (1) an increase from favorable exchange of approximately

5.4 percentage points, (2) the acquisition of PracticeWorks Inc. in October

2003, which accounted for approximately 2.0 percentage points of the

sales increase as it contributed $48 million to 2003 sales of dental sys-

tems, and (3) an increase in volume of approximately 2.9 percentage

points, driven primarily by volume increases in digital products. These

increases were partially offset by declines in price/mix of approximately

3.3 percentage points, which were related to both digital and traditional

products.

Net sales in the U.S. were $1,061 million for the current year as

compared with $1,088 million for the prior year, representing a decrease

of $27 million, or 2%. Net sales outside the U.S. were $1,370 million for

2003 as compared with $1,186 million for 2002, representing an increase

of $184 million, or 16% as reported, or an increase of 6% excluding the

favorable impact of exchange.

Net worldwide sales of digital products, which include laser printers

(DryView imagers and wet laser printers), digital media (DryView and wet

laser media), digital capture equipment (computed radiography capture

equipment and digital radiography equipment), services, dental practice

management software, and Healthcare Information Systems (HCIS) includ-

ing Picture Archiving and Communications Systems (PACS), increased

14% in 2003 as compared with 2002. The increase in digital product sales

was primarily attributable to favorable exchange, higher volumes of digital

media, digital capture equipment and services, and the PracticeWorks

acquisition. Service revenues increased due to an increase in digital

equipment service contracts during 2003 as compared with the prior year.

These increases were partially offset by declines in price/mix for digital

media and digital capture equipment.

Net worldwide sales of traditional products, including analog film,

equipment, chemistry and services, decreased 1% in 2003 as compared

with 2002, reflecting declines in volume and negative price/mix almost

entirely offset by favorable exchange.

Gross profit for the Health Imaging segment was $1,049 million for

2003 as compared with $930 million for 2002, representing an increase of

$119 million, or 13%. The gross profit margin was 43.2% in 2003 as

compared with 40.9% in 2002. The increase in the gross profit margin of

2.3 percentage points was primarily attributable to: (1) a decrease in man-

ufacturing cost, which increased gross profit margins by approximately

3.2 percentage points, primarily due to favorable media and equipment

manufacturing cost led by DryView digital media and digital capture

equipment, complemented by lower service costs, (2) favorable exchange,

which contributed approximately 1.1 percentage points to the gross profit

margin, and (3) the acquisition of PracticeWorks in the fourth quarter of

2003, which increased gross profit margins by approximately 0.4 percent-

age points for the current year. These increases were partially offset by

decreases attributable to price/mix, which negatively impacted gross profit

margins by 2.4 percentage points due to lower prices for digital media,

digital capture equipment and analog medical film.

SG&A expenses for the Health Imaging segment increased $43 mil-

lion, or 12%, from $347 million for 2002 to $390 million for 2003. As a

percentage of sales, SG&A expenses increased from 15.3% for 2002 to

16.0% for 2003. The increase in SG&A expenses is primarily due to the

acquisition of PracticeWorks, which had $22 million of SG&A expenses in

2003, an increase in the benefit rate, and the unfavorable impact of

exchange which accounted for $16 million of the increase.

R&D costs for the Health Imaging segment increased $26 million, or

17%, from $152 million in 2002 to $178 million in 2003. As a percentage

of sales, R&D costs increased from 6.7% in 2002 to 7.3% in 2003. The

increase is primarily due to $12 million of R&D costs associated with the

acquisition of PracticeWorks, $10 million of which was a one-time write-

off of purchased in-process R&D. The remainder of the increase is due to

increased spending to drive growth in selected areas of the product port-

folio.

Earnings from continuing operations before interest, other charges,

net, and income taxes for the Health Imaging segment increased $50 mil-

lion, or 12%, from $431 million for 2002 to $481 million for 2003 due pri-

marily to the reasons described above.

Commercial Imaging Net worldwide sales for the Commercial Imaging

segment for 2003 increased from $1,456 million for 2002 to $1,559 mil-

lion for 2003, representing an increase of $103 million, or 7%, or an

increase of 4% excluding the favorable impact of exchange. The increase

in net sales was primarily comprised of: (1) increases in volume, which

contributed approximately 4.8 percentage points to 2003 sales, which was

primarily attributable to commercial and government products and servic-

es, imaging services and document scanners, and (2) an increase of

approximately 3.2 percentage points due to favorable exchange, which

was partially offset by declines due to price/mix of approximately 1.1 per-

centage points, primarily driven by graphics products.

Net sales in the U.S. were $912 million for 2003 as compared with

$818 million for 2002, representing an increase of $94 million, or 11%.

Net sales outside the U.S. were $647 million in the current year as com-

pared with $638 million in the prior year, representing an increase of $9

million, or 1%, or a decrease of 7% excluding the favorable impact of

exchange.

Net worldwide sales of the Company’s commercial and government

products and services increased 33% in 2003 as compared with 2002.

The increase in sales was principally due to an increase in revenues from

government products and services under its government contracts, includ-

ing the modification of a long-term contract in the fourth quarter of 2003.

Net worldwide sales of graphic arts products to Kodak Polychrome

Graphics (KPG), an unconsolidated joint venture affiliate in which the

Company has a 50% ownership interest, decreased 14% in 2003 as com-

pared with 2002, reflecting declines in both volume and price/mix in

graphic arts film. This reduction resulted largely from digital substitution

and the effect of continuing economic weakness in the commercial print-

ing market.

KPG’s earnings performance continues to improve driven primarily by

its world-leading position in the growth segments of digital proofing and

digital printing plates, coupled with favorable foreign exchange. KPG’s

operating profit has been positive for 14 consecutive quarters and has

shown consistent improvement during that same period. The Company’s

equity in the earnings of KPG contributed positive results to other charges,

net during 2003.