Kodak 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

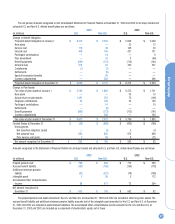

Financials

57

specific time. Rather, the costs associated with environmental remediation

become estimable over a continuum of events and activities that help to

frame and define a liability, and the Company continually updates its cost

estimates. The Company has an ongoing monitoring and identification

process to assess how the activities, with respect to the known expo-

sures, are progressing against the accrued cost estimates, as well as to

identify other potential remediation sites that are presently unknown.

Estimates of the amount and timing of future costs of environmental

remediation requirements are necessarily imprecise because of the con-

tinuing evolution of environmental laws and regulatory requirements, the

availability and application of technology, the identification of presently

unknown remediation sites and the allocation of costs among the poten-

tially responsible parties. Based upon information presently available, such

future costs are not expected to have a material effect on the Company’s

competitive or financial position. However, such costs could be material to

results of operations in a particular future quarter or year.

Other Commitments and Contingencies The Company has entered into

agreements with several companies, which provide Kodak with products

and services to be used in its normal operations. The minimum payments

for these agreements are approximately $266 million in 2004, $238 mil-

lion in 2005, $124 million in 2006, $98 million in 2007, $80 million in

2008 and $179 million in 2009 and thereafter.

Qualex, a wholly owned subsidiary of Kodak, has a 50% ownership

interest in Express Stop Financing (ESF), which is a joint venture partner-

ship between Qualex and a subsidiary of Dana Credit Corporation (DCC), a

wholly owned subsidiary of Dana Corporation. Qualex accounts for its

investment in ESF under the equity method of accounting. ESF provides a

long-term financing solution to Qualex’s photofinishing customers in con-

nection with Qualex’s leasing of photofinishing equipment to third parties,

as opposed to Qualex extending long-term credit. As part of the operations

of its photofinishing services, Qualex sells equipment under a sales-type

lease arrangement and records a long-term receivable. These long-term

receivables are subsequently sold to ESF without recourse to Qualex and,

therefore, these receivables are removed from Qualex’s books. ESF incurs

debt to finance the purchase of the receivables from Qualex. This debt is

collateralized solely by the long-term receivables purchased from Qualex,

and in part, by a $60 million guarantee from DCC. Qualex provides no

guarantee or collateral to ESF’s creditors in connection with the debt, and

ESF’s debt is non-recourse to Qualex. Qualex’s only continued involvement

in connection with the sale of the long-term receivables is the servicing of

the related equipment under the leases. Qualex has continued revenue

streams in connection with this equipment through future sales of photo-

finishing consumables, including paper and chemicals, and maintenance.

Although the lessees’ requirement to pay ESF under the lease agree-

ments is not contingent upon Qualex’s fulfillment of its servicing obliga-

tions, under the agreement with ESF, Qualex would be responsible for any

deficiency in the amount of rent not paid to ESF as a result of any lessee’s

claim regarding maintenance or supply services not provided by Qualex.

Such lease payments would be made in accordance with the original

lease terms, which generally extend over 5 to 7 years. To date, the

Company has incurred no such material claims, and Qualex does not

anticipate any significant situations where it would be unable to fulfill its

service obligations under the arrangement with ESF. ESF’s outstanding

lease receivable amount was approximately $367 million at December 31,

2003.

Effective July 22, 2003, ESF entered into an arrangement amending

the Receivables Purchase Agreement (RPA), which represents the financ-

ing arrangement between ESF and the banks. Under the amended RPA

agreement, maximum borrowings were lowered to $257 million. Total out-

standing borrowings under the RPA at December 31, 2003 were $248 mil-

lion. The amended RPA extends through July 2004, at which time the RPA

can be extended or terminated. If the RPA were terminated, ESF would

need to find an alternative financing solution for new borrowings. Pursuant

to the ESF partnership agreement between Qualex and DCC, commencing

October 6, 2003, Qualex no longer sells its lease receivables to ESF.

Qualex currently is utilizing the services of Imaging Financial Services,

Inc., a wholly owned subsidiary of General Electric Capital Corporation, as

an alternative financing solution for prospective leasing activity with its

customers.

At December 31, 2003, the Company had outstanding letters of cred-

it totaling $121 million and surety bonds in the amount of $113 million

primarily to ensure the completion of environmental remediations and

payment of possible casualty and workers’ compensation claims.

Rental expense, net of minor sublease income, amounted to $159

million in 2003, $158 million in 2002 and $126 million in 2001. The

approximate amounts of noncancelable lease commitments with terms of

more than one year, principally for the rental of real property, reduced by

minor sublease income, are $125 million in 2004, $103 million in 2005,

$77 million in 2006, $59 million in 2007, $43 million in 2008 and $87

million in 2009 and thereafter.

In December 2003, the Company sold a property in France for

approximately $65 million, net of direct selling costs, and then leased

back a portion of this property for a nine-year term. In accordance with

SFAS No. 98, “Accounting for Leases,” the entire gain on the property sale

of approximately $57 million was deferred and will be amortized over the

nine-year lease term. No gain was recognizable upon the closing of the

sale as the Company’s continuing involvement in the property is deemed

to be significant. The noncancelable lease commitment amounts noted

above include approximately $5 million per year for 2004 through 2008,

and approximately $20 million for 2009 and thereafter, in relation to this

transaction.

The Company and its subsidiary companies are involved in lawsuits,

claims, investigations and proceedings, including product liability, com-

mercial, environmental and health and safety matters, which are being

handled and defended in the ordinary course of business. There are no

such matters pending that the Company and its General Counsel expect to

be material in relation to the Company’s business, financial position or

results of operations.

NOTE 12: GUARANTEES

The Company guarantees debt and other obligations under agreements

with certain affiliated companies and customers. At December 31, 2003,

these guarantees totaled a maximum of $363 million, with outstanding

guaranteed amounts of $161 million. The maximum guarantee amount

includes guarantees of up to: $160 million of debt for Kodak Polychrome

Graphics (KPG), an unconsolidated affiliate in which the Company has a

50% ownership interest ($50 million outstanding); $7 million for other

unconsolidated affiliates and third parties ($7 million outstanding); and

$196 million of customer amounts due to banks in connection with vari-

ous banks’ financing of customers’ purchase of product and equipment

from Kodak ($104 million outstanding). The KPG debt facility and the relat-