Kodak 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

64

by eliminating manufacturing positions on a worldwide basis, and 3) elimi-

nate selling, general and administrative positions, particularly in the

Photography segment.

The total restructuring charge for continuing operations recorded in

2003 relating to the First Quarter, 2003 Restructuring Program was $81

million, which was composed of severance, exit costs, long-lived asset

impairments and inventory write-downs of $67 million, $8 million, $5 mil-

lion and $1 million, respectively. The severance charge related to the elim-

ination of 1,850 positions, including approximately 1,225 photofinishing,

325 administrative and 300 manufacturing positions. The geographic

composition of the 1,850 positions to be eliminated includes approximate-

ly 1,100 in the United States and Canada and 750 throughout the rest of

the world. The reduction of 1,850 positions and the total severance and

exit charges of $75 million are reflected in the First Quarter, 2003

Restructuring Program table below. The remaining actions anticipated

under the First Quarter, 2003 Restructuring Program are expected to be

completed during the first quarter of 2004.

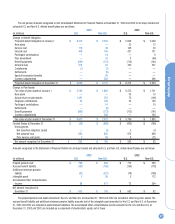

The following table summarizes the activity with respect to the sev-

erance and exit costs charges recorded in connection with the focused

cost reductions that were announced in the first quarter of 2003 and the

remaining balances in the related reserves at December 31, 2003:

(dollars in millions) Number of Employees Severance Reserve Exit Costs Reserve Total

Q1, 2003 charges 425 $ 28 $ — $ 28

Q1, 2003 utilization (150) (2) — (2)

Balance at 3/31/03 275 26 — 26

Q2, 2003 charges 500 20 4 24

Q2, 2003 utilization (500) (13) — (13)

Balance at 6/30/03 275 33 4 37

Q3, 2003 charges 925 19 4 23

Q3, 2003 utilization (400) (12) (1) (13)

Balance at 9/30/03 800 40 7 47

Q4, 2003 utilization (625) (17) (3) (20)

Balance at 12/31/03 175 $ 23 $ 4 $ 27

The charges of $80 million for severance, long-lived asset impair-

ments and exit costs reserves were reported in restructuring costs and

other in the accompanying Consolidated Statement of Earnings for the

year ended December 31, 2003. The charges taken for inventory write-

downs of $1 million were reported in cost of goods sold in the accompa-

nying Consolidated Statement of Earnings for the year ended December

31, 2003. The severance and exit costs require the outlay of cash, while

the inventory write-downs and long-lived asset impairments represent

non-cash items. Severance payments will be paid during the period

through 2005 since, in many instances, the employees whose positions

were eliminated can elect or are required to receive their severance pay-

ments over an extended period of time. Most exit costs are expected to be

paid during 2004. However, certain costs, such as long-term lease pay-

ments, will be paid over periods after 2004.

As a result of initiatives implemented under the First Quarter, 2003

Restructuring Program, the Company recorded $24 million of accelerated

depreciation on long-lived assets in cost of goods sold in the accompany-

ing Consolidated Statement of Earnings for the year ended December 31,

2003. The accelerated depreciation relates to long-lived assets accounted

for under the held and used model of SFAS No. 144. The year-to-date

amount of $24 million relates to lab equipment used in photofinishing that

will be used until their abandonment. The Company will incur accelerated

depreciation charges of $8 million in the first quarter of 2004 and $1 mil-

lion in the second quarter of 2004 as a result of the initiatives implement-

ed under the First Quarter, 2003 Restructuring Program.

In addition to the $105 million of restructuring charges recorded in

2003 under the First Quarter, 2003 Restructuring Program, the Company

recorded $17 million of charges in the second quarter associated with the

Company’s exit from the Photography segment’s Phogenix joint venture

with Hewlett Packard. The $17 million charge included approximately $2

million of inventory write-downs, $6 million of long-lived asset impair-

ments and $9 million of exit costs. The inventory write-downs were

reported in cost of goods sold in the accompanying Consolidated

Statement of Earnings for the year ended December 31, 2003. The long-

lived asset impairments and exit costs were reported in restructuring

costs and other in the accompanying Consolidated Statement of Earnings

for the year ended December 31, 2003. The exit costs, which represent

the only cash portion of the charge, are expected to be paid during 2004.

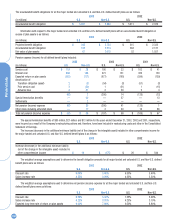

Fourth Quarter, 2002 Restructuring Program

During the fourth quarter of 2002, the Company announced a planned

Program consisting of a number of focused cost reduction initiatives

designed to deploy manufacturing assets more effectively in order to pro-

vide competitively-priced products to the global market. In the announce-

ment, the Company discussed the restructuring initiatives under its Fourth

Quarter, 2002 Restructuring Program that would begin in the fourth quar-

ter of 2002 and extend into 2003. These initiatives were expected to affect

a total of 1,300 to 1,700 positions worldwide, including approximately 150

positions in the Company’s U.S. research and development organizations,

500 positions in its U.S. one-time-use camera assembly operations, 300

positions in its Mexico sensitizing operations and 550 positions in its glob-

al manufacturing and logistics organization. Specific initiatives included

the relocation of the one-time-use camera assembly operations in