Kodak 2003 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

120

receivables goals for 2003, and effectively managing other discretionary parts of the business. Against these positive results, the Committee also consid-

ered management’s inability to satisfy its target customer satisfaction goal for business end users.

After looking at these results, the Committee chose to exercise negative discretion to partially ameliorate the positive effect of foreign exchange on the

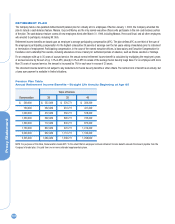

Company’s 2003 EXCEL results. As a result of this decision, the Committee set the award pool for 2003 under EXCEL at 112% of target. The Summary

Compensation Table on page 104 lists for 2003 the awards to the named executive officers.

Long-Term Incentives

Traditionally, long-term compensation has been delivered to the Company’s executives through stock options, the Performance Stock Program and

selected grants of restricted stock.

Beginning in 2004, long-term compensation will principally be provided to the Company’s executives in the form of performance stock units under the

new Leadership Stock Program. Only the Company’s officers will continue to be eligible for an annual grant of stock options. A description of the new

Leadership Stock Program and the Company’s new stock option grant practices appears earlier in this Report under the section entitled “Key Executive

Compensation Actions Last Year.” The Company will also continue its practice of periodically awarding grants of restricted stock to selected executives.

These awards will generally be made to either (1) induce the recipients to remain with or to become employed by the Company; or (2) recognize excep-

tional performance.

As a result of the Company’s new stock option grant practices, only the Company’s officers received a stock option award in 2003. Under these new

practices, the options will continue to be priced at 100% of the fair market value of the Company’s stock on the day of grant, but now will have a term of

only seven years, rather than ten. The Company will continue to base target grant ranges on the median survey values of the companies it surveys.

Grants to individual officers will then be adjusted based in large part on the officer’s relative leadership assessment. Finally, the Committee will ultimate-

ly determine the size of the stock option awards to the executive officers using the recommendations made by management as a starting point. The

2003 stock option awards granted by the Committee to the named executive officers are listed in the table entitled “Option/SAR Grants in Last Fiscal

Year” on page 106.

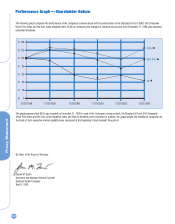

Although the new Leadership Stock Program replaces the Performance Stock Program, the pending cycles of the Performance Stock Program will con-

tinue to run until they expire. A description of the Performance Stock Program, as well as the threshold, target and maximum awards for the named

executive officers, appears on page 108-109. Based on the Company’s performance over the three-year performance cycle ending in 2003, no awards

were paid for this cycle.

In 2002, the Committee approved a one-time, performance-based, long-term award program (i.e., the Executive Incentive Program), under the 2002-

2004 cycle of the Performance Stock Program. The purposes of this program were to improve by year-end 2003 investable cash flow and the financial

performance of certain strategic product groups. A description of the Executive Incentive Program appears on page 108.

In order for awards to be earned under the Executive Incentive Program, Company performance over the program’s two-year period had to exceed the

program’s two pre-established, threshold performance goals. In the case of investable cash flow, the Company not only exceeded its threshold goal, but

also considerably surpassed its target goal. With regards to the program’s other metric based on the financial performance of certain strategic product

groups, performance by the Company exceeded the program’s threshold goal. As a result of this performance, the program’s performance formula pro-

vided a payout equal to 79% of target. As explained in last year’s Proxy Statement, the program’s participants received an interim award in 2002 of 30%

of their target award due to achieving certain pre-established interim goals by year-end 2002. Each participant’s interim award was then subtracted

from the award he or she earned for the entire cycle, and the net award amount was paid to the participant in the form of shares of the Company’s com-

mon stock. The net award amounts paid to the named executive officers are listed under the column entitled “LTIP Payouts” in the Summary

Compensation Table on page 104.

SHARE OWNERSHIP PROGRAM

The interests of the Company’s executives should be inseparable from those of its shareholders. The Company aims to link these interests by encourag-

ing stock ownership on the part of its executives.

One program designed to meet this objective is the Company’s share ownership program. As described earlier in the report under the section entitled

“Key Executive Compensation Actions Last Year,” the Committee recently approved several changes to this program in an effort to strengthen the align-

ment of the interests of the Company’s executive officers with those of its shareholders. As a result of these changes, all executive officers will now be

required to retain a specified percentage of the shares attributable to stock option exercises or the vesting or earn-out of full value shares until they

attain their ownership requirements.