Kodak 2003 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

119

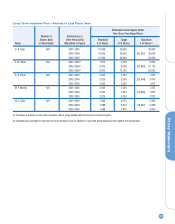

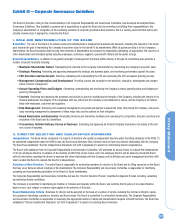

Level Salary Multiple Retention Ratio

CEO 5x 100%

COO/President 4x 100%

Executive VPs 3x 75%

Senior VPs 2x 75%

Other Executive Officers 1x 50%

The number of shares of Kodak stock that must be held is determined by multiplying the executive officer’s annual base salary rate as of January 1,

2004, by the applicable multiple, and dividing the result by the price of the Company’s stock on January 1, 2004. The number of shares to be held will

only change if the executive officer is promoted to a higher position.

COMPONENTS OF EXECUTIVE COMPENSATION PROGRAM

The three components of the Company’s executive compensation program are:

• base salary,

• short-term variable pay, and

• long-term incentives.

Base Salary

Base salary is the only fixed portion of an executive’s compensation. Each executive’s base salary is reviewed annually based on the executive’s relative

responsibility.

Short-Term Variable Pay

Three key principles underlie EXCEL, the Company’s short-term variable pay plan for its executives: alignment, simplicity and discretion. Alignment to

Company objectives is achieved through the two performance metrics used to fund the plan: revenue growth and economic profit. The inclusion of rev-

enue growth as a performance metric emphasizes the Company’s need for sustained profitable growth. The use of economic profit stresses the continu-

ing need for earnings growth and balance sheet management. Beginning in 2004, investable cash flow will replace economic profit to underscore the

importance of cash flow to the Company’s new growth strategy. Simplicity is accomplished through ease of plan administration. Under EXCEL, each par-

ticipant has three to four key performance goals. Discretion, the third key principle, may be used to adjust the size of the plan’s funding pool, modify the

funding pool’s allocation to the Company’s units, and determine the performance and rewards of the plan’s participants.

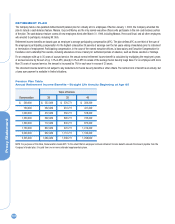

Participants in EXCEL are assigned target awards for the year based on a percentage of their base salaries as of the end of that year. This percentage is

determined by the participant’s wage grade. For 2003, target awards ranged from 25% of base salary to 155% of base salary for the CEO.

Each year the Compensation Committee establishes a performance matrix for the year based on the plan’s two performance metrics.This matrix deter-

mines the percentage of the plan’s target corporate funding pool that will be earned for the year based on the Company’s actual performance against

these two metrics. The target corporate funding pool is the aggregate of all participants’ target awards for the year. Under the performance matrix, the

corporate funding pool will fund at 100% if target performance for each performance metric is met.

The Compensation Committee may use its discretion to adjust (upward or downward) the amount of the corporate funding pool for any year. The

Committee considers a number of baseline metrics before applying this discretion. In 2003, these baseline metrics included investable cash flow, inven-

tory, receivables, capital expenditures, market share and customer satisfaction. In addition, the Compensation Committee may choose to exercise discre-

tion to recognize unanticipated economic or market changes, extreme currency exchange effects or management of significant workforce issues.

The CEO allocates the corporate funding pool among the Company’s units. Each business unit has its own targets for operational performance for the

year. Actual performance against these targets accounts for 75% of the business unit’s allocation. The remaining 25% is determined by overall Company

performance for the year measured against the Company’s targets for the year based on the two EXCEL performance metrics.

Within each staff, regional, functional and business unit, local senior management allocates the unit’s funds to its participants based on each partici-

pant’s individual performance. This assessment includes performance against pre-established goals, leadership and support of the Company’s Diversity

and Inclusion strategy.

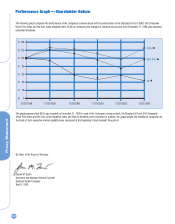

In 2003, the Company substantially beat its performance target for revenue. In terms of economic profit, it significantly exceeded its threshold perform-

ance goal for 2003, but did not attain its performance target. Due to these strong results, EXCEL’s corporate funding pool funded at a level sufficient to

pay out at a 146% of target level under the performance matrix established for the year.

In fixing the corporate funding pool for the year, the Committee noted the significant positive impact that foreign exchange had on the Company’s rev-

enue for the year. The Committee also took into account management’s performance in maintaining worldwide film market share, exceeding its 2003

investable cash flow goal, nearly satisfying its target inventory goals, obtaining its consumer customer satisfaction goal and generally achieving its