Kodak 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

18

Winthrop Inc., which represented a portion of the Company’s non-imaging

health businesses. The repurchase of these properties will allow the

Company to directly manage the environmental remediation that the

Company is required to perform in connection with those properties,

which will result in better overall cost control. In addition, the repurchase

eliminated the uncertainty regarding the recoverability of tax benefits

associated with the indemnification payments that were previously being

made to the purchaser.

During the fourth quarter of 2003, the Company recorded a net of tax

credit of $7 million through discontinued operations for the reversal of an

environmental reserve, which was primarily attributable to positive devel-

opments in the Company’s remediation efforts relating to a formerly

owned manufacturing site in the U.S. In addition, during the fourth quarter

of 2003, the Company reversed state income tax reserves of $3 million,

net of tax, through discontinued operations due to the favorable outcome

of tax audits in connection with a formerly owned business.

The loss from discontinued operations for 2002 was comprised of

losses incurred from the shutdown of Kodak Global Imaging, Inc., which

amounted to $35 million net of tax, partially offset by net of tax earnings

of $12 million related to the favorable outcome of litigation associated

with the 1994 sale of Sterling Winthrop Inc.

Net Earnings Net earnings for 2003 were $265 million, or $.92 per basic

and diluted share, as compared with net earnings for 2002 of $770 mil-

lion, or $2.64 per basic and diluted share, representing a decrease of

$505 million, or 66%. This decrease is primarily attributable to the reasons

outlined above.

2002 COMPARED WITH 2001

Results of Operations— Continuing Operations

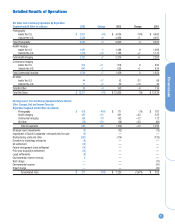

Consolidated Net worldwide sales were $12,835 million for 2002 as

compared with $13,229 million for 2001, representing a decrease of $394

million, or 3% as reported, with no net impact from exchange. Declines in

volume accounted for approximately 1.5 percentage points of the sales

decrease, driven primarily by volume decreases in traditional film and U.S.

photofinishing services. Declines in price/mix reduced sales for 2002 by

approximately 1.5 percentage points, driven primarily by traditional con-

sumer film products and health film and laser imaging systems.

Net sales in the U.S. were $5,993 million for the current year as

compared with $6,459 million for the prior year, representing a decrease

of $466 million, or 7%. Net sales outside the U.S. were $6,842 million for

the current year as compared with $6,770 million for the prior year, repre-

senting an increase of $72 million, or 1% as reported, with no impact from

exchange.

Net sales in EAMER for 2002 were $3,491 million as compared with

$3,333 million for 2001, representing an increase of 5% as reported, or

1% excluding the favorable impact of exchange. Net sales in the Asia

Pacific region for 2002 increased slightly from $2,231 million for 2001 to

$2,240 million for 2002, with no impact from exchange. Net sales in the

Canada and Latin America region for 2002 were $1,111 million as com-

pared with $1,206 million for 2001, representing a decrease of 8% as

reported, or an increase of 6% excluding the negative impact of exchange.

Net sales in emerging markets were $2,425 million for 2002 as com-

pared with $2,371 million for 2001, representing an increase of $54 mil-

lion, or 2%. Sales growth in China and Russia of 25% and 20%, respec-

tively, were the primary drivers of the increase in sales in emerging mar-

kets, partially offset by decreased sales in Argentina, Brazil and Mexico of

53%, 11% and 6%, respectively. The sales growth in China resulted from

strong business performance for health and consumer products. The

increase in sales in Russia is a result of continued growth in the number

of Kodak Express stores, which represent independently owned photo spe-

cialty retail outlets, and the Company’s efforts to expand the distribution

channels for Kodak products and services. The sales declines in Argentina,

Brazil and Mexico were reflective of the continued economic weakness

currently being experienced by many Latin American emerging market

countries. The emerging market portfolio accounted for approximately

19% and 35% of the Company’s worldwide and non-U.S. sales, respec-

tively, in 2002.

Gross profit was $4,610 million for 2002 as compared with $4,568

million for 2001, representing an increase of $42 million, or 1%. The gross

profit margin was 35.9% in the current year as compared with 34.5% in

the prior year. The increase of 1.4 percentage points was primarily attrib-

utable to manufacturing cost, which favorably impacted gross profit mar-

gins by approximately 2.7 percentage points year-over-year due to

reduced labor expense, favorable materials pricing and improved product

yields. This increase was also attributable to costs associated with

restructuring and the exit of an equipment manufacturing facility incurred

in 2001 but not in the current year, which negatively impacted gross profit

margins for 2001 by approximately 1.0 percentage point. The positive

impacts to gross profit were partially offset by year-over-year price/mix

declines, which reduced gross profit margins by approximately 2.3 per-

centage points. The price/mix decreases were primarily related to declin-

ing prices on consumer film, health laser imaging systems and consumer

color paper, and product shifts primarily in the Photography segment.

SG&A expenses were $2,530 million for 2002 as compared with

$2,625 million for 2001, representing a decrease of $95 million, or 4%.

SG&A decreased slightly as a percentage of sales from 19.8% for the prior

year to 19.7% for the current year. The net decrease in SG&A is primarily

attributable to the cost savings from the employment reductions and other

non-severance related components of the Company’s focused cost reduc-

tions, offset by acquisitions in the Photography and Commercial segments

and higher strategic venture investment impairments in 2002 when com-

pared with 2001 of $15 million.

R&D costs remained relatively flat at $762 million for 2002 as com-

pared with $779 million for 2001, representing a decrease of $17 million,

or 2%. As a percentage of sales, R&D costs also remained flat at 5.9% for

both the current and prior years.

Earnings from continuing operations before interest, other charges,

net, and income taxes for 2002 were $1,220 million as compared with $352

million for 2001, representing an increase of $868 million, or 247%. The pri-

mary reason for the increase in earnings from operations was a decrease in

restructuring costs and asset impairments of $586 million. Results for 2002

also benefited from the savings associated with restructuring programs

implemented in 2001. In addition, results for 2001 included charges of $138

million for the Wolf bankruptcy charge, environmental reserve and Kmart

bankruptcy, and goodwill amortization charges of $153 million.

Interest expense for 2002 was $173 million as compared with $219

million for 2001, representing a decrease of $46 million, or 21%. The